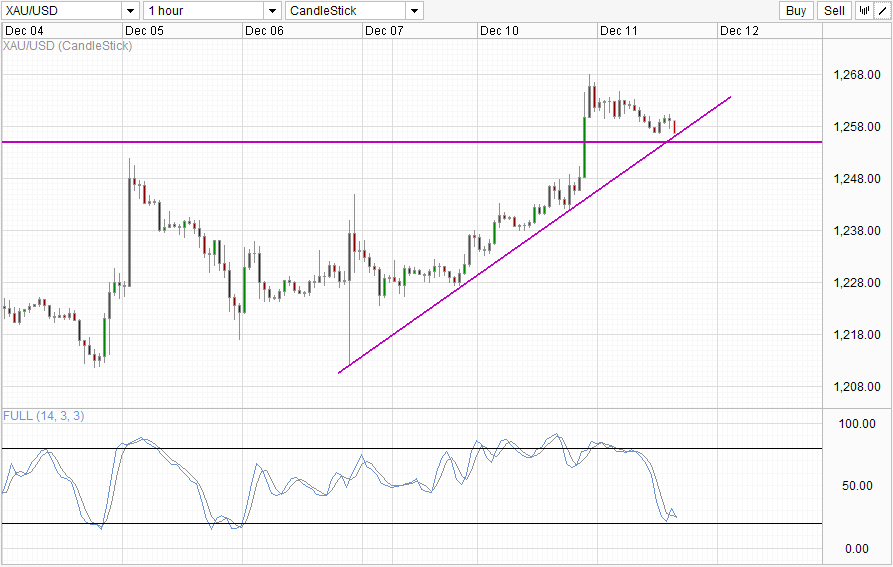

Hourly Chart

Bernanke certainly wasn’t joking when he said that he didn’t understand Gold prices action, and price movement in the past 2 weeks seem to agree. Once again we’ve seen Gold prices rising up sharply without any rhyme or reason yesterday, with prices hitting a high of 1,268 during early US session. Previously we could use the “Taper Fear” boogeyman as the reason for price action (even though it is not a very convincing explanation as explained in our past analysis), but we can’t even use this right now as Stock prices actually pushed lower yesterday. If an alleviation of Taper Fear was the reason why Gold prices rallied, then we should have seen S&P 500 higher, and not lower.

Therefore we are back to using yet another boogeyman that has been touted a few times in the past 2 weeks – buying pressure from large financial institutions. This is actually a boogeyman explanation as nobody has actually seen or heard the supposed big whales in action. Nonetheless with the lack of bullish follow-through, it is hard to believe that the market is genuinely bullish especially given the lack of fundamental reasons for stronger Gold demand. Previously we’ve also seen hedge-funds doing something similar back in April, hence there has been precedent for such occurrence and we should not be surprised that the same may be happening this time round.

Nonetheless, without hard evidence it will be highly risk to fade this move. As such, it is no surprise that bears may not be willing to commit to any strong selling activities even if they think prices are inflated. Hence, there is still a decent chance that we could see prices rebounding off the rising trendline and confluence with the 1,255 support. Furthermore, by pushing above 1,255 bulls have managed to invalidate short-term bearish pressure, which should encourage closet bulls to drive prices up a little bit more.

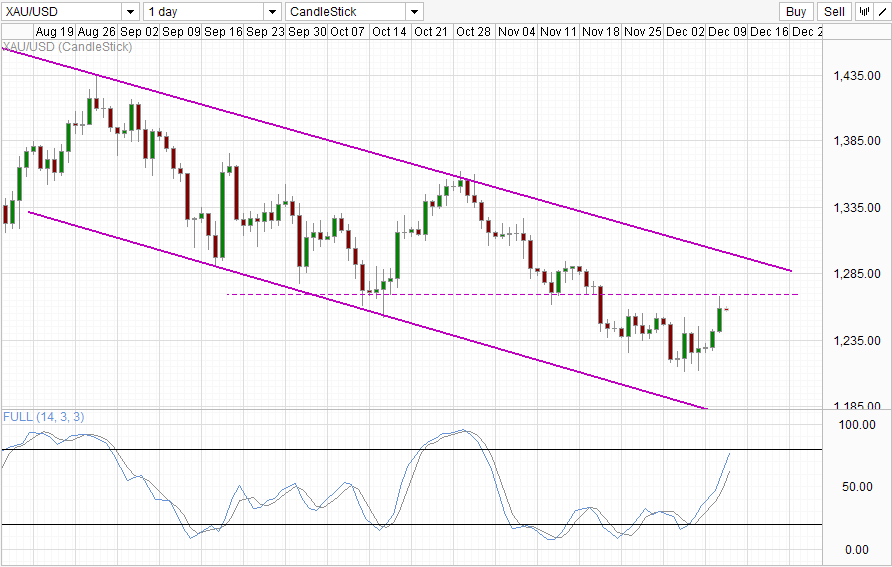

Daily Chart

Daily Chart is still bearish though, with 1,270 ceiling hanging just above. Stochastic readings are also close to the Overbought region, lending strength to the resistance and favor a move back towards Channel Bottom. It should be noted that even if bulls manage to break 1,270 (in theory possible should Fed not taper next week, but even then there are signs that Gold prices are immune to Taper Fears already), Channel Top will still add further bearish pressure downwards. Hence, a sustained bullish push will require a strong fundamental shift which is difficult to imagine for now.

More Links:

WTI Crude Technicals – Inching Closer to 61.8% Fib But Bears Maintain Advantage

GBP/USD – Settles at Resistance Level at 1.6450

EUR/USD – Runs into Resistance Level at 1.38

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.