Hawkish Powell the catalyst for higher yields

Yields are on the rise on Thursday which may be weighing on stocks ahead of the US open, with the return on 10-year Treasuries at levels not seen since 2011.

Another strong batch of US data on Wednesday combined with some hawkish comments from Federal Reserve Chair Jerome Powell appears to have been the catalyst for a surge in yields, as investors begin to factor in the possibility of higher interest rates and faster hikes. Powell suggested that the Fed remains “a long way from neutral at this point” and that they may go beyond which may go against what investors had in mind.

Source – Thomson Reuters Eikon

There appeared to be a belief that in removing the reference to monetary policy being accommodative from the statement last week, that the central bank was near the neutral rate and therefore rate hikes may be more limited but that is clearly not the case. With the economy running hot and headwinds – such as trade wars – not yet weighing, the Fed is clearly very comfortable maintaining the pace of tightening and is willing to go further in order to keep it in check.

EUR/USD – Struggling euro breaches 1.15

India coming under scrutiny as USD rally and oil prices raise concerns

The spike in US Treasuries has driven demand for the greenback which is back near last month’s peak, mostly it would appear at the expense of emerging market currencies – again – and the yen. Rising interest rates have coincided with increased focus on emerging markets which has resulted in significant focus on Turkey and Argentina in recent months and is causing concerns for India.

USDINR Daily Chart

OANDA fxTrade Advanced Charting Platform

A surging dollar and a relentless rise in oil prices has been particularly troubling for India, with concerns around its current account deficit drawing the spotlight. It would appear this could be the next domino to fall which could continue to put pressure on the rupee and force the central bank to reluctantly raise interest rates in an attempt to bring some order. Scrutiny of the country’s shadow banking industry following government intervention in IL&FS isn’t going to help matters and may worry investors.

Asia market close: focus on JGB’s and CNH

Gold resilient to recent USD gains

Gold has been surprisingly resilient to dollar strength over the last couple of weeks which some have attributed to Italy-related safe haven flows. It has not been the safe haven of choice in recent months though during periods of stress, with Treasuries and therefore the greenback instead being favoured, which has in turn weighed on the yellow metal as it’s priced in dollars.

Gold Daily Chart

Perhaps, the euro-specific nature of the Italian issues is what’s driven support for Gold during these periods but even if that’s the case, if we continue to see the dollar perform well, it’s going to limit its upside potential.

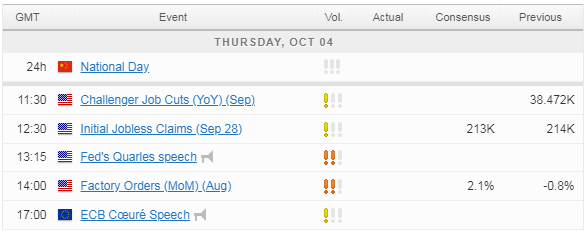

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.