The combined inputs of a PBOC reserve ratio cut, a strong US jobs report and Fed Chairman Powell’s soothing comments of Fed rate trajectory saw risk appetite gain a solid footing at the end of last week. Asia has been more cautious today, with some asset classes lacking follow-through momentum as trading got underway this week.

Markets Rise After Strong US Jobs Growth with Fed Talking Down Rate Hikes

Currency safe havens in demand

Safe haven assets saw some demand in relatively slow Asian trading this morning, retracing some of the moves seen Friday, as USD/JPY slid 0.37% to 108.11 and gold advanced 0.4% to 1,289.60. Equity markets fared a little bit better, though most indices gave up early gains to trade marginally in the red. China shares underperformed as the reserve ratio cut boost faded quickly. The China50 index slumped 1.48% to 10,463 after the 100-moving average on the four-hour chart proved to be stubborn resistance.

China50 4-Hour Chart

US-China trade talks restart as China’s economy slows

The first mid-level trade negotiations since the 90-day tariff truce came into effect start today. While no groundbreaking progress or announcements, the sit-down comes as US President Trump commented Friday that China’s weakening economic growth puts the US in a strong position. He feels China “sort of have to” come to a deal.

More PBOC liquidity easing to come?

Hot on the heels of the central bank’s reserve ratio cut on Friday, the fifth in a year, the China Daily newspaper ran an opinion piece today suggesting China has room for more cuts, while it reiterated that policymakers are studying new ways to give small companies access to cheaper financing.

Will other Fed speakers echo Powell?

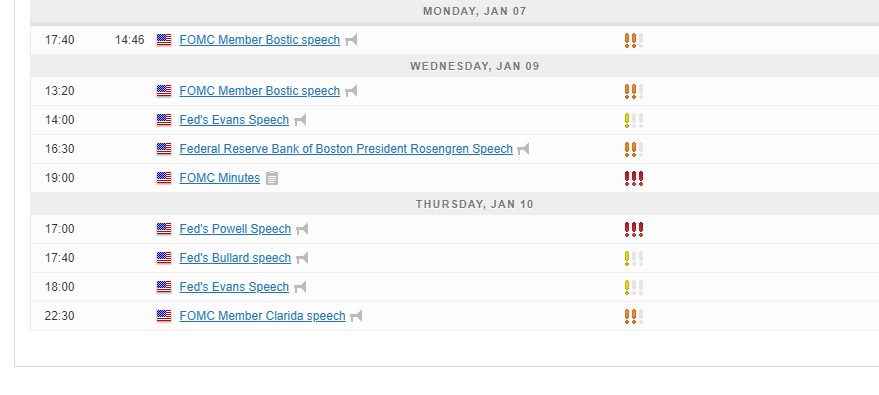

Fed’s Bostic speaks later today, the first of eight scheduled speeches by Fed members this week, the bulk of which come on Thursday. We would need to hear the message of flexible, data-driven response on the rate trajectory this year for the current risk-on mood to extend.

Fed member speech calendar

The Fed’s monetary policy reaction function is yawing dovish

German factory orders seen contracting

The rest of the data calendar sees retails sales from both Germany and the Euro-zone for November. The former are expected to drop 0.9% y/y while there are no survey results for the latter. German factory orders are expected to show the first contraction in four months, 0.5% m/m while the North American calendar is populated with the US December ISM non-manufacturing PMI (59.7 from 60.7) and Canada’s Ivey manufacturing PMI (last 57.3).

You can view the full MarketPulse data calendar at https://www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.