Can talks with opposition parties yield a solution?

The Brexit saga continues to dominate the headlines after Theresa May’s government narrowly – albeit predictably – survived a no confidence vote in parliament on Wednesday. This comes 24 hours after her deal suffered a humiliating defeat in parliament and as she seeks to engage in discussions with opposition parties in an attempt to overcome the impasse.

While opposition leaders have – mostly – welcomed the opportunity to take a more active role, they all appear to share the same disdain for the no deal option, with opposition Labour leader Corbyn insisting it is removed before any discussions can take place. Unfortunately for May, this is an important negotiating tool with the EU and is not something she will therefore let go of easily, making the impasse that much harder to overcome.

The next few days in the Brexit soap opera may not be as eventful as the last but they will be extremely important as Theresa May prepares to present plan B to parliament on Monday before likely departing to Brussels to engage in further negotiations. Andrea Leadsom has confirmed this morning that a statement and motion on the next step will be put forward on Monday, with a full day of debate taking place on 29 January.

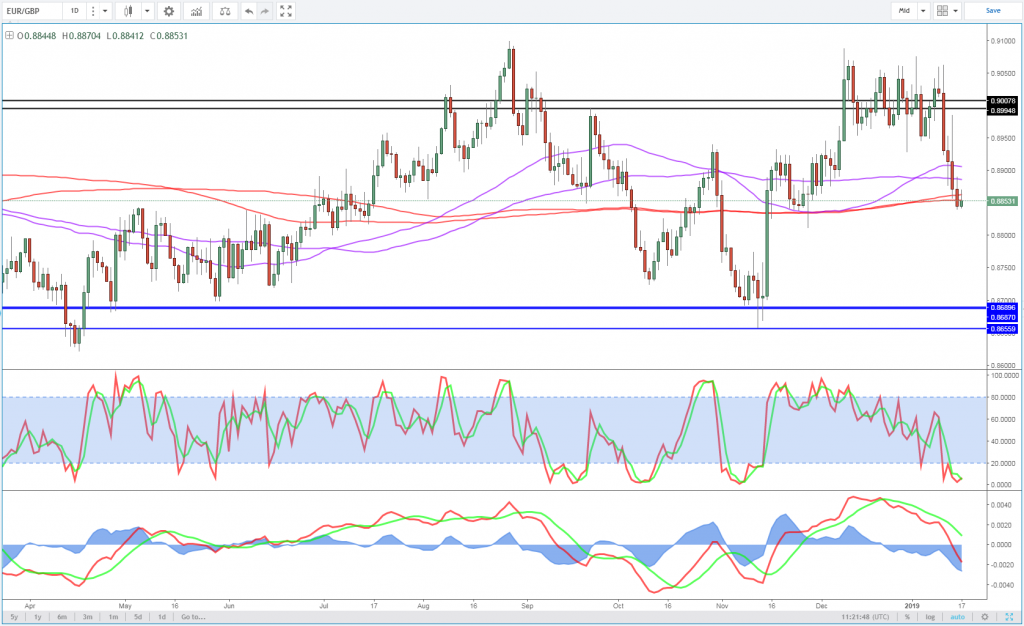

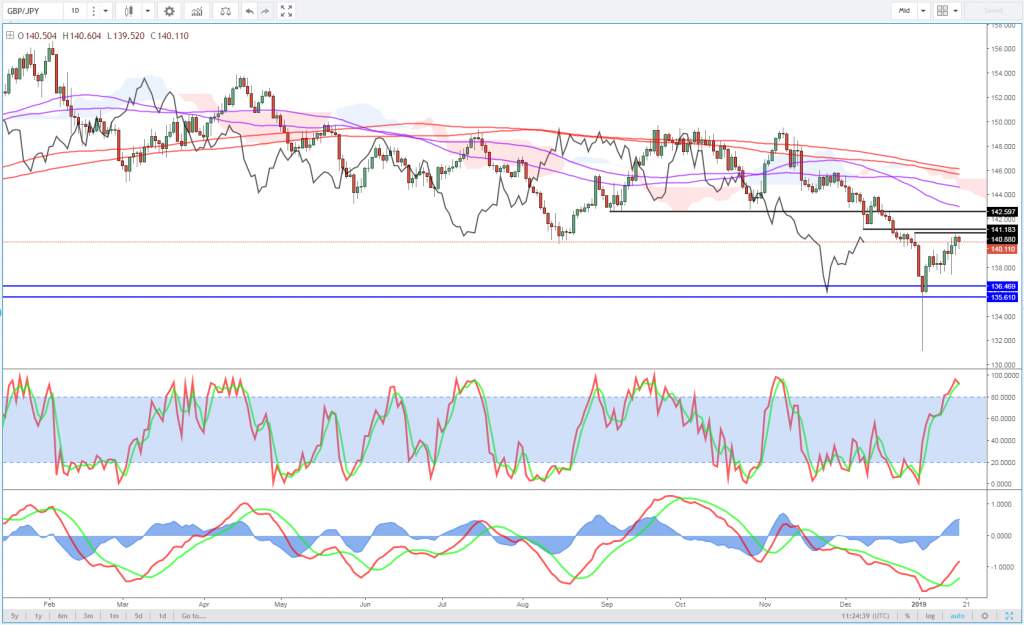

Traders have been very quick to respond to developments in parliament over the last few days which has yielded very little apart from a surge in volatility. The pound may be higher against the euro and yen but this more than likely reflects the weakness we’ve seen in both across the board than sterling itself. Against the dollar, which has made no progress for most of the last 48 hours, the pound is relatively flat, despite there having been large moves in the interim.

GBPUSD Daily Chart

EURGBP

GBPJPY

OANDA fxTrade Advanced Charting Platform

The FTSE has broadly tracked the wider market in recent days but has displayed sensitivity to sterling moves during that period. A stronger pound is negative for the UK index as a large portion of earnings for the companies within it are generated abroad, which would make them worth less when reported in the home currency. The opposite was true in the aftermath of the referendum in 2016 when a more than 10% drop in the pound contributed to a more than 20% jump in the index which outperformed the market.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.