Chinese rally provides little boost elsewhere

Surging stocks in China hasn’t provided much of a catalyst for similar moves elsewhere at the start of the week, with local investors seeing recent comments from various officials as evidence that the private sector will be protected, despite heightened risk from a trade war with the US.

President Xi added his name to the list of those vowing to support private firms over the weekend, giving investors reason to pile back in to battered Chinese stocks. The Shanghai Composite had fallen more than 30% from its peak this year prior to Friday’s comments, which has been the clearest sign so far that tariffs are biting.

The tariffs may not yet be taking their toll on the trade data but as long as the stock market continues to take a beating and growth stalls – as the data last week showed – Trump will be confident that the measures are effective and continue to threaten to double down until he wins concessions. There’s still a long way to go in this particular trade spat it would seem.

China equities lead the pack as US indices lag

Italian budget and Brexit enough of a headache for EU

Europe has its own problems, without having to worry about hostile trade policies of the world’s two largest economies, as Italy prepares to defy the EU on its budget and risk sanctions and the UK pushes negotiations to the wire over the backstop for the Northern Irish border.

Reports over the weekend suggest Italy is not willing to budge on its 2.4% deficit target and will instead conduct regular monitoring to ensure it doesn’t exceed it. This is unlikely to satisfy the European Commission but at the same time, it will be extremely reluctant to impose financial sanctions and fuel the already growing populist movement in the country that has already delivered a Eurosceptic coalition government.

source: tradingeconomics.com

We could hear from the EC as early as Tuesday, which will likely come as a request to amend and resubmit the 2019 budget at this stage.

Asia market update: US-China digging in for the long haul?

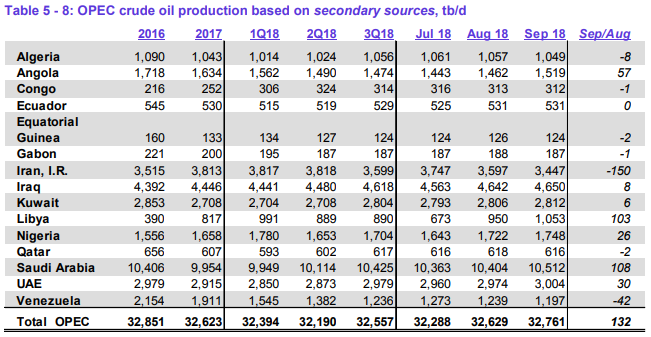

Falih comments don’t provide much comfort for oil traders

Comments from Saudi Energy Minister Falih this morning don’t appear to have provided much comfort to oil traders, despite his insistence that a repeat of a 1973-style oil embargo is not their intention and that production will likely go up to 11 million barrels per day in the near future.

Source – OPEC Monthly Oil Market Report

This comes as people become increasingly frustrated with the handling of the apparent Khashoggi murder, with Trump appearing very keen to accept any explanation that removes any link whatsoever to the Crown Prince. Trump has been desperate not to threaten the relationship the US has with Saudi Arabia or the arms deal that he signed with the Crown Prince not too long ago.

It would appear the route forward has already been laid and the explanation – no matter how unbelievable many find it – will be accepted by the White House and the whole saga will attempt to be brushed under the rug. This may prevent a series of sanctions and counter measures between the two countries that could disrupt oil supply and drive prices much higher and Trump may even believe he can use the situation to push the Saudi’s to increase output as sanctions against Iran kick in, or is that the cynic in me?

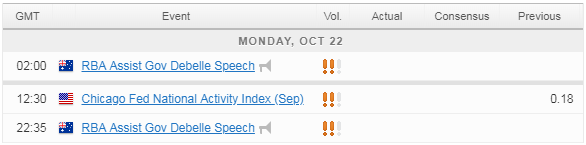

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.