China could face another $257 billion of tariffs in December

We’re expecting a mixed start to trading in Europe on Tuesday, as investors shrug off the threat of new Chinese tariffs by the US in a sign that sentiment may be improving.

A tariff on the remaining $257 billion of Chinese imports has been threatened for some time, so the latest revelation comes as little surprise to investors. It did shed some light on when they could be implemented though, with the report claiming they could be imposed as early as December if talks between the two President’s fail next month. Given that neither side has shown much of a willingness to compromise until now, this seems rather likely.

You will find more infographics at Statista

You will find more infographics at Statista

That said, the last couple of months has seen the Chinese economy in particular experience something of a slowdown, with growth in the previous quarter slipping to 6.5% and other economic indicators suggesting that tariffs are already biting. The US economy is very strong right now but growth did slow a little in the third quarter and with momentum slipping ahead of next week’s midterms and some forecasting slower growth next year, I wonder whether this has played into the decision to accelerate these tariffs.

Commodities Weekly: Gold set for first monthly gain in seven

Market sentiment perhaps not as fragile as it has been

Seeing markets take the new tariff threats in their stride is certainly encouraging though, given just how fragile sentiment has been in recent weeks. The information may not be particularly new but the confirmation of such a move threatens to escalate the trade conflict between the world’s two largest economies and had the report come a week or two ago, I wonder whether the reaction would have been more negative.

It’s not been a straightforward start to the week but we have seen reasons for optimism, with Europe and Asia posting gains and the late rally in the US potentially providing a lift heading into Tuesday. If we can get through the week without too many setbacks, then investors may begin to see the light at the end of the tunnel and sense opportunities in the markets, rather than view it with anxiety and fear which has certainly been the case in recent weeks.

Daily Markets Broadcast 2018-10-30

Gold pares gains and oil loses its spark

Gold continues to pare recent gains this morning, down around 0.25% early in the day, as risk appetite gradually improves. This is being aided by the gradual increase in the dollar, which typically weighs on the yellow metal. Ultimately though, as we’ve seen recently, Gold has become increasingly correlated with the performance of US markets which have been the key risk barometer, so if we see markets stabilise and recover then Gold could come under a little pressure.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil has lost its spark over the last week, entering into a period of consolidation after falling almost 15% over the course of the month. Supply concerns linked to Iranian sanctions appear to have been a little overblown, especially in light of Saudi Arabia’s commitment to fill the shortfall, along with other major oil producers. The gloomier global economic outlook has also taken its toll on oil as traders weigh up the impact on demand in the coming years.

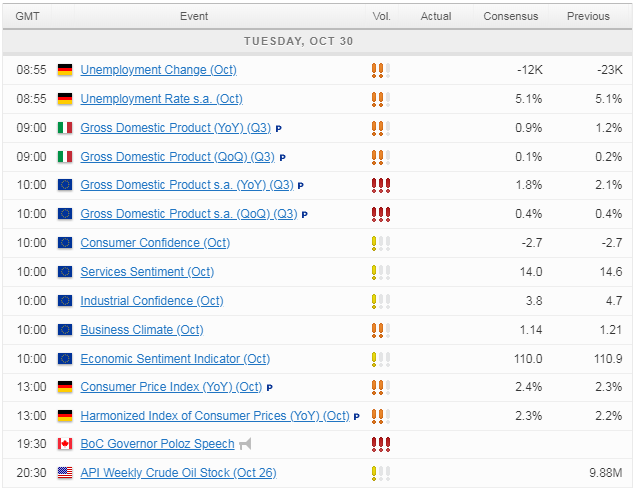

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.