Gold has lost ground in the Thursday session. In North American trade, spot gold is trading at $1231.26 an ounce, its lowest level since March 21. On the release front, US unemployment claims dropped to 238 thousand, below of the estimate of 246 thousand. On Friday, the US releases wage growth and Nonfarm payrolls reports, and any unexpected readings could mean some movement in gold prices.

Gold prices have slipped 2.1 percent in response to the Federal Reserve rate statement on Wednesday. As expected, the Federal Reserve stayed on the sidelines, holding the benchmark rate at 0.75 percent. However, the Fed rate statement was hawkish, as policymakers emphasized the positives and downplayed a soft first quarter. The statement noted that consumer spending remains strong and that inflation was “running close” to the Fed’s 2 percent target. The Fed’s message is clearly one of optimism, as the central bank remains on track to raise interest rates twice more in 2017. The Fed’s bullish statement immediately raised the likelihood of a rate hike at June meeting, which jumped to 74 percent after the statement, up from 63% before meeting. This sent gold prices lower, as the base metal moves inversely to interest rates. The Fed has two key goals which have been achieved, namely full employment and an inflation rate of 2%. One area of concern is the balance sheet, which stands at $4.5 trillion. The minutes of the March meeting stated that policymakers want to start reducing this figure before the end of 2017, and we could see another reference to the balance sheet in the April minutes.

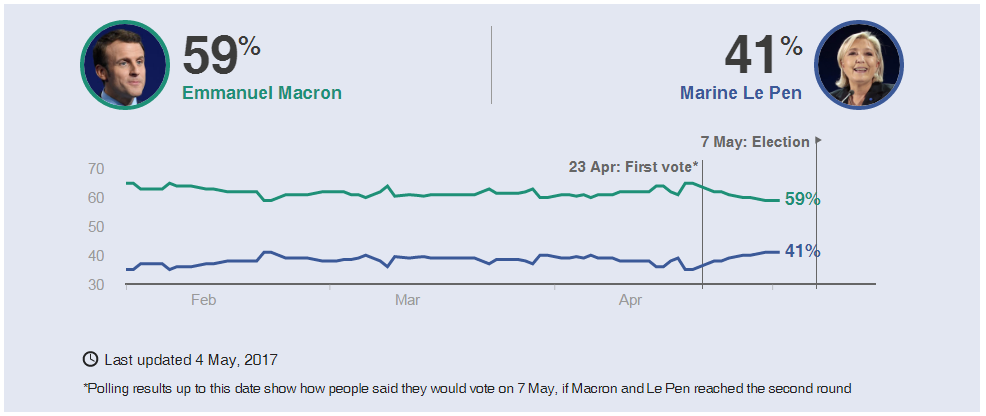

There was plenty of excitement in the French election television debate on Wednesday. The two remaining presidential candidates Emmanuel Macron and Marie Le Pen faced off and traded barbs throughout the debate. Opinion polls showed Macron the clear winner, with 64% of surveyed viewers saying that he won the debate. Parliamentary elections are scheduled for June, so the French political landscape will remain uncertain until then. Macron’s En Marche! party is expected to win the most seats, and has an outside short at forming a majority in parliament.

The polling average line looks at the five most recent national polls and takes the median value, ie, the value between the two figures that are higher and two figures that are lower.

Source – BBC

French Election Timeline

May 3 – TV debate between the two remaining candidates

May 5 – [from midnight] Poll blackout

May 7 – Second round of French presidential elections. Last polls close at 19:00 BST / 14:00 EDT, with an exit poll result announced immediately.

May 11 – Official proclamation of the new President.

May 14 – [from midnight] End of Francois Hollande’s mandate

June 11 – First round of legislative elections

June 18 – Second round of legislative elections.

XAU/USD Fundamentals

Thursday (May 4)

- 7:30 US Challenger Job Cuts. Actual -42.9%

- 8:30 US Unemployment Claims. Estimate 246K. Actual 238K

- 8:30 US Preliminary Nonfarm Productivity. Estimate 0.1%. Actual -0.6%

- 8:30 US Preliminary Unit Labor Costs. Estimate 2.5%. Actual 3.0%

- 8:30 US Trade Balance. Estimate -44.9B. Actual -43.7B

- 10:00 US Factory Orders. Estimate 0.6%. Actual 0.2%

- 10:30 US Natural Gas Storage. Estimate 61B. Actual 67B

Friday (May 5)

- 8:30 US Average Hourly Earnings. Estimate 0.3%

- 8:30 US Nonfarm Employment Change. Estimate 194K

- 8:30 US Unemployment Rate. Estimate 4.6%

*All release times are GMT

*Key events are in bold

XAU/USD for Thursday, May 4, 2017

XAU/USD May 4 at 13:50 EST

Open: 1237.74 High: 1241.26 Low: 1225.67 Close: 1231.26

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1175 | 1199 | 1232 | 1260 | 1285 | 1307 |

- XAU/USD was flat in the Asian session. The pair has posted slight losses in the European and North American sessions

- 1232 is providing support

- 1260 is a weak resistance line

- Current range: 1232 to 1260

Further levels in both directions:

- Below: 1232 and 1199 and 1175

- Above: 1260, 1285, 1307 and 1337

OANDA’s Open Positions Ratio

XAU/USD ratio has shown movement towards long positions. Currently, long positions have a majority (65%). This is indicative of trader bias towards XAU/USD reversing directions and moving to higher levels.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.