Pound surges as May seeks to hold off rebellion a little longer

This was meant to be the day to watch this week, as MPs head back to Parliament to have a “meaningful vote” on Theresa May’s deal and put forward any amendments.

Unfortunately, May had other plans this week and not only cancelled the vote on her deal before the week even got underway, but also pre-empted the rebellion on Tuesday by proposing a vote on no-deal and an extension on 13 and 14 March, coincidentally – I’m sure – the same time that others were proposing forcing through an extension request with Brussels.

As ever in the world of politics, this is nothing more than a game of strategy, with the Prime Minister doing whatever it takes to cling onto her deal and position long enough to see it over the line, whatever it takes in the interim. For now it would appear she is succeeding and the latest move may not only have kept MPs at bay for a couple more weeks but also given a lift to the markets.

What’s not to like? The opposition Labour Party has been forced into backing a second referendum out of fear of losing more MPs to the newly formed Independent Group – revitalising an option that potentially opens the door to remaining in the EU – and May has put a major obstacle in the way of no deal, great news for the pound which fears that option more than anything else.

Aussie retreats as construction falters

Still, it remained below 1.33 against the dollar, the upper end of a range it’s held since the middle of last year and one that may only be broken when a significant step forward is achieved or no-deal is taken off the table altogether.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Gold consolidates but looks potentially vulnerable near-term

There isn’t much new to report on gold, which has been stuck in consolidation over the last few days and is showing little sign of sparking back to lift. The yellow metal is potentially looking a little overbought at this point, with the dips clearly not being bought as convincingly, dollar softness not spurring it on and the momentum indicators showing weakness.

Gold Daily Chart

This near-term outlook could therefore be a little more bearish, with $1,320 being the next level of support and $1,300 below that.

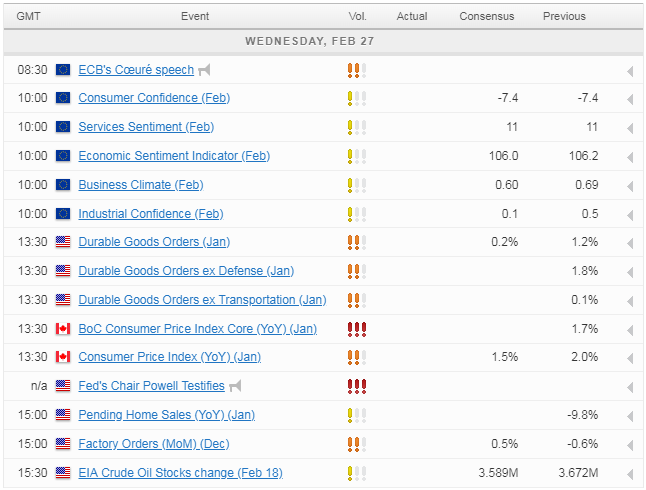

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.