Tuesday January 5: Five things the markets are talking about

Capital markets remain relatively listless, especially during this week in which much of Asia is on holiday. Interested parties are desperately seeking out any market momentum to apply to their convictions.

Perhaps the ‘big’ dollar may have to wait to react to this evenings State of the Union address from President Trump (09:00 pm EDT) – market focus is likely to be on any indications on how Sino-U.S trade negotiations are going, anything positive on the trade news front should provide support for the greenback.

Until then, it’s about picking your poison – despite volatile U.S and Euro equity and bond markets, the forex market remains confined to its recent tight trading ranges outright.

Ongoing trade tensions between the U.S and China, rising populism, budgetary issues in Italy, French protests, monetary policy divergence, and Brexit have all being taking their toll on financial markets, except the forex space – that remains in a ‘wait and see mode.’

On tap: Corporate earnings season continues. On Wednesday, Fed Chair Powell will deliver his first public comments following last months FOMC meeting and rate decision (07:00 pm EDT).

1. Stocks driven by trade talk and earnings

Asian markets closed Tuesday: China, Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan, Pakistan

In Japan, the Nikkei ended lower overnight, breaking its three-day rally as the market digested a slew of corporate earnings. The index ended -0.19% lower, while the broader Topix edged up +0.1%.

Down-under, financial equities pushed Aussie stocks to record one of their best day in years as the market saw plans of a high-powered banking inquiry as “less severe” than expected, and not posing a serious threat to one of Australia’s most profitable sector. The S&P/ASX 200 index surged +1.95% to trade atop its four-month high – the benchmark rallied +0.5% on Monday.

Note: The RBA remains in focus this week – Governor Lowe is expected to speak on Feb 6th, while the RBA quarterly statement on monetary policy seen on Feb 8th.

In Europe, regional indices trade higher across the board, maintaining their upward momentum of late following a stronger session stateside yesterday and mixed Asian session following mixed European PMI data.

U.S stocks are set to open in the ‘black’ (+0.12%).

Indices: Stoxx600 +0.76% at 326.66, FTSE +1.16% at 7,115.75, DAX +0.93% at 11,280.14, CAC-40 +0.80% at 5,040.26, IBEX-35 +0.66% at 9,034.25, FTSE MIB +0.99% at 19,800.50, SMI +0.82% at 9,092.50, S&P 500 Futures +0.12%

2. Oil prices rise on tighter supply, but data caps gains, gold higher

Oil prices are better bid as the market expects U.S sanctions on Venezuela and production cuts led by OPEC+ to trump any glut. However, U.S data showing a decline in factory orders is providing a cap to the market.

Brent crude futures are up +33c, or +0.53%, at +$62.84 a barrel, down from a high of +$63.63, while WTI futures are up +46c, or +0.84%, at +$55.02 per barrel – they touched their highest level in more than two-months at +$55.75 Monday.

Analysts note that there are currently little signs of any overhang in the market now that the U.S has imposed sanctions on Venezuela, on top of the reduced supply from Saudi Arabia.

Note: Last week, the U.S administration announced export sanctions against state-owned oil firm Petroleos de Venezuela SA (approx. +500k bpd) – this has led to some disruption for oil refineries on the Gulf coast. They have had to seek alternative heavy crude supplies from Canada.

OPEC supply fell this month by the largest amount in two-years, which has helped to offset limited compliance so far by non-OPEC Russia.

While OPEC cuts, the U.S continues willing to expand its supply. However, data on Friday showed a drop in the number of U.S oil rigs on line to their lowest in eight-months, lending temporary prices some support.

But weighing on markets, U.S government data yesterday showed that new orders for U.S made goods unexpectedly fell in November, with sharp declines in demand for machinery and electrical equipment. The prospects for growth in fuel demand have been clouded by poor economic data in China and U.S-China trade tensions.

Ahead of the U.S open, gold has inched a tad higher in the Euro session in thin trading as investors made purchases after prices touched a one-week low in yesterday’s session. However, gold ‘bulls’ can expect that improved market risk appetite to cap the yellow metal’s gains. Spot gold has rallied +0.2% to +$1,314.10 per ounce, after having printed its weakest price since January at +$1,308.20 in yesterday’s session. U.S gold futures are firm at +$1,318.10 an ounce.

3. Reserve Bank of Australia (RBA) sticks to the script

The RBA in its first policy meeting for 2019 overnight stuck with its upbeat narrative on the Aussie economy. The official cash rate remained at +1.5% with the RBA forecasting a “gradual” lift in inflation in 2019 and 2020, and +3% GDP growth in 2019.

Governor Lowe said that the growth forecast is enough for unemployment to continue falling. He reiterated that the low level of interest rates was continuing to support the Australian economy and that inflation remains “low and stable.” He viewed that the AUD (A$0.7245) has remained within a narrow range.

Note: AUD rallied on the report which has disappointed a lot of the policy doves in the market. Futures traders have already priced in a +50% likelihood of a rate cut before the end of this year. The RBA shows no sign yet of delivering that.

Elsewhere, the yield on U.S 10-year Treasuries has gained +1 bps to +2.73%, the highest in more than a week. In Germany, the 10-year Bund yield has rallied +1 bps to +0.19%, while in the U.K, the 10-year Gilt yield has increased less than +1 bps to +1.279%, the highest in more than a week.

4. ‘Big’ dollar looking for guidance

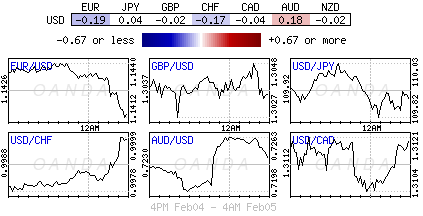

The ‘mighty’ USD is maintaining a slightly firmer tone outright against G10 pairs in quiet trading with the dollar supported by slightly higher U.S Treasury yields.

EUR/USD (€1.1420) is a tad softer as this morning’s PMI Services data print hovered around the contraction level for the key countries and highlighted the growth concerns for the region.

GBP/USD (£1.3007) saw any of its Euro session gains evaporate in the aftermath of weak PMI Services data (50.1). The overall the reading was the lowest print since the Brexit vote back in 2016.

AUD/USD (A$0.7242) is a tad firmer in the aftermath of the RBA decision to keep its policy steady and was less optimistic on both the growth and inflation front. Ahead of the RBA statement, the futures market was implying a +50% chance of RBA rate cut by the end of the year amid weaker than expected December and Q4 retail sales earlier data this week.

5. Weak U.K PMI services sends pound lower

Data this morning from the world’s fifth-biggest economy showed that the IHS Markit/CIPS UK Services Purchasing Managers’ Index (PMI) fell to 50.1 in January from 51.2 in December – the 50 mark separates growth from contraction. Today’s print was the lowest in nearly three-years and suggests that the British economy is flat-lining after losing momentum in H2 2018.

With Brexit nearing (March 29), the U.K’s dominant services sector is reporting job cuts for the first time in six-years and falling new orders. Sterling has slipped to trade atop of its two-week low outright on the news.

Note: Today’s print will likely worry BoE ahead of their latest interest rate decision announcement and new forecasts for the economy on Thursday.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.