UK data and Brexit eyed, while US team heads to Beijing for more talks

It promises to be another very interesting week for investors, with the US, China and UK very much at the centre of most of the headlines sending ripples through the markets.

In the UK, we’ll be bouncing back and forth between Brexit and the economy, as we get an almost daily update on the economy. That starts with GDP data this morning, which is expected to show the economy flatlined in December but grew slightly across the whole quarter. In a week in which Germany could follow Italy into technical recession, this suddenly doesn’t seem quite so bad.

Trade talks between the two largest economies continue to be the primary focus for investors, with the narrative around the success of them appearing to change week by week. The prospects for a deal now look very slim, with the best case scenario now looking like an extension of the deadline and a commitment to no more tariffs during that period. Of course, assuming anything when Trump is involved isn’t wise and, well you know the rest.

Swiss franc in (another) mini flash crash

Robert Lighthizer and Steve Mnuchin have been tasked with heading to Beijing this week to work on the differences and try and rescue a deal, with the 90 day deadline fast approaching. Traders will continue to closely monitor the progress with the dollar being well backed as talks appear to falter, much in the same way that it did during the initial escalation phase.

Gold remains above $1,300 after first test of key support

The rebound in the dollar, following a period of weakness since mid-December, has taken some of the shine off gold. Not much has changed in terms of the key levels here. We continue to see it flirting with $1,300 from above and came within a whisker of testing it last week. As long as this holds, it continues to look bullish, even if the dollar remains a major headwind.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

OPEC monthly report eyed as prices remain pressured

Oil is also feeling the weight of a stronger dollar dragging on price, with both WTI and Brent coming off their highs and further delaying a very bullish technical break to the upside. Of course, there are other factors contributing to the declines we’ve seen including record US output and questions over Russia’s compliance with the deal but together all of these are weighing.

Will the US and China finally share their toys?

The OPEC monthly report will be one to look out for on Tuesday and should give us much better insight into how the group and its allies are complying with the output agreement. With there being so many doubts over global growth this year, it will also be interesting to see what impact this has on the cartel’s assessment of demand growth and whether that will exacerbate the oversupply issue.

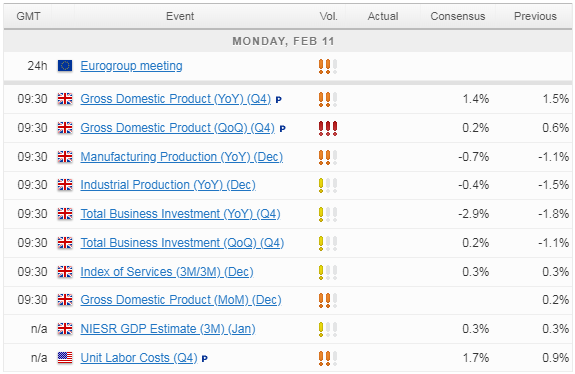

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.