The slight bearish bias following the sudden plunge spotted 2 days ago has developed into a full bearish reversal. Prices traded lower for most part of European/US trading session yesterday following the confirmation of the bearish breakout from the rising Channel. This decline appears to be risk appetite driven, with gains in US stocks driving pushing prices lower as market realize that the need for defensive assets such as Gold has become lower.

It is also likely that Technicals play a huge role in the descend, as there wasn’t any major news announcement made yesterday. Furthermore, current decline has formed a descending Channel that look almost like a mirror image from the rising Channel with the sudden plunge candle as the line of symmetry.

Hourly Chart

Given this backdrop, the likelihood of descending Channel Top holding becomes more likely, and so is the subsequent move towards Channel Bottom with mild bearish acceleration expected should soft support of 1,225 is broken. Stochastic readings suggest that bearish momentum is tapering with Stoch curve currently pointing higher and looking likely to be bottoming out soon. Hence, a break of Channel Top cannot be ruled out, but even in this event, price will be facing resistance around 1,233 which is the latest swing high. Considering that price has yet to hit 1,225 in current bearish cycle, and coupled with the fact that a proper Bullish Stoch Cycle signal was given earlier, it can be interpreted that the bullish correction from 1,225 never really ended. This implies that even more bullish target above 1,233 is possible, albeit more unlikely given the stronger bearish bias.

As Fed will be releasing the minutes to the latest FOMC meeting where QE was finally tapered, traders can expect volatility as we approach this key risk event. This increases the possibility of the above mentioned bullish scenarios, but traders should be mindful that this doesn’t necessary invalidate the overall bearish bias in the Short-Term.

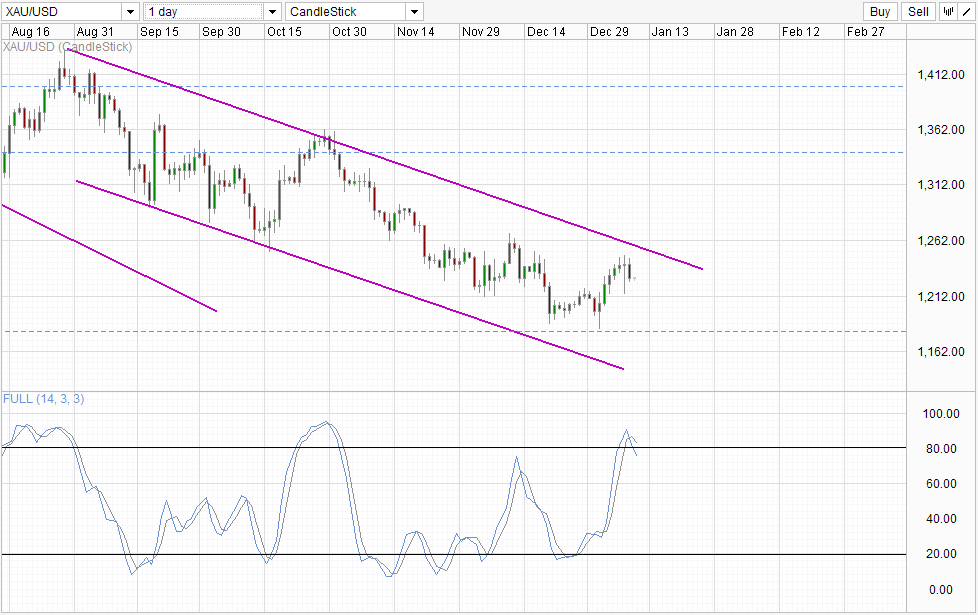

Daily Chart

Daily Chart remains bearish with the previous 3 candles forming an Evening Star bearish pattern of some sorts (not exactly an Evening Star as the “Star” is not supposed to have such a long bearish tail). This coupled with the fact that Stochastic reading is now showing a fresh bearish cycle signal bodes well for bears and increase the likelihood of a push towards 1,180 support and ultimately Channel Bottom.

This is in line with Mid/Long term expectations of lower Gold prices as the Fed will be implementing further cuts to current QE program in 2014. As such, there will be lower inflation risk (not that there was much to begin with) and hence lower demand need for Gold.

More Links:

EUR/USD Technicals – No Immediate Bearish Threat Below 1.363

GBP/USD – Pound Remains Rangebound

USD/CAD – Weak Canadian Trade Balance, PMI Sink Loonie

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.