Trade talks and border wall comments eyed

US futures are back in the green on Tuesday following a strong start to the week, as investors turn their attention to Trump’s State of the Union Address.

The speech is going to be closely monitored by investors, keen to get an update on trade talks with China and border security, or more specifically the wall, which led to the longest ever government shutdown last month and could trigger another in just over a week. There have been plenty of reports that Trump is considering using emergency powers to deliver on his promise of border wall funding and this could be the platform for it, or at least a strong hint of an intention to do so.

European stock markets have had a good morning, with the FTSE the rare outperformer as sterling continued to edge lower and BP earnings lifted the oil sector. Higher oil prices and output contributed to the stunning profit growth, which bodes well for the rest of the sector, especially with prices appearing to have bottomed and showing potential for another burst higher.

Gold dips as investors cheered by superb NFP

Oil continues to test key resistance

WTI and Brent are pushing hard against technical resistance right now. There are a number of supporting factors for oil prices at the minute, be it the OPEC+ production cut agreement, falling US oil rigs, the less pessimistic growth outlook or an overall improvement in market risk appetite. Resistance remains around the $65 and $55 levels, which are holding for now but may weaken the longer it persists. A break through here could be a very bullish signal and the catalyst for another pop higher.

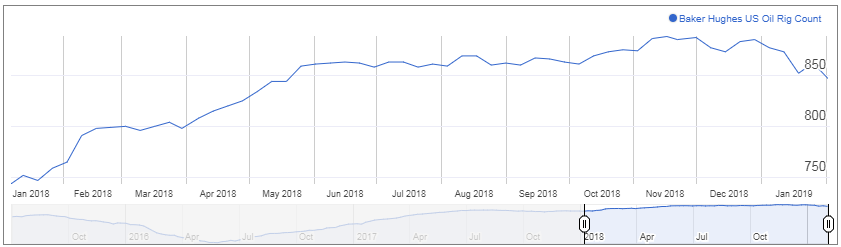

Both API and EIA have reported rising inventories over the last couple of weeks which may cast some doubts over the success of the output cut that was put in place late last year. Of course, this takes time to have a significant impact but if there’s any question that compliance is lacking, it could easily threaten the recovery in oil prices. Again though, US output is also key here and it may be at record highs now but the rig count has been declining since mid-November which may be an interesting leading indicator for future production.

USD/CAD – Canadian dollar at 3-month high after strong weekly gains

Gold soft on resurging dollar but may prove temporary

Gold continues to pare late-January gains, with the burst that took it through $1,300 having lost its spark. I’m not concerned at this stage and as long as it remains above $1,300, I think it continues to look bullish. It will be interesting to see whether it finds strong support if the level is tested from above, with a rebound off here providing bullish confirmation of the initial breakout and providing some level of comfort to gold bulls.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

We may have more days of softness in the interim though, with a similar rebound in the dollar being primarily responsible for gold’s reversal of fortune. The greenback has been experiencing a bit of a bounce over the last few sessions, aided by the jobs report on Friday which offered further comfort on the state of the US economy. Still, I’m not confident the gains can be sustained against the backdrop of a more dovish Fed and positive trade talks with China.

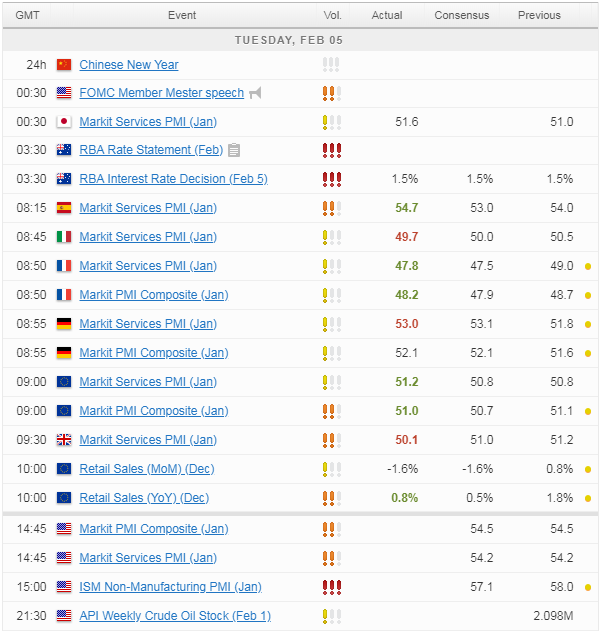

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.