Daily Markets Broadcast

2018-10-31

Wall Street ends a volatile day sharply higher

Wall Street closed strongly yesterday, bouncing from near-four month lows, amid gains in the tech and transport sectors. China’s manufacturing PMI slides to 50.2 in October, below estimates.

US30USD Daily Chart

-

The US30 index posted its biggest one-day gain in two weeks amid strong buying in the last hour of trading. Gains were led by the tech and transport sectors

-

The index has traded below the 200-day moving average, which is at 25,092 today, for the past five days

-

The run-up to Friday’s nonfarm payroll report starts today with the release of October’s ADP employment change, which is expected to show an add of 189,000 jobs.

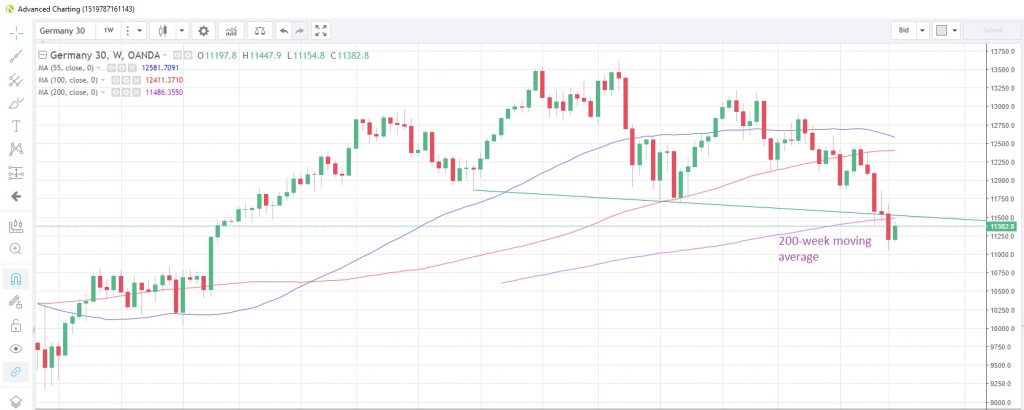

DE30EUR Daily Chart

-

The DE30 index rose for a second straight day yesterday, despite disappointing data, but is till on track to post its worst month since February

-

Support at the 55-month moving average at 11,187 remains intact, while the 200-week moving average caps at 11,487

-

Euro-zone Q3 GDP growth came in below forecast at +0.2% q/q vs +0.4%. Today we see October CPI data, which is expected to accelerate to +2.2% y/y from +2.1%. Slower growth and higher inflation is generally viewed as not a good combination for equities.

CN50USD Daily Chart

-

The China50 index rose for the first time in three days yesterday, still holding above the five-week low struck mid-month. However, it’s still facing its worst month since February

-

The 55-month moving average at 10,550 still lends support while the next resistance point is possibly at 11,252, the 55-day moving average

-

October manufacturing PMI came in below forecast with a 50.2 print, lowest since July 2016, which was the last time the index was below the 50 expansion/contraction threshold. The disappointing number could hamper sentiment.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.