Gold prices have been relatively stable for the past week. The high low range was actually decent at around $25 per ounce, but most of the action was restricted between 1,315 – 1,325 – a mere $10 USD range. This stability is not surprising as we did not really see acute volatility during in US stocks nor other major currency pairs. Nonetheless, it is interesting to see Gold not being able to muster stronger gains W/W even though US stocks and USD are clearly trading lower, which should have helped push Gold higher. It is not as if market is immune to “risk off” and USD direction, Silver has been extremely bullish last week. This discrepancy highlights the weakness in Gold and drove Gold/Silver cross to the top negative price movements list on a W/W basis.

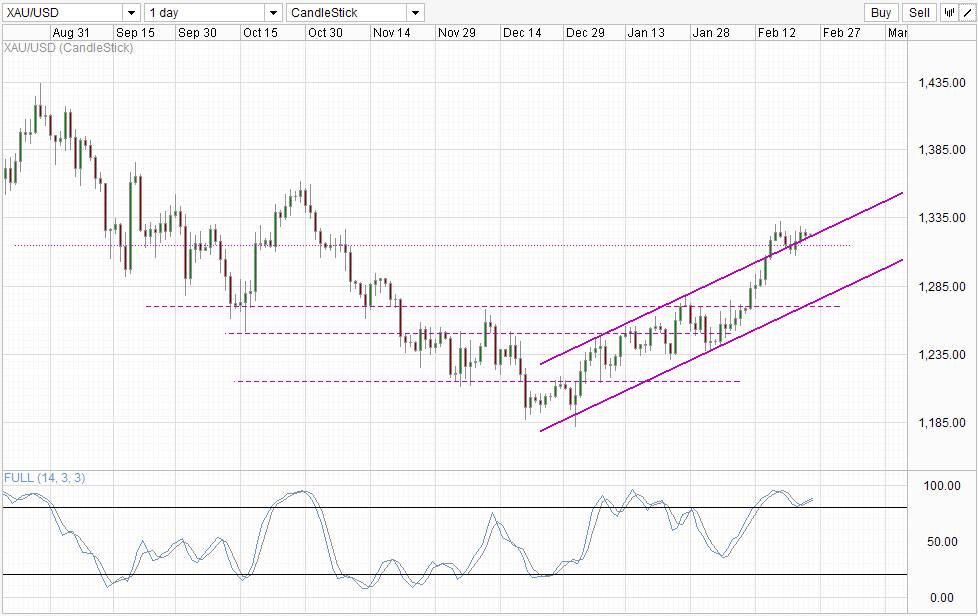

Daily Chart

However, despite the weakness in Gold, technicals remain bullish. Currently prices is situated above rising Channel Top. Even in the event that prices break below Channel Top, 1,315 will provide further bullish support, making a quick bearish sell-off less likely. Furthermore, Stochastic readings showed that we have managed to avoid a bearish cycle from starting last week with Stoch curve rebounding off the 80.0 level higher. This coincide with prices rebounding off Channel Top last Wednesday – a move that confirms the bullish breakout.

Hence, the bullish momentum should remain in play for now – a momentum that is built by institutional speculators continuing to buy. Latest Commitment of Traders report showed yet more gains in Net Non-Commercial Positions which has increased by more than 13K contracts W/W. However, this would also mean that the bearish risk becomes even higher as it is clear that the institutional traders are the only thing that is preventing Gold prices from falling, and once these institutions hit their buying limits we should be able to see a significant bearish pullback.

More Links:

EUR/USD Technicals – Early Bearish Move Seen But 1.3725 Expected To Hold

AUD/USD Technicals – Lower In The Morning But No Panic For Bulls

Week In FX Americas – Loonies Takes A Brief Flight

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.