Price action in Gold is tracking movement in Stocks closely, with the yellow metal climbing to a fresh 4 month high just as S&P 500 climbed to record highs yesterday. Prices subsequently followed S&P 500 lower, climbing from a high of 1,339 during US session to a low of 1,332.5 during Asian session this morning. This close correlation with US stocks and essentially risk trends is surprising as market should already have moved away from stimulus speculative play, as such fundamentally we should be seeing Gold being inversely correlated to stocks instead of what we are seeing now. As such, it is hard to deny that there is a sizeable portion of speculative/technical influence on Gold direction.

Hourly Chart

If that is true, then the likelihood of further sell-off in Gold in the short-term is possible as price should be heading lower towards Channel Bottom. However, some form of confirmation will be welcomed (e.g. a bearish rejection pattern as price attempt to climb back above 1,335 – 1,336 soft support turned resistance) as the potential for price to rebound remains as Stochastic curve has already started to push higher and threatens to cross Signal line to give us a stoch trough. Even in the event that a trough is averted, the bearish potential for Gold may be limited in the short-run as readings are close to the Oversold region, increasing the challenge for price to break below Channel Bottom which is now above the 1,330 key resistance turned support as well.

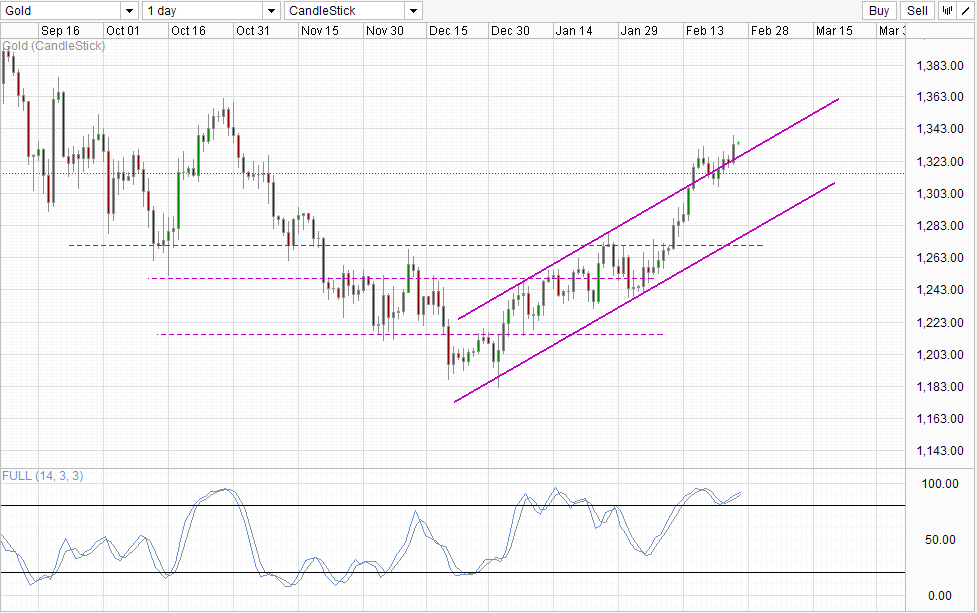

Daily Chart

The confirmation becomes even more important when we remember that trend is bullish on the long-term chart. As such, it is likely that any short-term bearish move is only “corrective” in nature and it is entirely likely that bearish objectives may not be completed before the next bullish wave start.

On the technical merits of Daily Chart alone, yesterday’s rally is yet another confirmation for the breakout of Channel Top which highlights the strength of bulls and increases conviction for a move towards 1,360. However, just like WTI Crude and S&P 500, current rally in Gold remain precarious as there hasn’t been a significant bearish pullback since the onset of the rally, and downside risks continue to pile up as we’re not seeing anything fundamental that can support current gain in prices. That being said, the fact remains that bullish momentum is strong and there is no sign of such momentum abating. As such, it will certainly be counter-trend for traders to short right now for all the misgivings we may have about current uptrend right now.

More Links:

WTI Crude – Mild Weakness Seen As Price Trades Below 103.0 Once Again

S&P 500 – 1,850 Resistance Intact

EUR/USD – Steady After Strong German Business Climate

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.