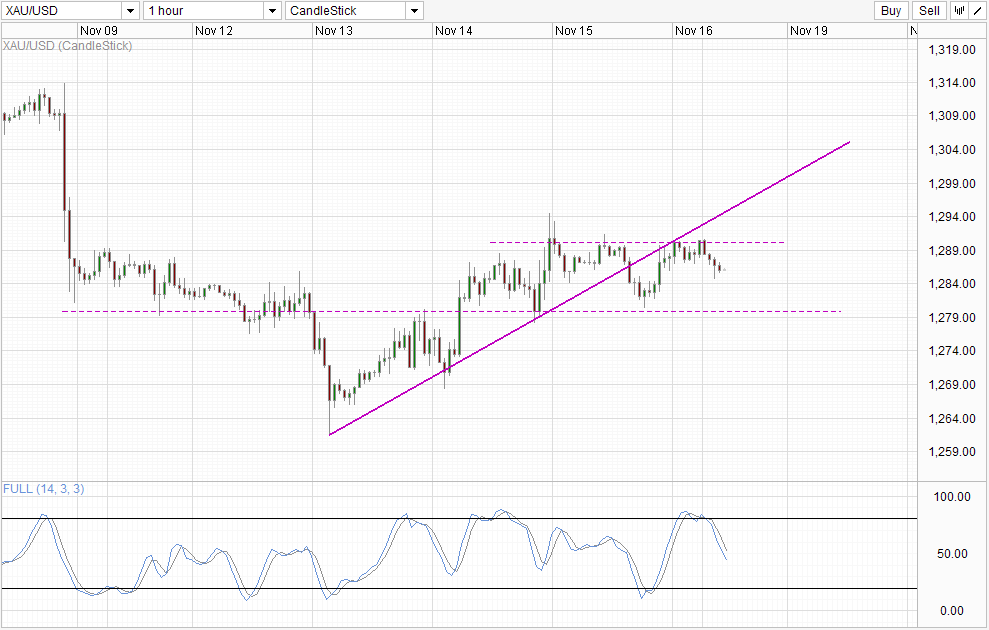

Hourly Chart

Despite closing last week with a mild gain, Gold prices remain strongly offered on Monday. Prices pushed lower immediately on open, reaching a low of 1,285 within the first 3 hours of trading. Stochastic readings are also bearish, as Stoch levels has pushed below the 80.0 level with a new Bearish Cycle in play. This opens up a potential move towards 1,279/1,280 support, where price is expected to find significant support as Stochastic curve will most likely be within Oversold region when the bearish target is met.

The reason for this morning’s decline can be attributed to last Friday’s Commitment of Traders data which reflected a fall of 30,000 contracts in net-long positions – the largest drop since 6th Mar 2013. This fall in net-long positions also coincide with an increase in Open Interest, suggesting that this decline is supported by large portion of the market – an important feature for continued declines.

However, it should be noted that COT numbers are lagging in nature, and the latest numbers are taken last Tuesday, before Janet Yellen released her dovish prepared statements ahead of the Senate confirmation hearing. With Gold prices recovering strongly since Tuesday’s low (Wednesday’s Asian hours), one should reasonably suspect that the market sentiment may have changed, which lowers the relevancy of the bearish data. Hence, the likelihood of Gold prices rebounding from 1,279 – 1,280 strongly is high, and prices may even push higher from here towards 1,290 once again if the S/T sentiment is indeed bullish.

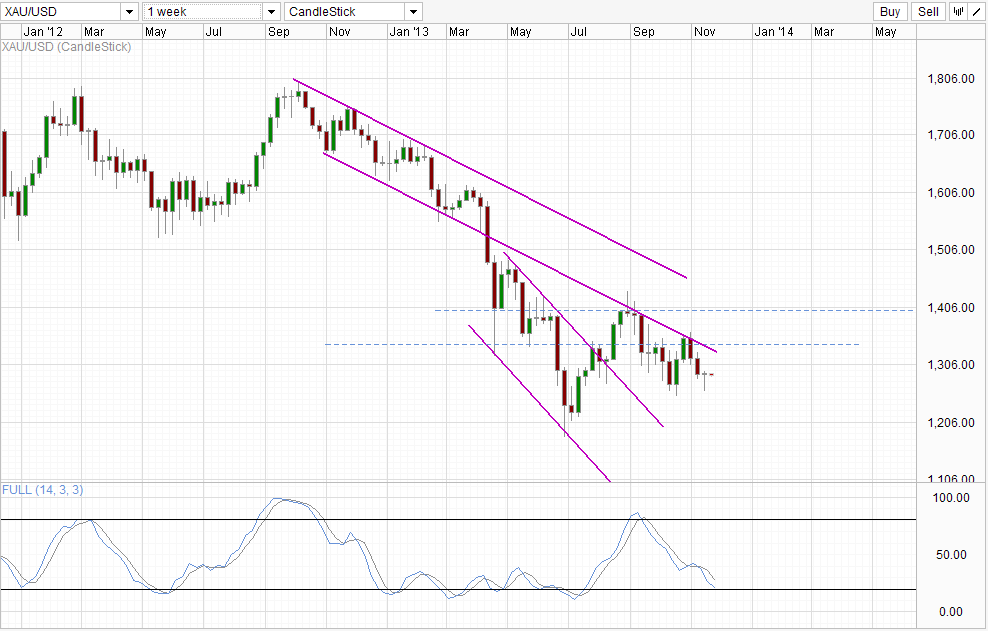

Weekly Chart

The bearishness in Weekly Chart has taken a huge setback due tot he long-legged doji candle that is formed last week. Even though this does not necessary invalidates the overall bearish momentum, immediate bearish pressure has been relived, with the possibility of price testing the descending Channel Bottom directly above. Stochastic readings have also pushed yet closer towards Oversold regions, limiting room for bears to push further.

Fundamentally, long-term demand for Gold is falling as the need for inflation protection is lower right now. The lower inflation risks applies even if we continue QE well into 2014, as there isn’t enough evidence to show that inflation has actually risen beyond tolerable levels. This decrease in demand is further exacerbated by the decline in physical demand from India and China – due primarily to the slowdown of their respective economies and rendering Gold too expensive for them to buy in previous volumes. That being said, market momentum can still catch all of us by surprise (see July rally), hence even though outlook for Gold remains bleak, conservative traders should wait for bearish momentum to return before betting heavily that a push towards 1,200 and Channel Top below will materialize.

More Links:

EUR/USD Technicals – 1.35 Resistance Holding Strong

Week in FX Americas – Market Unfazed By Yellen Comments

Week in FX Europe – BoE Shifting The Goal Posts?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.