Monday February 4: Five things the markets are talking about

Global equities hover atop of their four-month highs while the ‘big’ dollar holds firm after last Friday’s solid non-farm payroll (NFP) report and this despite inconclusive Sino-U.S trade talks stateside last week.

Trading overnight was subdued with many of the Asian markets closed for the Lunar New Year.

On the Brexit front, European Commissioner Juncker said that PM Theresa May’s bid to reopen the U.K’s divorce deal with the EU has increased the chances of a “disorderly Brexit” and that EU leaders should prepare for the worst.

The EU has offered no signs of giving any concessions to the U.K over the next few weeks. Nevertheless, PM May is still planning on going to Brussels to make her case. The EU seems set “not” to offer her anything until after the U.K has another vote on February 14th.

The next move for investors’ risk appetite will likely be dictated by ongoing U.S corporate earnings for this week.

On tap, tomorrow, the Reserve Bank of Australia (RBA), and on Thursday, the Bank of England (BoE) will deliver their respective monetary policy announcements. Also, on Thursday, investors will also see industrial production from Germany, which has been weak, and from France and Italy both out on Friday. Elsewhere, CAD trade balance & U.S ISM non-manufacturing PMI (Feb 5), U.S advanced GDP, retail sales & NZD unemployment (Feb 6) and CAD employment (Feb 8).

Note: The expectations are for census bureau to release the key Q4 GDP, personal income and spending data next week, between Feb 11-15.

Finally, tomorrow evening, U.S President Donald Trump will deliver his delayed State of the Union (9pm EDT).

1. Stocks see green in thin trading

Global equity markets performed strongly last week after the Fed pledged to be patient with further interest rate hikes, signaling a potential end to its tightening cycle.

In Japan overnight, the Nikkei booked moderate gains (+0.5%) amid strength in commodity and brokerage stocks and overcame a slump in electronics (Sony was down -8%). Elsewhere, all but one of the 33 Topix sectors rallied overnight following Friday’s strong U.S jobs report. The broader Topix gained +1.1%.

Down-under, Aussie stocks climbed to new session highs before the close, as investors took some late positions ahead of a long-awaited report on alleged financial-sector wrongdoing. The review has pressured both financial and insurance stocks for the past 12-months, the ASX 200 rallied +0.5%.

Note: China’s financial markets are closed all week, while those in S. Korea are shut until Thursday.

In Hong Kong, equities edged a tad higher in half-day trading overnight, on the back of mildly positive data on the Chinese economy. The Hang Seng index closed up +0.2%, while the Hang Seng China Enterprises index fell -0.3%.

In Europe, regional bourses trade flat to slightly higher ahead of a busy week for corporate earnings as China is closed for the lunar New Year.

U.S stocks are set to open in the ‘black’ (+0.11%).

Indices: Stoxx600 +0.02% at 359.76, FTSE +0.27% at 7,039.05, DAX +0.03% at 11,184.08, CAC-40 -0.23% at 5,007.57, IBEX-35 -0.23% at 8,998.80, FTSE MIB +0.29% at 19,633.50, SMI +0.08% at 9,005.50, S&P 500 Futures +0.11%

2. Oil hits 2019 high on Venezuela sanction and OPEC, gold lower

Oil hit a new 2019 high in Europe this morning as OPEC-led supply cuts and U.S sanctions against Venezuela’s petroleum industry offset forecasts of weaker demand and an economic slowdown.

Brent crude hit +$63.40 a barrel, the highest since Dec. 7, and is up +49c at +$63.24. Elsewhere, U.S crude (WTI) hit a 2019 high of +$55.68 and was later up +9c at +$55.35.

Analysts note that there are currently little signs of any overhang in the market now that the U.S has imposed sanctions on Venezuela, on top of the reduced supply from Saudi Arabia.

Note: Last week, the U.S administration announced export sanctions against state-owned oil firm Petroleos de Venezuela SA (approx. +500k bpd) – this has led to some disruption for oil refineries on the Gulf coast. They have had to seek alternative heavy crude supplies from Canada.

OPEC supply fell this month by the largest amount in two-years, which has helped to offset limited compliance so far by non-OPEC Russia.

While OPEC cuts, the U.S continues willing to expand its supply. However, data on Friday showed a drop in the number of U.S oil rigs on line to their lowest in eight-months, lending temporary prices some support.

Ahead of the U.S open, gold prices have fallen in thin trade as risk-aversion recedes amid some signs of progress in Sino-U.S trade talks and as the dollar firmed. Spot gold has fallen about -0.4% to +$1,313.38 per ounce, after having hit +$1,326.30 last week – its highest level since April 26.

3. Italian sovereign yields back up aggressively

Italy’s government borrowing costs have rallied to their highest level in three-weeks in the Euro session, pushed up by heightened concern that the Italian economic outlook will worsen the country’s fiscal position.

Across the Italian curve, BTP yields have backed up an aggressive +8 bps as data last week confirmed that Italy’s economy had slipped into a recession in Q4, 2018. With Italian manufacturing activity contracting for a fourth consecutive month in January suggests that things could get worse for the economy. The spread of Italy’s 10-year BTP’s over Germany’s advanced +3 bps to +2.61% to the widest in almost three-weeks.

Weaker data in general has been supporting eurozone bond markets as investors bet the ECB will keep record-low rates in place for longer. Germany’s 10-year Bund yield has climbed less than +1 bps to +0.17%.

Elsewhere, the yield on 10-year Treasuries has increased by +1bps to +2.70%, while in the U.K, the 10-year Gilt yield has climbed +2 bps to +1.268%, the biggest increase in more than a week.

Note: While no monetary policy changes are expected by the BoE on Thursday, Governor Carney could revise down its above-trend U.K. economic growth expectations. Continued Brexit uncertainty coupled with weaker economic news would be reason enough to lower projections.

4. Dollar in demand for the moment

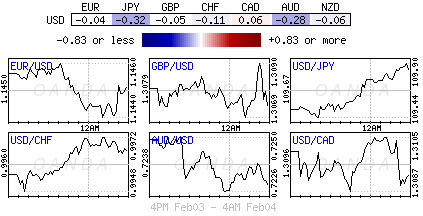

The USD is holding onto its recent ranges despite the recent ‘dovish’ FOMC statement last week. Last Friday’s strong payroll number is helping to support the dollar ‘bulls’ course of action as U.S growth remains quite strong.

The pound (£1.3053) has slumped to below the psychological £1.3100 handle outright as the U.K parliamentary vote last week still does not entirely rule out a ‘no-deal’ Brexit – PM May is again tasked with attempting to re-open negotiations (including a possible delay) with the E.U. It looks like the Brexit process will ‘go down to the wire’ – the current deadline for the U.K to leave the E.U is March 29. The E.U has been very forthright in their views and what they are willing to accept and not accept. PM May can expect a hostile greeting from its E.U partners as she attempts reopen closed doors.

EUR/USD little changed in session at €1.1450 area.

5. Eurozone producer prices slip more than expected

Data this morning from Eurostat showed Eurozone producer prices fell more than expected month-on-month in December, pressured mostly by cheaper energy – prices fell -2.6% in December and rose +7.7% y/y.

Analysts had expected a -0.6% monthly fall and a +3.2% annual rise.

Note: Ex-energy costs, producer prices fell only -0.1% on the month, and were +1.3% higher year-on-year.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.