Market volatility going nowhere

US futures may be trading in the green ahead of the open on Tuesday but as we saw at the start of the week, that doesn’t necessarily provide much comfort for the session ahead. They’ve also pared much of the gains from earlier on which doesn’t provide any additional hope.

The levels of volatility we’re seeing right now isn’t going to give anyone confidence that we’re not headed for further declines in the markets. We did see a late rally in the US session on Monday which may suggest pessimism isn’t quite as rife as it’s been in recent weeks although it’s difficult to read too much into any rallies at the moment. Any ray of hope seems to be quickly dashed by the market taking another dive lower, this particular correction may well have longer to run.

VIX Daily Chart

Source – Thomson Reuters Eikon

One reason for optimism has been the market taking reports of more tariffs in December in their stride and not slipping into panic mode as they may have a couple of weeks ago. The tariffs covering the remaining $257 billion of imports would represent a significant ramping up of trade tensions between the world’s two largest economies, albeit not an unforeseen one. Trump sounded very optimistic that a great deal will be done but didn’t think China is ready, which means further pain ahead, particularly for the latter which is already being impacted by those tariffs that have already been imposed.

European open – Markets flat despite US tariffs

US data interesting ahead of Fed meeting next week

We got away relatively unscathed from the data on Monday, with inflation, income and spending figures neither triggering concern about the strength of the economy and impact on interest rates or showing any real weakness. We have a scattering of data throughout the week but all eyes will be on Friday’s jobs report, coming less than a week before the November Fed meeting.

While the gathering next week isn’t expected to be a “live” meeting – no change in interest rates – it will be the first since the market went loco, to borrow a phrase from Trump. Given that this appears to have been sparked by comments from the Fed Chairman himself, it would be an opportunity to clarify or even backtrack. I’m not convinced they will yet though although they may include a reference to the market and the fact that further instability could force them to reconsider the timing of future hikes.

Commodities Weekly: Gold set for first monthly gain in seven

Stronger dollar limiting Gold recovery, oil drifts lower

Gold is continuing to trend lower this morning although it has picked up a little since the European open as stocks have moved into negative territory and US futures have reversed most of their gains. The yellow metal is off around 0.4% at the time of writing but given the direction of travel for stock markets currently, these losses may continue to be pared. The dollar has been relatively well bid this morning though which could limit the upside for Gold.

Oil is also not faring too well this morning and has been trending lower in line with the drop off we’ve seen in stock markets. The API inventory data will be keenly watched today for further evidence that the market isn’t quite as tight as it appeared, with the inventory numbers over the last couple of weeks giving investors pause for thought.

Oil (Brent and WTI) Daily Chart

OANDA fxTrade Advanced Charting Platform

API reported a huge build last week and another repeat of this should put further downside pressure on Brent and WTI, both of which have had a rather torrid October.

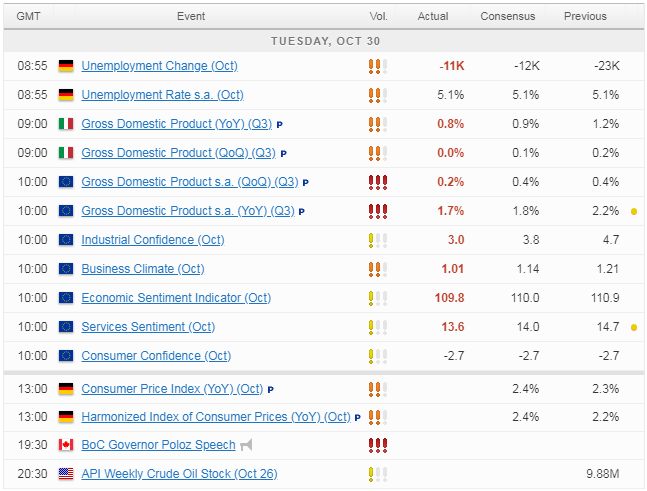

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.