Speculation that the US is about to announce the end to the Iran sanctions waivers later today boosted oil prices and took the shine off risk appetite that had remained buoyant into the close of trading last week.

Oil prices surge

West Texas Intermediate (WTI) climbed 2.5% during the Asian session, hitting the highest level since October amid speculation that the waivers on Iran sanctions granted by the US to eight oil importers last year would cease soon.

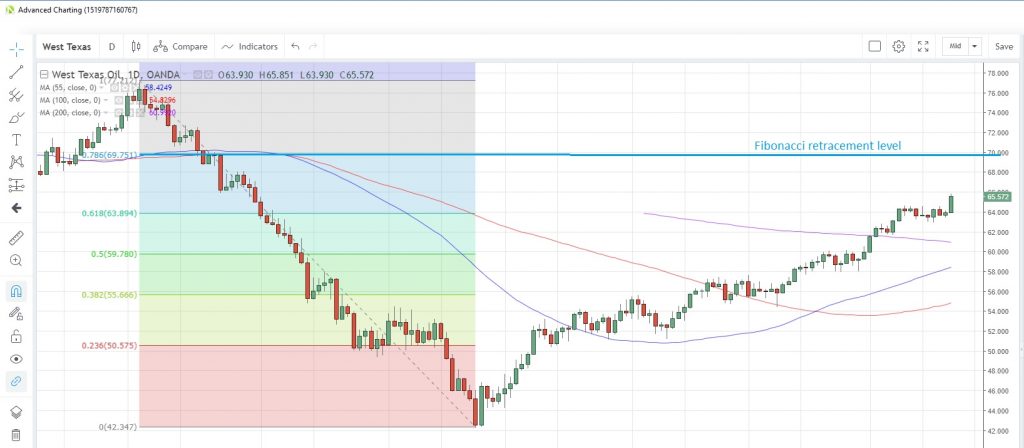

WTI surged to an intra-day high of $65.85 per barrel, the highest since October 31, and appears to be heading toward the next potential resistance point at $69.75, which is the 78.6% Fibonacci retracement of the October-December drop last year.

WTI Daily Chart

Equity markets take a hit

The recent equity market rally appears to be coming to a halt, though thin liquidity in markets due to numerous holidays across the globe for Easter Monday could be exaggerating the declines. The US30 index is down 0.24% and the Nas100 has fallen 0.36%. China shares faced additional pressure from a weak property sector, with the broader index falling 3.4%, giving back more than 70% of the gains made last week.

Risk-beta currencies were also under pressure, with the Australian dollar falling 0.19% versus the US dollar and 0.2% against the Japanese yen. AUD/JPY is now below the 55-moving average support on the 4-hour chats at 79.965. The US dollar was generally better bid, with USD/SGD rising to the highest level in 10 days.

AUD/JPY 4-Hour Chart

Bare data calendar to start the week

With many centres still enjoying the long Easter break, there is not much to report on the data calendar. The Chicago Fed national activity index for March and US existing home sales for the same month are the only items scheduled. Home sales are expected to fall 2.3% m/m after an 11.8% surge in February.

The full MarketPulse data calendar is available for viewing at https://www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.