Prices opened higher this morning, but bulls were quickly defeated with bears sending price packing much lower quickly, breaking the 1,210 soft support in the process and hitting a low of 1,207.5. At the time of writing, prices remain bearish, but a slight rebound is seen ahead of the test of resistance turned support around 1,207. Considering that there isn’t any major global economic development over the weekend nor this morning, today’s decline can only be attributed to the bearish momentum that started during US session last Friday. Hence, it is interesting to note that price manage to break the 1,210 level, and suggest that bullish momentum that has has been in play since 20th Dec may be reversing to a bearish one.

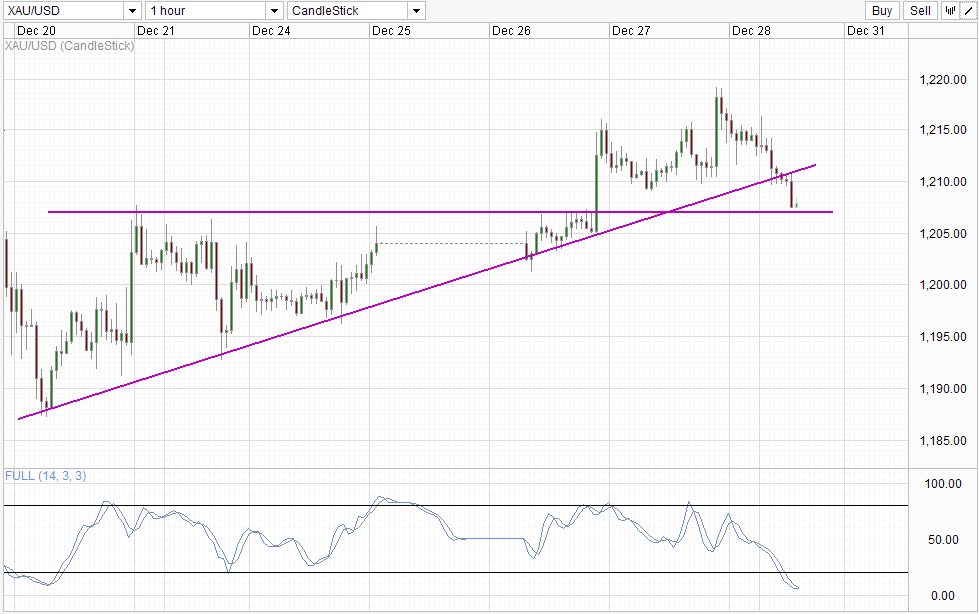

Hourly Chart

Further technical analysis agrees, as prices have broken below the rising trendline that represented the aforementioned bullish momentum which was the confluence with 1,210 soft support. This increases the likelihood of price breaking the 1,207 support level which will fully invalidate the uptrend. However, price may still rebound from 1,207 with Stochastic readings being extremely Oversold and Stoch/Signal line converging ahead of the 1,207 test. But as long as price stay below 1,210 and below the rising trendline a retest of 1,207 will remain a possibility.

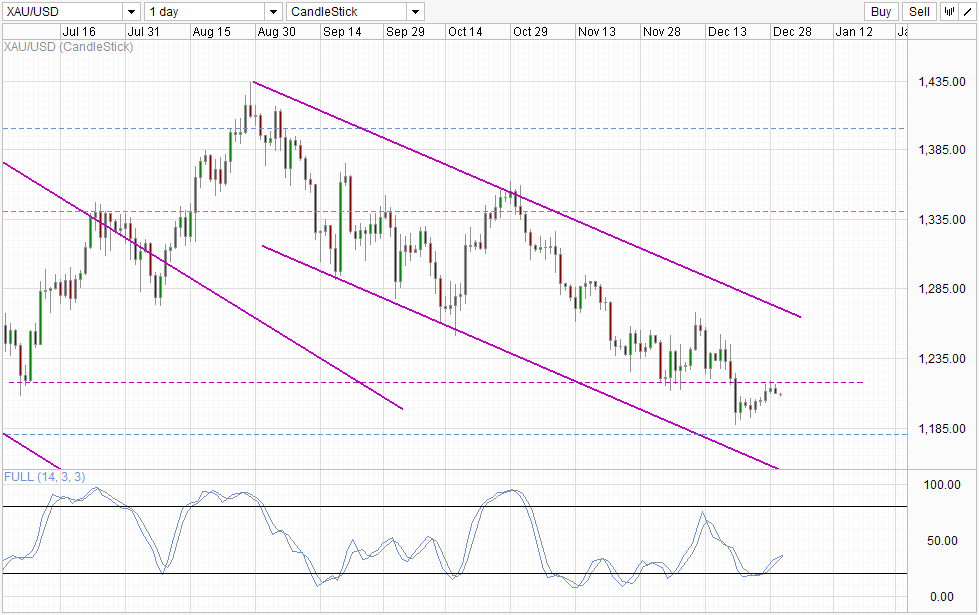

Daily Chart

Daily Chart reflects the same bearish bias with prices rebounding off the resistance around 1,217.5. This opens up the possibility for a push towards the previous 2013 swing low and possibly all the way towards Channel Bottom. Stochastic readings agrees with the downside bias as Stoch/Signal lines have converged and appears to be reversing soon, but current stoch levels do not favour an extreme bearish scenario as levels are already very close to being Oversold, suggesting that a rebound off the 2013 lows between 1,180.5 and 1,187.25 is possible.

More Links:

AUD/USD Technicals – Strong Bearishness Seen In Thin Trade

EUR/USD – Hint Of Bearish Bias But Don’t Bet On It

GBP/USD – Post-Christmas Rally Continues As Pound Soars

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.