Tuesday April 30: Five things the markets are talking about

The Fed’s two-day policy meeting gets underway today. Officials are poised to keep interest rates steady when it concludes Wednesday. Fed Chair Jerome Powell’s press conference will surely not want to be missed – will he be standing by his recent ‘dovish’ outlook?

Currently, solid U.S growth and muted price measures continue to support the Fed’s holding stance. The Fed’s preferred inflation gauge, the price index for personal-consumption expenditures, rose just +1.5% last month from March 2018. Ex-food and energy, core inflation was only slightly stronger at +1.6%, well below the Fed’s desired +2%.

Global equities had been trading under pressure in the overnight session on reported disappointed earnings from Alphabet and Samsung, one day after new record high prints stateside. Both U.S treasuries’ and the ‘big’ dollar have found a small bid on the back of disappointed investors. Nevertheless, some positive Euro data ahead of the U.S open has managed to pare back some of euro-equities losses.

This morning’s plethora of economic releases saw European data beat expectations on both the growth and inflation fronts (eurozone, Italian and Spanish GDP data; Italian unemployment, French, German, Spanish, Italian CPI readings).

Note: Markets in Japan remain closed for Golden Week, reopens May 6, while a number of other countries are set to follow suit on May 1 (CNY, CHF, GER. Fr. & ITL).

For now, various asset classes seem caught in the ‘twilight zone.’ Expect investors and dealers to continue to look for signals at the Feds policy meeting on Wednesday and earnings reports from the likes of Apple, GE and McDonald’s for some conviction.

On the Sino-U.S trade front, the next round of trade talks are expected to get underway later today with significant issues still unresolved, but with enforcement mechanisms “close to done” according to Treasury Secretary Mnuchin.

On tap: CAD GDP, consumer confidence & NZD employment change (Apr 30), Bank holiday – CNY, CHF, GER. Fr. & ITL, U.S ISM manufacturing PMI, FOMC monetary policy statement & CNY Caixin manufacturing PMI (May 1), U.K inflation report, BoE monetary policy statement & AUD building approvals (May 2), non-farm payroll (May 3).

1. Stocks start to wobble

Global equities have mostly edged down overnight after Wall Street hit a new high closing Monday, raising questions about how much longer the rally can continue while rising oil prices threaten to push inflation higher.

Note: Tokyo’s Nikkei was closed for a public holiday, reopens May 6.

Down-under, Aussie shares ended atop of their one-week low overnight as energy and mining stocks dropped sharply after disappointing factory data from China highlighted weakness in its economy. The S&P/ASX 200 index closed down -0.5%, after losing -0.4% yesterday. However, the index has advanced for a fourth consecutive month in April, gaining +2.3%. In S. Korea, the Kospi stock index ended lower, down -0.58%, also hit by disappointing China April factory growth. For the month, the Kospi has rallied +2.94%.

In China, stocks rallied overnight despite lacklustre factory activity data. The blue-chip CSI300 index rose +0.3%, while the Shanghai Composite Index gained +0.5%.

China April manufacturing PMI (OFFICIAL): 50.1 vs. 50.6E; Non-manufacturing PMI: 54.3 vs. 55.0e; Composite PMI: 53.4 v 54.0 prior. China April Caixin PMI manufacturing: 50.2 vs. 50.9E – however, export orders and employment back in contraction (below 50).

Note: The China market will be closed starting tomorrow due to the Labour Day holidays, and will reopen on Monday, May 6.

In Hong Kong, shares ended weaker overnight, hurt by declines in property and energy stocks, as the market awaits fresh stimulus after decent returns thus far in 2019. The Hang Seng index closed -0.7% lower at 29,699.11, while the China Enterprises Index ended down -0.8%.

Note: The index will be closed on Wednesday for Labour Day holiday, and will resume trading on Thursday, May 2.

In Europe, regional bourses trade mostly lower after mixed session in Asia and mixed U.S futures.

U.S stocks are set to open in the ‘red’ (-0.6%).

Indices: Stoxx600 -0.14% at 390.68, FTSE -0.14% at 7,430.25, DAX -0.10% at 12,315.72, CAC-40 -0.40% at 5,558.48, IBEX-35 -0.32% at 9,487.06, FTSE MIB +0.15% at 21,821.50, SMI +0.31% at 9,770.50, S&P 500 Futures -0.06%

2. Oil prices firm as Saudi’s says OPEC may extend supply cuts, gold higher

Oil prices are better bid this morning after Saudi Arabia said a deal between producers to withhold output in 2019, year to date, could be extended beyond June to cover all of 2019.

Saudi energy minister Khalid Al-Falih statement comes despite pressure by Trump directly insisting that OPEC raise output to make up for a supply shortfall expected from tightening U.S sanctions against Iran.

Brent crude futures are at +$72.25 per barrel, up +21c, or +0.3c, from their last close. U.S West Texas Intermediate (WTI) crude futures are at +$63.67 per barrel, up +17c, or +0.3%, from Tuesday’s close.

Despite a questionable global economy, oil prices have surged +40 ytd, supported mostly by supply cuts led by OPEC+ as well as by U.S sanctions on producers Iran and Venezuela and not necessarily by an increase in global demand.

Consensus expect a balanced output for the remainder of this year – U.S sanctions are estimated to be counter balanced by an increase in production from OPEC+ and the U.S.

Note: U.S. exports exceeded +3M bpd for the first time in early 2019 amid a more than +2M bpd production surge over the past year, to a record of more than +12M bpd.

Ahead of the U.S open, gold prices have been small better bid as lacklustre Chinese factory activity data have renewed concerns about the health of the global economy. Spot gold has rallied +0.3% to +$1,283.44 per ounce, while U.S gold futures are up +0.3% at +$1,285.30 an ounce. Expect investors to wait for the Fed’s two-day policy meeting starting later this morning for clues on the interest rate outlook.

3. Eurozone bond yields little changed

Euro government bond yields are little changed despite investor focus falling on economic growth and inflation numbers across the bloc’s biggest economies.

Data this morning showed that France, the second largest in the eurozone, grew +0.3% in Q1, the third quarter in a row at that rate. It was in line with market expectations. Spain’s economy, the fourth biggest, expanded a stronger-than-expected +0.7% in Q1. This stronger data has helped to offset the weaker tone overnight from China, where readings on manufacturing activity failed to meet expectations.

Germany’s 10-year Bund yield has pushed back through zero percent to trade at +0.002% but remains below the one-month highs hit earlier this month.

Elsewhere, the yield on two-year Treasuries notes has fallen -2 bps to +2.27%, while the yield on 10-year Treasuries fell -1 bps to +2.51%. In Japan, the 10-year JGB yield is unchanged at -0.04%.

4. Dollar’s defining moment

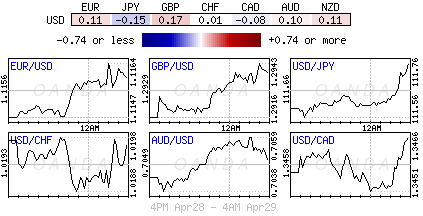

The ‘mighty’ USD is trading atop of its one-week lows against G10 currency pairs ahead of the U.S open. The greenback retreated from its recent cycle highs as US inflation data has been below expectations. Despite some of the negativity against the dollar, investors are content to continue buying U.S dollars on pullbacks.

EUR/USD (€1.1212) has edged above the psychological €1.12 handle as a plethora of Euro economic releases beat expectations on both the growth and inflation fronts (Euro Zone, Italian and Spanish GDP data; Euro Zone, German, Italian unemployment; French, German, Spanish, Italian CPI readings all exceeded consensus).

Rounding out the majors: USD/JPY at ¥111.31, lower by -0.2%; GBP/USD at £1.2989, higher by +0.4%; USD/CHF at $1.0180, lower by -0.1%

Argentina’s central bank (BCRA) said it will step in to the FX market more readily to support the peso after several days of volatility last week sent the currency plunging outright. BCRA expects to sell dollars even if the exchange rate is stronger than 51.45 pesos to the dollar, which was the level the bank had previously set for interventions. The peso lost more than -5% of its value in one day last week.

5. Eurozone economic growth stronger than expected

Data this morning showed that Eurozone economic growth was stronger than expected in the Q1, rebounding strongly from a slump in H2, 2018, while unemployment fell to its lowest rate in more than a decade.

Eurostat said that according to a preliminary estimate, GDP in the 19 countries sharing the EUR rose +0.4% q/q in Q1, up from +0.2% in Q4 of 2018 and +0.1% in Q3. Year-on-year, eurozone GDP rose +1.2%.

Note: Market expectations were looking for a +0.3% quarterly increase and a +1.1% annual expansion.

Other data showed that eurozone unemployment fell to +7.7% in March vs. +7.8% in February.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.