- Gold continues its decline with $2300/oz firmly back in sight.

- US Dollar index and US 10Y yield continue to rise, US 10Y now at 4.275%.

- PCE inflation data could be the catalyst needed for gold prices to find some direction.

Fundamental Overview

Gold prices remain under pressure this morning as rising US yields and a stronger US Dollar weigh on the precious metal. It appears as though the US inflation release (PCE Data) on Friday has market participants cautious as they await further clarity on rate cuts.

Geopolitical tensions have somewhat eased this week. Ongoing discussions between the US, Israel, and Hezbollah in Lebanon have neither led to a resolution nor escalated tensions. This could in part explain the lack of buying pressure and safe haven appeal at the start of this week.

The rise in US Treasuries and the US Dollar came about from comments by Federal Reserve policymakers. The rhetoric from policymakers was interpreted as hawkish with most of them agreeing that the Fed would remain cautious regarding any potential rate cuts this year. Fed policymakers Michelle Bowman and Lisa Cook refused to set a timeline on rate cuts with Bowman stating her readiness to raise rates if the inflation target remains out of reach.

US 2Y and 10Y Yield

Source: TradingView.Com (click to enlarge)

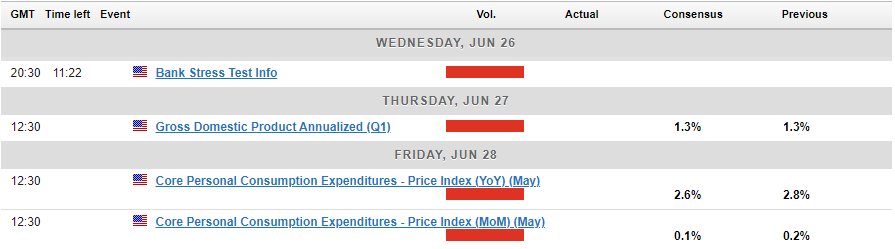

The Week Ahead: US GDP and PCE Data

Looking ahead to the rest of the week, today could well be the calm before the storm in many ways. Limited high impact data from the US is expected before market participants will hope for some clarity and volatility on Thursday and Friday with the release of the US Q1 GDP (est) and the personal consumption expenditure (PCE) price index.

The lack of clarity regarding rate cuts is certainly a stumbling block for the precious metal. A higher interest rate usually leads to outflows in gold as the opportunity cost of holding onto the precious metal increases. Add this to the fact that gold prices have enjoyed a significant rally over the past few months and the bearish pressure is likely to grow.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Looking at the PCE data and a soft print below consensus could be the catalyst needed for gold bulls to return with some conviction. Whereas a slight uptick in the PCE number could lead to further uncertainty regarding rate cuts and thus add further pressure on gold prices as market participants may choose to unwind more of their positions in the precious metal.

Gold Technical Outlook

The technical outlook for gold remains frustrating for market participants, with indecision prevailing in the market. This indecision is evident in the price action, characterized by higher lows followed by lower highs, indicating that range-bound trading may persist. A catalyst is urgently needed to drive gold prices back above the 2380 mark or to trigger a convincing and sustainable break below 2300

Looking at the H2 chart below and there is a trendline in focus which coincides with the 2320 resistance area. A break above this level could open up a retest of Mondays high at the 2334 resistance area. The next area of interest being 2350 which is also a psychological level and may prove tough to crack without an increase in volatility. Supporting an upside break is the golden cross pattern on the H2 chart, as the 100-day MA has now crossed above the 200-day MA which is usually a sign of bullish momentum and the potential for a rise in price.

Alternatively a break of 2310 is needed if the 2300 level is to be retested. The challenge for bears is a sustainable break of the 2300 handle which has proved rather elusive thus far. The brief dips below this support have been met with significant buying pressure, and this is likely to continue without any shift in the overall fundamental outlook of the precious metal.

Gold H2 (two-hour) Chart – June 26, 2024

Source: TradingView.Com (click to enlarge)

For a full technical and fundamental breakdown of Brent Crude Oil, read the article below.

Read: Oil Price Outlook: Brent Crude Eyes Further Gains on Supply Risks

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.