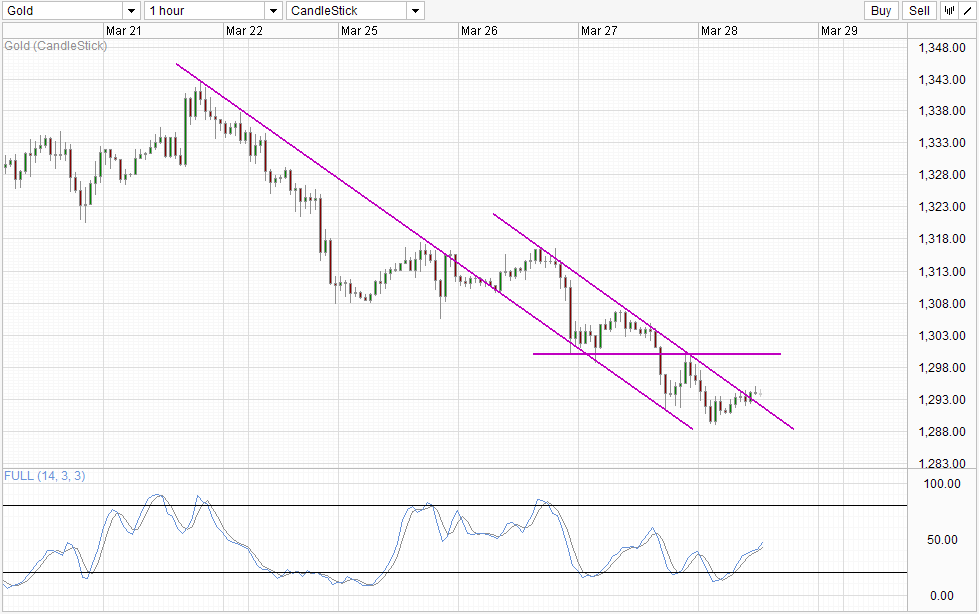

Gold broke 1,300 round figure convincingly yesterday, and yet again the reason for the decline was simply due to market sentiment unrelated to any short-term fundamental drivers. Stocks were trading lower while latest economic data was less optimistic than before but that did little to hamper the march towards lower territory. Prices did rebound higher during early US session after the initial decline but that only served to confirm the break of 1,300 round figure, resulting in further bearish selling for the rest of US session.

Currently we are trading higher and prices appear to have broken the pace of bearish momentum by pushing above the descending channel. Stochastic readings are also bullish, as such we cannot rule out a push towards 1,300 in the short-run once again, but prices should ideally break soft resistance of 1,294 – 1,295 for confirmation.

Given the limited upward potential, traders need to weigh the benefit and risks should to go long right now. As today is the end of the week, aggressive traders may still wish to buy Gold hoping that previously short traders would be taking profit/squaring their positions later today, but this is still a risky move given that it is counter-trend, and the Risk/Reward ratio is not particularly attractive. This is because just as how we cannot eliminate the possibility of a move towards 1,300, it is also equally possible if not more that prices may simply straddle Channel Top and push lower. Similarly, Stochastic readings may be heading up higher but the likelihood of a reversal in Stoch curve remains with “resistance” expected around the 50.0 – 60.0 levels. Furthermore, counter-trend signals from Stochastic tends to be highly unreliable during strong trends, and traders need to be caution if they use this as part of the buying decision.

More Links:

USD/CAD – Loonie Rally Continues As US Unemployment Claims Shine

AUD/USD – Aussie Rally Continues As US Posts More Mixed Numbers

USD/JPY – Modest Gains Ahead of US Unemployment Claims

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.