- Stagflation risk has led to a softer US 10-year Treasury real yield below 2.38%.

- The 6% decline of Gold (XAU/USD) from its recent all-time high in April may have reached an inflection point to kickstart another potential medium-term impulsive bullish sequence.

- Watch the key short-term support of US$2,327 on Gold (XAU/USD).

This is a follow-up analysis of our prior report, “Gold Technical: A floor may have been formed for the bulls” published on 6 May 2024. Click here for a recap.

Since our last publication, Gold (XAU/USD) has rallied by 2.5% and staged a bullish breakout above its 20-day moving average last Thursday, 9 May, and a positive follow-through at the start of this week as it inched higher today, 15 May with a current intraday high of $2,374 at this time of the writing.

Right now, it is just a whisker of 2.5% away from its current all-time high of US$2,431 printed recently on 12 April as market participants await another set of crucial economic data; US CPI and retail sales for April to gauge whether the odds have increase on the stagflation risk narrative that has been unfolding in the past three weeks.

Forward-looking survey-based economic data supports the risk of a stagflation

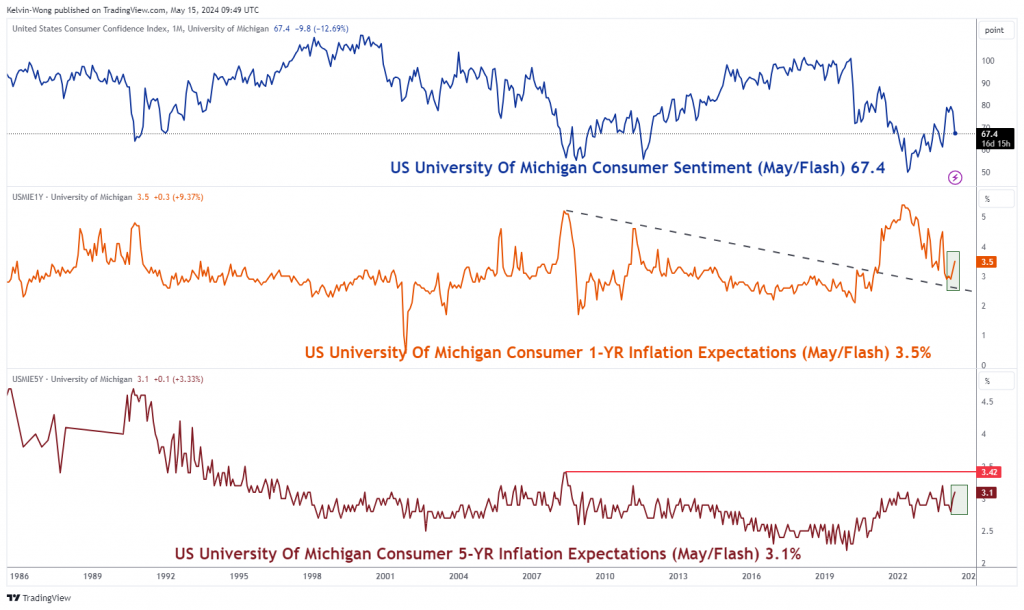

Fig 1: US University of Michigan Consumer Sentiment & Inflation Expectations data as of May 2024 (Source: TradingView, click to enlarge chart)

The latest preliminary US University of Michigan Consumer Survey for May released last Friday, 10 May has indicated a potential slowdown in consumer spending in the next few months as its consumer sentiment component has plunged to a six-month low of 67.4 from 77.2 recorded in April (see Fig 1).

Concurrently, the components of the 1-year and 5-year inflation expectations for May have risen to six-month highs of 3.5% y/y and 3.1% y/y respectively, lowering the chances of the consumer inflationary trend in the US to hit the Fed’s target of 2% in 2024.

This set of forward-looking survey-based economic data seems to foretell a potentially deadly concoction of stagflation.

A potential slow-down in consumer spending led to softness in longer-term US Treasury real yields

Fig 2: US 10-YR Treasury real yield major & medium-term trends as of 15 May 2024 (Source: TradingView, click to enlarge chart)

Since the release of the stagflation-liked University of Michigan Consumer Survey data, the US 10-year Treasury real yield has dropped lower; right now at this time of the writing, it is “dangerously” hoveringly above a key immediate support of 2.03% (the 200-day moving average & the lower boundary of a major ascending channel in place since 8 March 2022) (see Fig 2).

Also, its daily RSI momentum indicator has reflected a bearish momentum condition as it has just staged a breakdown below a parallel ascending support at the 50 level which suggests the odds are skewed towards a further fall in the US Treasury 10-year real yield rather than a recovery at this juncture.

Overall, a further softening of the US Treasury real yield implies a lower opportunity cost of holding non-interest-bearing assets such as Gold (XAU/USD) which in turn supports a potential positive feedback loop into its price actions.

Watch the US$ 2,327 key support on Gold (XAU/USD)

Fig 3: Gold (XAU/USD) major & medium-term trends as of 15 May 2024 (Source: TradingView, click to enlarge chart)

Fig 4: Gold (XAU/USD) short-term trend as of 15 May 2024 (Source: TradingView, click to enlarge chart)

Based on a technical analysis perspective, the recent bullish breakout above its 20-day moving average and the upper boundary of the minor “Descending Wedge” from its current all-time high of 12 April 2024 suggests the recent decline of 6.3% from 12 April to 3 May is likely a short-term corrective decline within a major uptrend phase that is still intact since 28 September 2022 (see Fig 3).

As seen on the hourly chart, Gold (XAU/USD) is now evolving in a short-term uptrend phase supported by its price actions that have oscillated within an ascending channel since the 3 May 2024 low (see Fig 4).

The key short-term pivotal support rests at US$2,327 and a break above US$2,378 sees the next intermediate resistances coming in at US$2,420 and US$2,450 in the first step.

However, a break below US$2,327 negates the bullish tone to expose the next support at US$2,300 with the key medium-term support zone coming right below it at US$2,265/260.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.