Trumps extends tariff deadline

The “significant” progress in the US-China trade talks prompted US President to tweet Sunday that he will extend the March 1 deadline to raise tariffs on Chinese goods. The latest forward steps include an agreement on China’s approach to its currency, though there was no agreement yet as to how this currency pact would be monitored.

Trump wins best trade Oscar with early morning Tweet

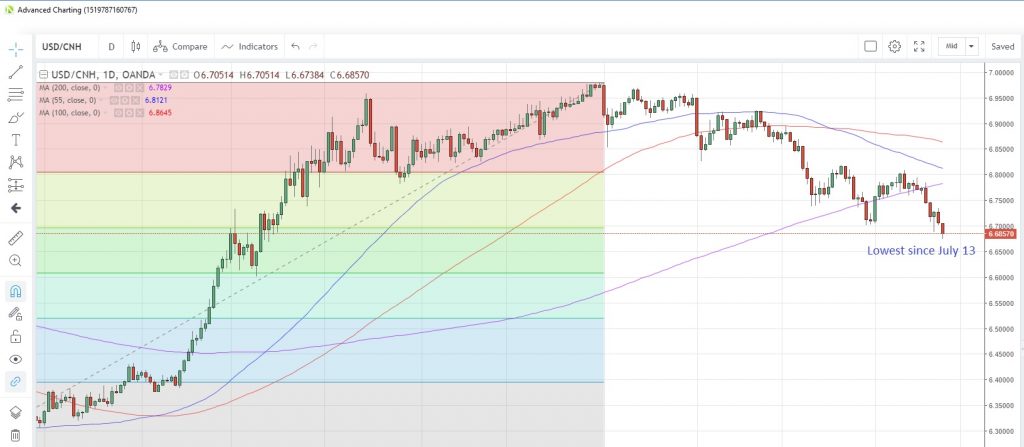

Nevertheless, it was risk-on during the Asian session with most equity indices in the black (the exception was Hong Kong) with Chinese shares jumping 1.5% though gains in other markets were minimal. The yuan strengthened to 6.6905 per US dollar, touching its highest since July 13 last year. Mysteriously, the yen failed to weaken despite the risk-on mood, with USD/JPY slipping 0.07% to 110.61.

USD/CNH Daily Chart

PM May delays next Brexit vote

UK PM Theresa May has delayed the next parliamentary Brexit vote by two weeks to March 12 at the latest, Bloomberg reported, leaving just over two weeks to the Brexit deadline on March 29. Some are suggesting this could be to encourage an extension of Article 50 to avoid the risk of a hard Brexit come March 29. Will there be an extension, making it two out of two? If so, we face more months of Brexit headlines of back-and-forth negotiations, but it will require some compromise from at least one side to prevent another deadline bottleneck.

The pound was marginally better bid this morning, extending Friday’s gains and building on its best weekly performance in four weeks last week. Convergence of the 100- and 55-week moving averages in the 1.3201-1.3222 window may be a tough hurdle to overcome.

GBP/USD Weekly Chart

Clarida sets off a week of Fedspeak

It’s a relatively slow start to the week on the data front, with a completely blank calendar in Europe only prevented by a speech by BOE’s Carney. Fed’s Clarida is due to speak today ahead of Chairman Powell’s testimony before the Houses on Tuesday and Wednesday. US economic releases include the Chicago Fed activity index for January and the Dallas Fed’s manufacturing index for February.

The full MarketPulse data calendar can be viewed at https://www.marketpulse.com/economic-events/

OANDA Senior Market Analyst Craig Erlam previews the week’s business and market news with Jazz FM

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.