Europe seen higher as bullish momentum builds

Positive momentum is rolling into the middle of the week as markets enjoy what has become an unusual winning streak, with Europe positioned for another higher open on Wednesday.

Stock markets across the region are expected to open more than half a percent higher on Wednesday, as we continue to experience a dovish Fed bounce to start the year. Sentiment remains on shaky ground but at the moment we’re experiencing something of a relief rally as the US central bank falls more in line with markets expectations and adopts a more cautious and reactive approach to interest rate hikes.

Slowly but surely, the numerous headwinds that contributed to the market sell-off in the final quarter of 2018 are becoming less gale force and more strong breeze. There is a clear risk that conditions could deteriorate quickly but at the moment, the storm is passing and investors are seeing opportunities in the wreckage.

Trade talk optimism boosts risk

May takes another stab at getting her Brexit deal through parliament

The US government remains in partial shutdown but the prospect of progress in trade talks between the US and China is very encouraging. The Italian budget situation was resolved before the turn of the year which was a welcome development in Europe. Brexit continues to be a major risk factor for Europe, particularly the UK, but despite the political soap opera that is expected to play out over the next couple of months, I’m still confident that any catastrophic outcome will not materialise as there simply is no appetite for it, regardless of the threats.

MPs will begin debating Theresa May’s Brexit deal again in parliament today ahead of a proposed vote next Tuesday. Barring any late intervention from Europe, in the way of clarification on the temporary nature of the backstop, I struggle to see how the deal passes next week as nothing has changes since May embarrassingly pulled it late in the day in December, fearing a crushing defeat. The pound therefore remains very vulnerable over the next week and beyond, assuming May’s deal spectacularly fails as is widely expected.

All is calm in the Foggy Bottom

Oil up almost 20% since Christmas on risk bounce

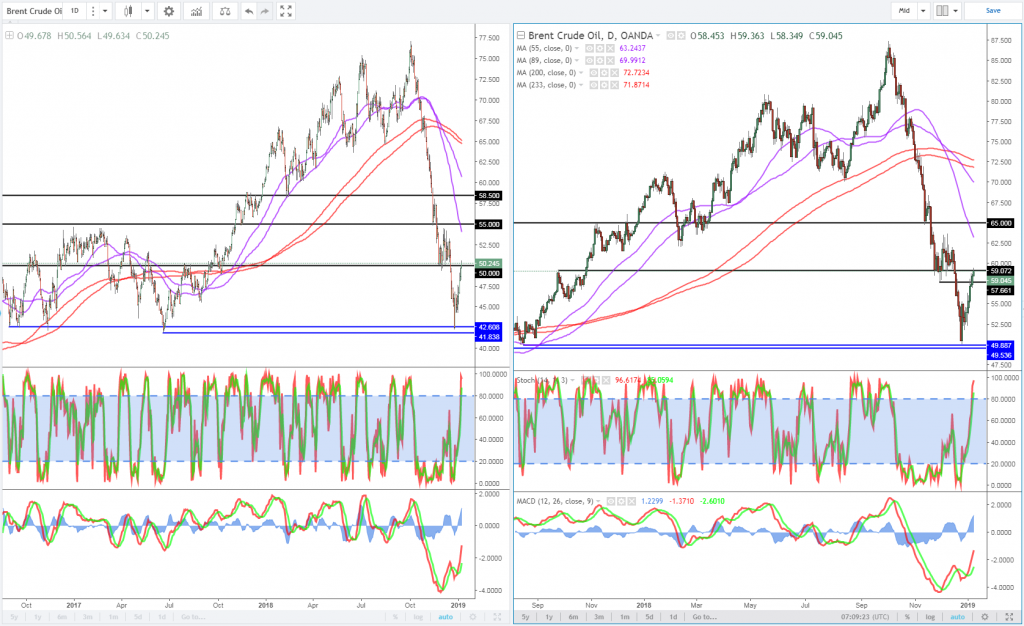

Oil continues to benefit from this improvement in risk appetite, trading more than 1% higher again today, having rebounded almost 20% from its Christmas lows. The rebound in stock markets that has occurred in the same period is no coincidence and strongly suggests that global growth fears – which were arguably overdone – were at least partly responsible for such a severe decline in prices.

Oil (WTI and Brent) Daily Chart

OANDA fxTrade Advanced Charting Platform

The bounce we’ve since seen also corresponds nicely with the production cut that was agreed between OPEC+ nations and Saudi efforts to manipulate US inventory data that can be a major influencer on price movements. Brent now faces an interesting test around $60 a barrel, a break of which would bring the $63-65 range into focus. Should equity markets continue their recovery this week, I see no reason why oil prices won’t also enjoy the ride.

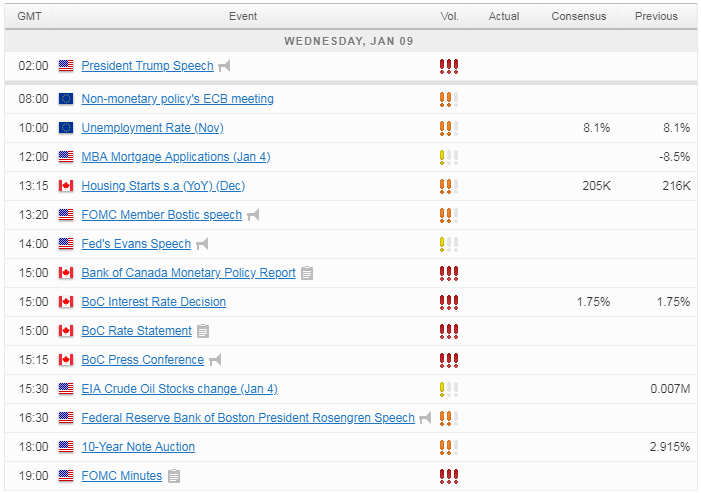

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.