The bearish themes that have dominated markets since the start of the year continued into today’s Asian session, with little on the horizon that could possibly reverse this sentiment.

PMIs pressure risk appetite

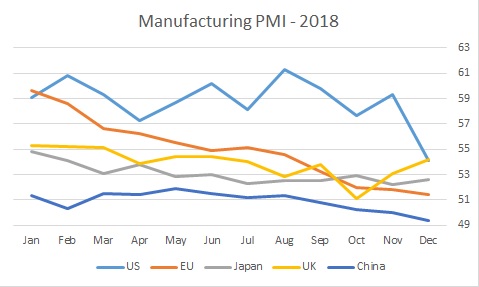

The majority of the major PMI gauges of manufacturing slid in December (the exceptions being (surprisingly) the UK, and this morning’s release of Japan’s data) with the US gauge tumbling by the most since 2008. It would appear that Trump’s agenda of resetting global trade terms has stirred up some (maybe) unforeseen domestic costs, which could spur an increased resolve to reach a deal, if such evidence continues to mount.

Manufacturing PMI major economies – 2018

The service sector could be a white knight for risk appetite, as China’s Caixin non-manufacturing PMI rose for a second straight month, hitting 53.9, the highest in six months. This was enough to drag Asian equity indices off their lows and prompt buying of the Australian dollar and selling of the Japanese yen. AUD/JPY is currently up 0.63% at 75.782.

AUD/JPY Daily Chart

It’s payrolls day

There are two events in the US session which could dictate the direction for risk appetite over the next few days. First off, we have the December US nonfarm payroll report, which has been somewhat erratic over the past 12 months, with results ranging from +101.000 to +313,000. The forecast for December is +177,000, according to the latest survey of economists, up from November’s +155,000 but still below the six-month moving average of +185,000. As my colleague Ed Moya has mentioned, while the jobs sector has been relatively robust, the rest of the US economy is telling a different story.

The ISM employment index slid 2.2% to 56.2% in December, suggesting employment is continuing to expand, albeit at the slowest pace since June last year, and could imply that the nonfarm payroll number might disappoint.

The second event is the speech by Fed Chairman Jerome Powell at the American Economic Association’s annual meeting alongside former Fed heads Janet Yellen and Ben Bernanke. Any hint that he is determined to carry on with the quantitative tightening policy regardless would be devastating for markets, which have priced out any Fed hikes in 2019.

Aside from the employment report, service sector PMI data are due from Germany, the Euro-zone, the UK and the US, while Canada also reports its own jobs data for December.

The full MarketPulse data calendar can be viewed at https://www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.