- Brent oil prices have recovered to $78.30 despite OPEC+ downgrading demand growth forecasts and falling Chinese imports.

- China’s oil imports fell for the fifth consecutive month in September stoking demand fears.

- OPEC+ revised its global oil demand growth forecast for 2024 downwards for the third time.

Most Read: Gold (XAU/USD) Price Outlook: China Sends Mixed Signals Keeping Gold Prices Steady

Oil prices fell in early trade before recovering during the European session to trade at 78.300 at the time of writing. Brent has held firm which is a surprise given that OPEC + downgraded demand growth once more and Chinese imports fell for a fifth month.

China’s oil imports fell in September by 0.6% from a year earlier. The drop is largely down to weaker fuel demand and narrowing export margins. According to the data, China brought in 11.07 million barrels per day which is the fifth straight month of declines and down from last month’s 11.13 million barrels per day.

The data came as a surprise given the new refinery by Shandong Yulong Petrochemical started one of its two 200,000 barrel per day crude units during September. It may be that we only see the changes from next month onward, however an uptick in domestic demand is sorely needed. Market participants will hope that the recent stimulus package may still lead to fruition and increase demand moving forward.

OPEC + Cuts Demand Growth Again

OPEC + Meanwhile downgraded its global demand growth for 2024 and 2025. This is the producer groups third consecutive downward revision which faces a dilemma around rasing production quota from December onward.

If you have been reading my oil articles over the past few weeks/months, I have stated my belief that an increase in output/production in December is unlikely given the downward pressure on Oil prices. Most OPEC + members do not benefit when Oil prices are low and thus an increase in production at a time when uncertainty around demand lingers may have a negative impact on prices.

In its monthly report, OPEC stated that global oil demand is projected to increase by 1.93 million barrels per day (bpd) in 2024, a slight decrease from the 2.03 million bpd growth forecasted last month. Until August, OPEC had maintained this forecast since it was initially made in July 2023.

China was primarily responsible for the 2024 downgrade, with OPEC reducing its growth forecast for China to 580,000 bpd from 650,000 bpd. Although government stimulus measures are expected to bolster demand in the fourth quarter, OPEC noted that oil consumption is encountering challenges due to economic issues and a shift towards cleaner fuels.

The revision does bring OPEC + closer to the IEA estimates but the discrepancy between the two organizations are still abnormally large.

The Week Ahead

There is a lack of high impact US data this week with eyes firmly focused on the geopolitical situation in the Middle East. China on the other hand does remain a point of interest, any clarity on the recent stimulus measure could have a positive impact on Oil prices.

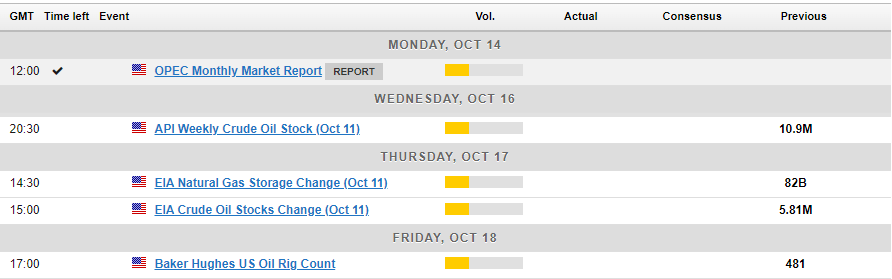

Wednesday we get inventories data filtering through from the API and Thursday from the EIA, both of which could stoke some short-term volatility and moves for oil prices.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Download the Full OPEC Report HERE: https://momr.opec.org/pdf-download/

Technical Analysis

From a technical perspective, Oil continued to hold the high ground today despite a indecisive candle close on Friday. At the moment sellers do appear to be winning the day as markets fhave failed to push oil prices beyond the days opening price.

A bearish close today would provide bears with some hope of further downside. However, as the geopolitical tensions rise in Israel and the Middle East, the risk of spike in prices to beyond the 80 a barrel mark continues to persist.

In a similar vain to gold prices at the moment the risk for further upside appears to be outweighing the downside risks.

Immediate resistance rests at 78.97 before the psychological 80.00 mark comes into focus. Beyond 80.00 markets will focus on 81.58 before the 100 and 200-day MAs come into focus.

Conversely, a break lower here could lead oil back 76.35 support before the psychological 75.00 handle comes into focus.

Brent Crude Oil Daily Chart, October 14, 2024

Source: TradingView (click to enlarge)

Support

- 76.35

- 75.00

- 72.38

Resistance

- 78.97

- 80.00

- 81.58

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.