Wednesday October 10: Five things the markets are talking about

U.S treasury yields are largely stable, after declining from their seven-year high print yesterday.

Euro equities are on the back foot after Asia stocks managed to break a multi losing session.

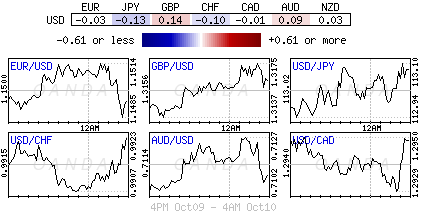

Elsewhere, the ‘big’ dollar has stalled temporarily after U.S President Trump said the Fed should not raise interest rates as fast. However, Trump’s plea is unlikely to alter the broader theme of dollar gains in the short-term.

Dollar ‘bulls’ have yet to have a clear understanding of what the top is for the Fed cycle, and until the Trump administration changes its tune on China and trade, investors will continue to support the USD against emerging markets and pro-growth currencies.

For the dollar ‘bear’s’ next month’s midterm elections have the potential to derail dollar demand, especially where the loss of the House by the GoP would curtail most hopes for fresh fiscal stimulus. However, a month is a long time in politics.

Despite the U.S bond rout easing a tad, +$230B of new U.S debt is coming to the market this week, which should put pressure on dealers to back up yields.

U.S producer and consumer price data is also due in the next two-days and it too will determine where yields go from here.

1. Stocks mixed results

In Japan, the Nikkei edged a tad higher overnight as investors picked up defensive stocks on the dips, while index-heavyweight SoftBank dived on news it was to buy a majority stake in U.S shared office space provider WeWork. The Nikkei share average ended +0.2% higher, while the broader Topix was also up +0.2%.

Down-under, Aussie stocks rallied after its worst 48-hours in six-months. The ASX 200 closed +0.1% higher as the health-care sector rebounded +1.5%, reversing some of yesterday’s -3.9% losses, the biggest drop in seven-years. In S. Korea, the Kospi stock index closed down -1.12% overnight, hitting its lowest close in 18-months after the IMF cut its growth forecast for the country.

In China, stocks were mixed after the close overnight, as gains in utilities and communications led shares higher while losses in the energy sector led shares lower. At the close, the Shanghai composite rallied +0.18%.

In Hong Kong, stocks closed marginally higher earlier this morning, with investors remaining nervous about volatility in the U.S and a weak yuan. The Hang Seng Index edged up +0.08%.

In Europe, regional bourses continue their bearish tone with declines across the board. Sino-U.S trade concerns, coupled with Italian budget and U.K Brexit commentary continue to weigh on markets.

U.S stocks are set to open in the ‘red’ (-0.1%).

Indices: Stoxx600 -0.4% at 371.5, FTSE -0.1% at 7227, DAX -0.6% at 11904, CAC-40 -0.7% at 5283, IBEX-35 -0.6% at 9203, FTSE MIB -0.2% at 20023, SMI 0% at 8960, S&P 500 Futures -0.1%

2. Oil dips as IMF cuts growth outlook; eyes on hurricane

Oil prices have eased a tad after the IMF yesterday lowered its global growth forecasts. Nevertheless, markets are well supported on pullbacks as Hurricane Michael, a category 4, moves toward Florida causing the shutdown of nearly +40% of U.S Gulf of Mexico crude production.

Brent crude is down -20c at +$84.80 a barrel, after a +1.3% gain on yesterday. U.S light crude is down -15c at +$74.81.

Also providing an underlying bid is data showing crude exports from Iran, OPEC’s third-largest producer, are declining before the imposition of new U.S sanctions next month.

According to tanker data, Iran’s crude exports fell further in the first week of October, as buyers sought alternatives ahead of U.S sanctions that are to take effect on Nov. 4. Iran exported +1.1M bpd of crude in the first week of October, down from at least +2.5M bpd in April – before President Trump imposed sanctions.

Yesterday, the IMF cut its global economic growth forecasts for 2018 and 2019, raising concerns that demand for oil may also slump.

Ahead of the U.S open, gold is holding steady in a narrow range overnight, as the ‘big’ dollar pulls back from its seven-week high – support remains strong for the dollar on the back of a strong U.S. economy and expectations of steady interest rate hikes by the Fed. Spot gold is little changed at +$1,189.35 an ounce, moving largely within a +$4 range. U.S. gold futures have rallied +0.1% to +$1,192.60 an ounce.

3. Sovereign yields dip, including Italy’s BTP’s

Italian BTP yields have eased a tad this morning after Italy’s Economy Minister Giovanni Tria confirmed budget forecasts and said that he expected collaboration with the E.U over the budget.

After hitting multi-year highs yesterday, Italian government bond yields fell -2 bps along the curve – the two-year BTP yield fell to +1.70%. The spread of Italy’s 10-year BTP’s over Germany’s has widened +10 bps to +3.026%.

Yesterday, President Trump repeated his displeasure with higher short-term interest rates set by the Fed. Trump believes U.S inflation remains “in check,” which does not warrant a tighter monetary policy, especially at the Fed’s current pace.

The yield on U.S 10’s has eased -1 bps to +3.21%. In Germany, the 10-year Bund yield has decreased -1 bps to +0.54%, while in the U.K, the 10-year Gilt yield has backed up less than +1 bps to +1.719%.

4. Dollar takes a breather

The pound (£1.3160 +0.10%) has advanced to a four-month high against the EUR and a two-week high against the dollar, on signs of momentum in the Brexit negotiations. According to the Times, a group of between 30 and 40 Labour members of parliament will defy Jeremy Corbyn and endorse a less hard-line proposal to prevent a ‘no-deal’ exit from the E.U.

Note: Both the U.K and E.U are said to have made progress in Brexit negotiations over Irish backstop.

Rising Italian bond yields continue to provide some resistance for the EUR (€1.1482), but major falls are not in the cards as long as the ‘single’ unit’s existence is not threatened, and as long as the ECB indicates ‘whatever it takes’ promise is in place.

The USD/JPY (¥113.19) is a tad higher as the yen snapped a four-day winning streak as some safe-haven flows retreated as U.S Treasury rates stabilized.

5. U.K economy picked up in the summer

Data this morning showed that U.K economic growth picked up over the summer, supported by stronger retail sales and house building in response to warmer-than-usual weather.

According to the ONS, economic output in the three-months through August was +0.7% higher than in the three-months through May, equivalent to annualized growth of +2.8%.

However, there were signs that the U.K economy was losing traction towards the end of the period, with output flat in August compared with July.

According to the ONS, “the economy continued to rebound strongly after a weak spring with retail, food and drink production and house building all performing particularly well during the hot summer months.”

Note: The BoE indicated it would follow its two rate rises with a number of further moves over the coming years if the economy continues grow at around its current rate. However, expect the Brexit strategy to determine monetary policy, at least in the short-term.

Other data showed that the U.K’s trade deficit widened in August as its goods deficit deepened to -£11.2B from -£10.4B in July, while its manufacturing output was -0.2% lower in August than in July, a second straight month of decline.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.