Tuesday Oct 2: Five things the markets are talking about

Capital markets are in a sombre mood as a number of reasons for caution come to the fore.

Brexit rhetoric and the Italian government’s fiscal plans top the agenda, followed closely by trade deals and tariffs and political drama in Washington.

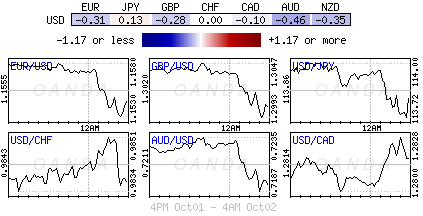

Amid the risk-off mood the ‘big’ dollar again has found support against G10 pairs. Euro stocks and U.S futures are currently following Asian declines, as Treasuries and bund prices advance.

The EUR (€1.1517) remains under pressure for a fifth consecutive day, pressured by remarks from Italy’s Deputy PM Luigi Di Maio that they will not change its budget deficit targets despite pressure from Brussels and its E.U partners.

Elsewhere, the pound (£1.2960) succumbs to Brexit rhetoric at the Conservative Party annual conference.

On tap: Fed Chair Powell is due to speak (12:45 pm EDT) about the outlook for employment and inflation at the National Association for Business Economics Annual Meeting, in Boston. Audience questions expected.

1. Stocks mostly see ‘red’

Asian equity markets traded generally lower as China remains on holiday, with Japan being the exception.

In Japan, the Nikkei edged up to a fresh 27-year high overnight, building on recent strength thanks to upbeat earnings hopes, mostly on the back of a weaker yen. The Nikkei share average ended +0.1% higher, while the broader Topix was up +0.3%.

Down-under, Aussie shares closed at their lowest in more than three-months overnight as financial stocks extended losses following a Royal Commission interim report on the sector. The S&P/ASX 200 index fell -0.8%, after dropping -0.6% on Monday. In S. Korea, stocks saw their worst day in nearly two-months on heightened U.S-China tensions. The Kospi fell -1.25%, marking its biggest percentage loss since August 13.

In Hong Kong, stocks also fell overnight on signs of weakness in China’s manufacturing sector. Resuming trade after a public holiday yesterday, the benchmark Hang Seng Index was down -1.64%.

In Europe, regional bourses open down across the board with Italy at the fore, as concerns over Italian finances keeps risk sentiment depressed. Four year high Brent prices are supporting energy stocks. The financial sector remains the worst performer.

U.S stocks are set to open in the ‘red’ (-0.4%).

Indices: Stoxx50 -1.2% at 3,374, FTSE -1.1% at 7,447, DAX -1.0% at 12,220, CAC-40 -1.1% at 5,449, IBEX-35 -1.2% at 9,297, FTSE MIB -1.4% at 20,324, SMI -0.7% at 9,060, S&P 500 Futures -0.4%

2. U.S oil hits four-year peak ahead of sanctions on Iran, gold higher

Earlier this morning, U.S oil prices hit their highest level since November 2014, while Brent crude trades atop of yesterday’s four-year high print, as markets prepare for tighter supply once U.S sanctions against Iran begin to hit in November.

U.S West Texas Intermediate (WTI) crude futures are at +$75.90 a barrel – WTI has rallied +18% since mid-August, while Brent crude oil futures are at +$85.28 per barrel, up +30c, or +0.4%, from Monday’s close. Brent has risen by more than +20% from its lows in August.

Market sentiment also got a boost from yesterday’s announcement of a “new” trilateral pact between the U.S, Mexico and Canada (USMCA), saving a +$1.2T a year open-trade zone that had been on the verge of collapse.

Iran’s oil industry, which at its most recent peak this year, supplied +3% of the world’s almost +100M barrels of daily consumption. U.S sanctions are set to start on Nov. 4.

Ahead of the U.S open, gold prices have found some support as risk appetite wanes, one day after getting a boost from the USMCA deal. Spot gold is up +0.5% at +$1,193.80, after declining about -0.3% in yesterday’s session. U.S gold futures are +0.5% higher at +$1,197.60 an ounce.

3. BTP/Bund yield gap at its widest in five-years

The Italian/German 10-year bond yield spread trades atop of its five-year highs as eurozone officials warned of a return to crisis days and an Italian lawmaker said most of Italy’s problems would be solved if it returned to its own currency.

As Italian bond yields surged +11-20 bps, the yield premium investors demand to hold Italian paper over German debt shot higher. The BTP/Bund 10-year bond yield gap has widened out to +302 bps.

Note: Bunds remain exposed to opposing forces, with safe-haven runs triggered by Italy jitters pushing German yields lower, but expectations of rate raises by the ECB next year is pointing to higher Bund yields.

The yield on U.S 10’s has decreased -2 bps to +3.06%. In Germany, the 10-year Bund yield has decreased -3 bps to +0.44%, the lowest in almost three weeks, while Italy’s 10-year yield has gained +12 bps to +3.421%, the highest in more than four-years.

4. Pound under pressure

As the market waits for PM May’s new Brexit draft proposal on the Irish border, uncertainties continue to threaten sterling (£1.2966) and this morning’s weaker construction PMI survey has caused it to fall further. Sterling fell to a three-week low of £1.2957, from 1.2987 beforehand, after data showed construction PMI fell to 52.1 in September from 52.9 in August, signalling “the weakest upturn in output for six-months.”

The EUR (€1.1517) continues to decline falling over -0.4% against the U.S dollar and -0.6% against the Yen (€130.98) on Italian Budget uncertainty.

Down-under, AUD/USD (A$0.7173 down -0.77%) has retraced earlier gains after the Reserve Bank of Australia (RBA) left rates on hold (see below), while the NZD/USD has declined after yesterday’s NZIER Business Confidence (-30 vs. -20) fell to the lowest level in nine-years.

5. RBA rate statement

It was as expected from the Reserve Bank of Australia (RBA), leaving the key policy rate at record lows (+1.5%) and traders with the impression that the RBA plans to remain sidelined for some time.

Nevertheless, Governor Lowes’s big concerns remain low wage growth and higher debt levels – a potential combo that could dissuade consumer spending and in turn ‘slows’ the country’s economy.

However, global expansion and recent domestic growth are positives and the RBA continues to expect GDP growth of more than +3% through 2019 and for the unemployment to drift down towards +5% over time.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.