A symbolic step forward for Brexit that will swiftly be followed by another step back

A mixed start for Europe is expected on Wednesday, with the FTSE the rare outperformer after the pound dipped on Tuesday evening following more Brexit votes in parliament.

It was a rare good evening for Theresa May, as the Brady amendment she supported received majority backing while those designed to block no-deal failed on this occasion. This obviously doesn’t include the Spelman amendment which called on the government to avoid no-deal but this was merely advisory and non-binding, in other words, largely pointless.

May will now head back to Brussels and attempt to renegotiate the backstop again, a tactic that’s been very unsuccessful in the past and faces the same result this time, with various officials reiterating after the vote that the withdrawal agreement will not be reopened. It’s almost as if they’re not taking the threat of no-deal seriously and therefore have no reason to negotiate on the backstop.

Brexit Quagmire Continues as Fed to Hit the Brakes

As far as the pound is concerned, I don’t view the drop on Tuesday as anything more than profit taking. The votes were merely symbolic and the view of parliament could easily change when May returns from Brussels without the amendments to the withdrawal agreement that she and others crave.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Sterling slipped back below 1.31 against the dollar but this is only a minor loss compared to the gains were saw in the run up to the vote and so I don’t believe the views of traders has actually dramatically changed, when it comes to the prospect of a no-deal Brexit. The pound remains well supported and a lot more will need to change, I feel, before no-deal becomes a realistic possibility. With so many in parliament strongly against it, I don’t see that happening and I don’t think traders do either.

Aussie gains as inflation shows mild acceleration

High level talks begin as US targets major Chinese firm

We’re not short of other talking points on Wednesday, with high level trade talks between the US and China resuming in Washington, as the 90 day deadline draws ever nearer. The meeting comes only a couple of days after the US brought charges against Huawei, a curiously timed move that risks creating friction between the two superpowers and threatening the progress that has already been made.

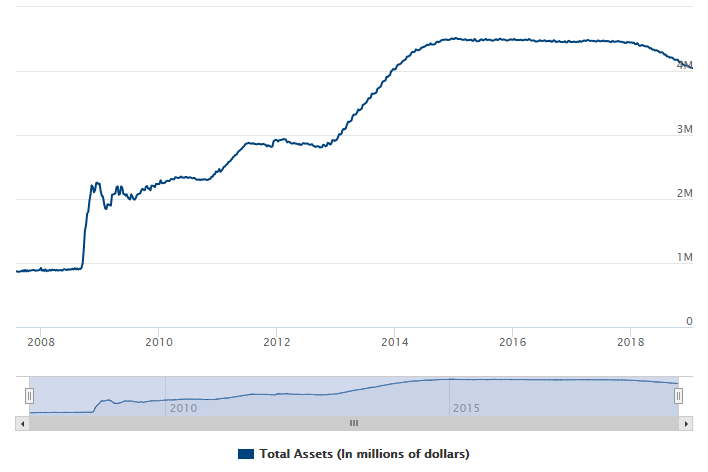

Quantitative tightening the new buzzwords

We’ll also hear from the Fed later as it announces its first monetary policy decision of the year. This is also the first meeting in which Jerome Powell will hold a press conference after the announcement, despite fresh economic projections not being released. We’ll be treated to this every meeting going forward now, which is convenient given the amount of questions circling about the Fed’s bond buying and the potential for it to slow its quantitative tightening experiment.

US Federal Reserve Balance Sheet

Source – Federal Reserve

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.