It’s Showtime

Stock markets are paring gains on Thursday as investors eagerly await the appearance of Fed Chairman Jerome Powell at this year’s vitual Jackson Hole event.

The central bank’s monetary policy framework has been the hot topic this week, with everyone speculating about what changes the Fed will consider that will allow interest rates to remain lower for longer.

Despite central banks offering unprecedented amounts of stimulus and stock markets hitting new highs on a regular basis, investors are craving another stimulus fix. With rates already at record lows, attention is turning to the timeframe, with investors effectively looking for guarantees that they won’t move for a considerable period of time.

With negative rates seemingly off the table, yield curve control and flexible inflation targeting have become the new buzz phrases. Basically, anything that ensures rates won’t rise for a very long period of time. I mean, who wants to Fed police to turn up and spoil the party we’re seeing in equity markets right now?

Flexible inflation targeting isn’t the worst idea when you consider the Fed’s record of actually hitting 2%. I’m just not convinced policy makers are going to see a particularly strong case for significantly amending its framework right now as there’s no chance of rates rising for a considerable time anyway.

Investors may have set themselves up for disappointment today and may have to settle for Powell reinforcing that rates are not rising for a long time. Then it’s a question of whether that’s accepted or punished, with the pressure increased through higher yields. But that’s for another day.

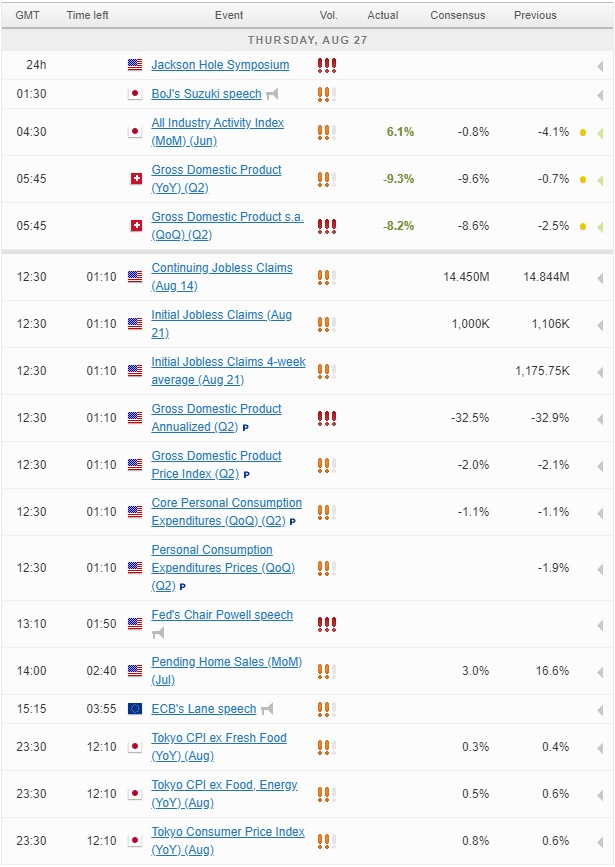

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.