Economic activity in the manufacturing sector expanded in January, and the overall economy grew for the 117th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The January PMI® registered 56.6 percent, an increase of 2.3 percentage points from the December reading of 54.3 percent. The New Orders Index registered 58.2 percent, an increase of 6.9 percentage points from the December reading of 51.3 percent. The Production Index registered 60.5 percent, 6.4-percentage point increase compared to the December reading of 54.1 percent. The Employment Index registered 55.5 percent, a decrease of 0.5 percentage point from the December reading of 56 percent. The Supplier Deliveries Index registered 56.2 percent, a 2.8 percentage point decrease from the December reading of 59 percent. The Inventories Index registered 52.8 percent, an increase of 1.6 percentage points from the December reading of 51.2 percent. The Prices Index registered 49.6 percent, a 5.3-percentage point decrease from the December reading of 54.9 percent, indicating lower raw materials prices for the first time in nearly three years.

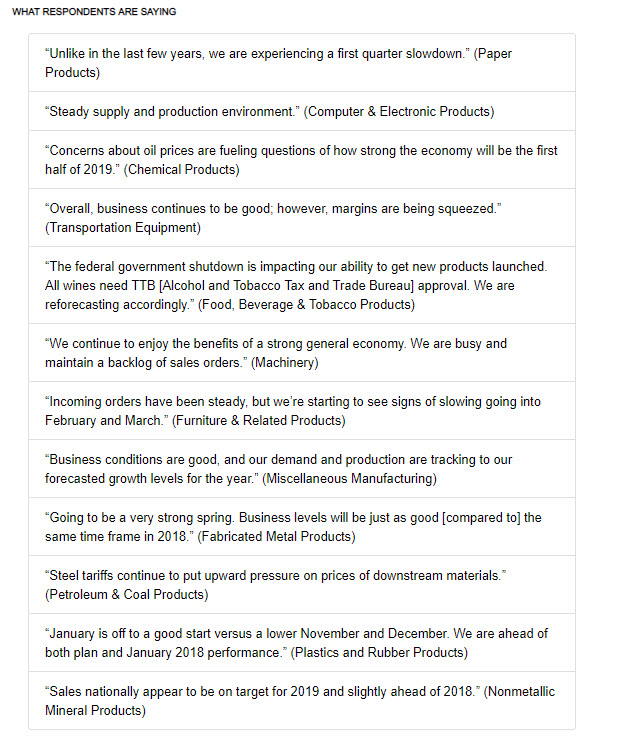

“Comments from the panel reflect continued expanding business strength, supported by strong demand and output. Demand expansion improved with the New Orders Index reading returning to the high 50s, the Customers’ Inventories Index remaining too low, and the Backlog of Orders remaining at a near-zero-expansion level. Consumption continued to strengthen, with production expanding strongly and employment continuing to expand at previous-month levels. Inputs — expressed as supplier deliveries, inventories and imports — continued to improve, but are negative to PMI® expansion. Inputs reflect an easing business environment, confirmed by Prices Index contraction.

“Exports continue to expand, but at the lowest level since the fourth quarter of 2016. Prices contracted for the first time since the first quarter of 2016. The manufacturing sector continues to expand, reversing December’s weak expansion, but inputs and prices indicate fundamental changes in supply chain constraints,” says Fiore.

Of the 18 manufacturing industries, 14 reported growth in January, in the following order: Textile Mills; Computer & Electronic Products; Plastics & Rubber Products; Miscellaneous Manufacturing; Furniture & Related Products; Printing & Related Support Activities; Primary Metals; Chemical Products; Transportation Equipment; Machinery; Fabricated Metal Products; Petroleum & Coal Products; Food, Beverage & Tobacco Products; and Electrical Equipment, Appliances & Components. The only industry reporting contraction in January is Nonmetallic Mineral Products.

EMPLOYMENT

Nine of 18 manufacturing industries reported employment growth in January in the following order: Textile Mills; Computer & Electronic Products; Primary Metals; Transportation Equipment; Machinery; Paper Products; Electrical Equipment, Appliances & Components; Chemical Products; and Plastic & Related Products. The five industries reporting a decrease in employment in January are: Wood Products; Printing & Related Support Activities; Furniture & Related Products; Nonmetallic Mineral Products; and Fabricated Metal Products.

INVENTORIES*

The 10 industries reporting higher inventories in January — listed in order — are: Furniture & Related Products; Textile Mills; Computer & Electronic Products; Miscellaneous Manufacturing; Transportation Equipment; Primary Metals; Chemical Products; Plastics & Rubber Products; Machinery; and Food, Beverage & Tobacco Products. The six industries reporting a decrease in inventories in January — listed in order — are: Apparel, Leather & Allied Products; Electrical Equipment, Appliances & Components; Paper Products; Petroleum & Coal Products; Nonmetallic Mineral Products; and Fabricated Metal Products.

PRICES*

Seven of the 18 industries reported paying increased prices for raw materials in January, in the following order: Textile Mills; Printing & Related Support Activities; Paper Products; Transportation Equipment; Miscellaneous Manufacturing; Computer & Electronic Products; and Food, Beverage & Tobacco Products. The seven industries reporting a decrease in prices for raw materials in January — listed in order — are: Fabricated Metal Products; Furniture & Related Products; Plastics & Rubber Products; Machinery; Chemical Products; Primary Metals; and Electrical Equipment, Appliances & Components.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.