Gold prices climbed sharply this morning, hitting a fresh 4-month high when the China/Hong Kong markets opened. Reasons for this increase can be easily attributed to strong risk aversion which drove Nikkei 225 more than 2% and Hang Seng Index 1.25% lower. However, it should be noted that Chinese stocks are far from bearish with CSI 300 continuing its recovery from recent multi-year low. The individual Shanghai and Shenzhen stock exchange composite index have also gained 0.44% and 0.72% respectively. Hence, it is hard to push the “flight to safety” narrative to explain this suddenly spike in prices, and credit should actually be given to strong inherent underlying strength of bulls in Gold which has been seen on Monday’s prices which is also highlighted in our analysis yesterday.

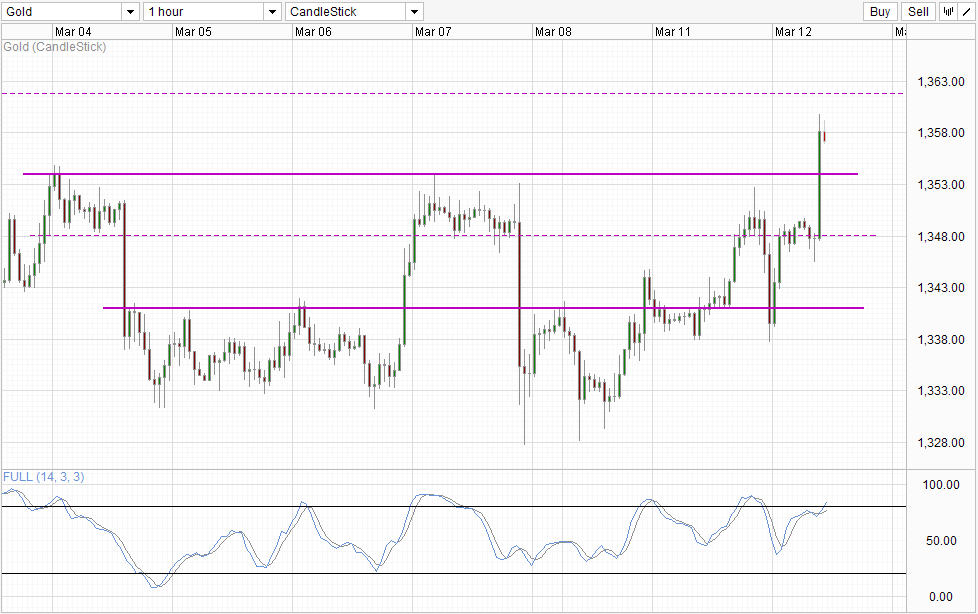

Hourly Chart

This inherent bullish strength does not mean that bulls get a free pass to push prices higher. From yesterday’s price action we can clearly see that it’s not the case. Prices climbed to a high of 1,352 during early US session, right in the middle of a consolidation zone seen on 4th and 7th March before declining sharply as well. All these happened despite US stocks being less than bullish during the same time period, suggesting that once again that there remain staunch sellers of Gold and they should not be ignored as well.

Nonetheless, with prices managing to rebound off 1,341 resistance turned support yesterday and breaking the 1,354 resistance right now, it is clear that bulls are firmly in charge right now. The only question remaining is how far bullish momentum can lead us given that Short-Term momentum appears to be Overbought according to Stochastic indicator. Furthermore, there are good fundamental reasons for long-term traders to sell gold as well (Fed Tapers), hence we should definitely not discount any possibility of bearish reprisal such as the sell-off during early US session happening more often moving forward.

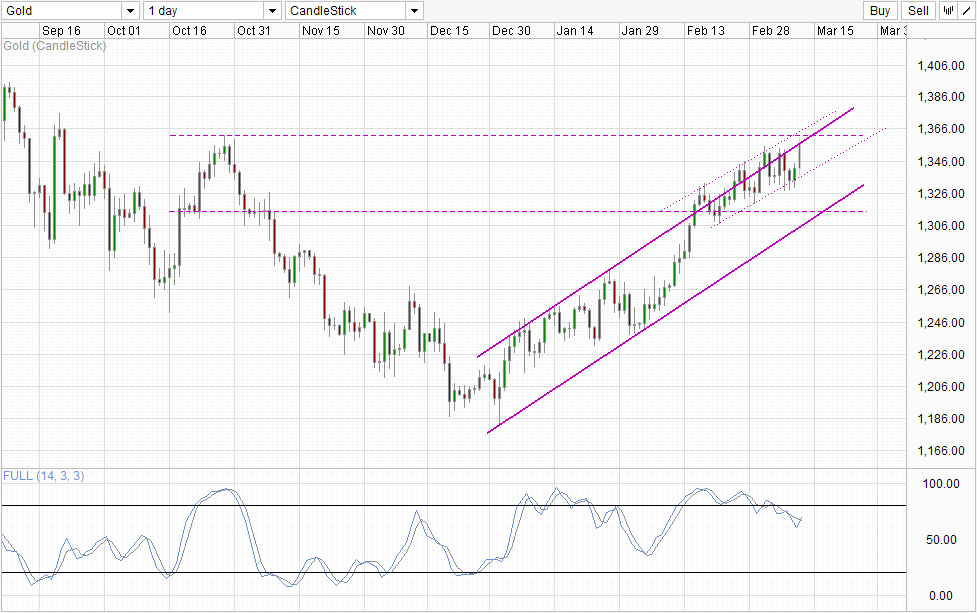

Daily Chart

On the Daily Chart, the latest rally is another confirmation that the smaller Channel is more relevant compared to the larger one. But this comparison may be moot as current price levels are heading into resistance in the form of Channel Tops from both Channels, with the swing high of Oct 2013 thrown into the mix to provide further bearish pressure. The only thing going for the bulls is that Stochastic has since crossed the Signal line, impairing the bearish cycle. However, this can only be interpreted as a short-term bullish reprieve which may allow price to fully test the Channel Top of the smaller channel better, with a low possibility of breaking out of Channel Top.

More Links:

GBP/USD – Rests on Support Level at 1.66

AUD/USD – Drops Sharply Through Key Level at 0.90

EUR/USD – Eases Away Slightly from Resistance Level at 1.39

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.