Profit taking continues following report on US/China trade talks

European equity markets are poised to open slightly in the red on Wednesday, extending what has so far been a loss making start to the week as Asia offers little direction for traders.

The four week rally in equities appears to have taken a breather, with a relative absence of solid news flow probably contributing to the profit taking that we’re seeing. We seem to be running on a lot of speculation at the moment, particularly where the US and China trade talks are concerned, which makes forming a judgement all the more difficult.

The latest report from the FT – that was denied shortly after by White House economic advisor Larry Kudlow – suggested that the US had turned down an offer of preparatory trade talks ahead of Chinese Vice Premier Liu He’s visit at the end of the month.

A positive shift in risk in Asia; BOJ adjusts forecasts

USD supported following report as gold sees risk-off support

The US dollar was slightly bid following these reports, although it failed to give back these gains later on when Kudlow denied them. This may suggest that traders see some validity in the initial report, despite the denial, although I don’t expect it changes too much. Both sides appear encouraged by the progress so far and with a little over a month to go until the 90 day period expires, we should soon have a much better idea as well. The dollar is a decent barometer of how the talks are going, with the greenback being preferred during the escalation phase and the reverse being true as both sides have sought to work towards a solution.

Gold is looking a little flat on the day, like many other instruments it would seem. While $1,300 continues to elude it, it did get a small boost on Tuesday as equity markets traded in the red. Risk appetite has improved a lot recently which has taken some of the shine off it and it would appear a brief pause here offered some near-term support.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Daily Markets Broadcast 2019-01-23

Oil stumbles but remains bullish

Risk appetite has also played a big role in the movements in oil over the last month or so as well, with the aggressive sell-off into year-end coincided with broader risk-off trading. It’s therefore little surprise to see that the pause we’re seeing this week across the board is taking the edge off Brent and WTI just as both near notable resistance levels, around $65 and $55, respectively.

Oil (WTI and Brent) Daily Chart

These continue to look bullish though, even if the near-term may see some softness. As long as Brent holds above $59 and WTI $50, I still think these look bullish going forward but that doesn’t mean we can’t see some consolidation for now after 25%+ gains over the last month. This should be well supported by the success of the output cuts from OPEC+ which we won’t be seeing yet.

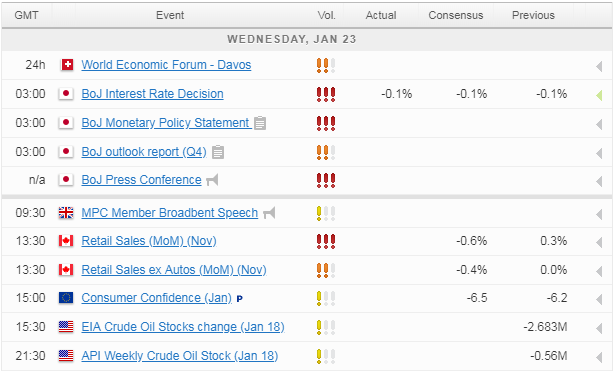

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.