Gold prices jumped slightly higher this morning following the Crimean vote which pushed the region 1 step closer to secession. Voting results reflected a 80% turnout and 93% in favor for annexation. As US and EU sides with the Ukrainian Government that this referendum is unconstitutional, such clear indication of intention to secede may encourage military intervention by Ukraine to prevent Russia from claiming the land. The increased likelihood of an all-out war sent prices of commodities such as Gold and Oil higher.

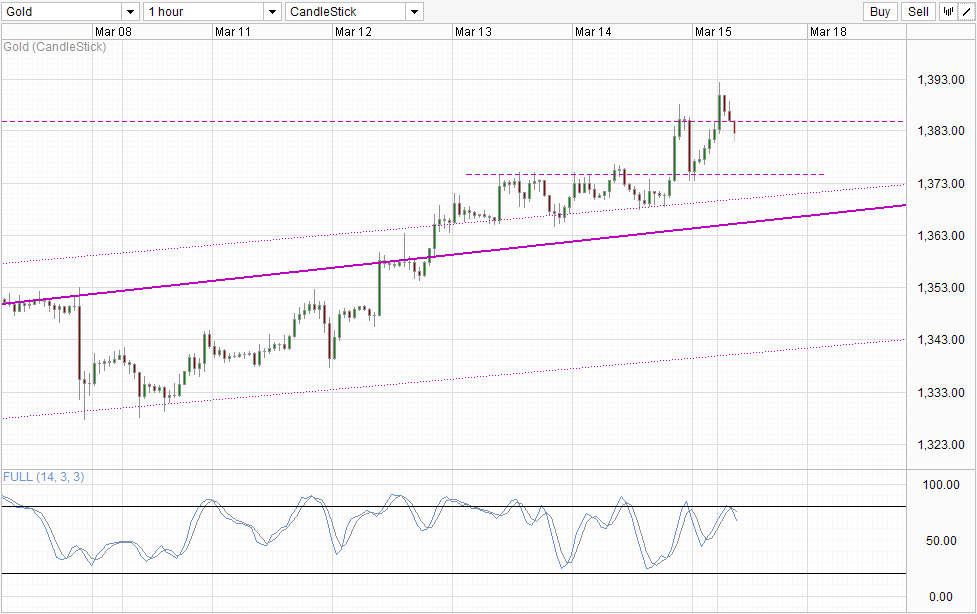

Hourly Chart

However, the bullish pressure did not last long, and prices subsequently fall after the initial hour of trading, even pushing below last Friday’s closing level. This is not surprising as the likelihood of a war breaking out is still remotely low. Firstly, Ukraine is not in any position to fight a war with a military superpower like Russia when US and the rest of Europe are hesitant to support the country with actual military supplies or manpower, choosing to go through the economic sanction route. Secondly, Russia will also prefer to end this without bloodshed as this will undermine Putin’s claim that they are taking over Crimea peacefully according to the wishes of the Crimean people. By going to war will burn out any little amount of goodwill left for Russia and may actually force US and her allies to participate even if they do not want to.

Case in point, it should be noted that Russian forces have already overtaken military installations in Crimea belonging to Ukraine without a bullet being fired from either side. It is clear that nobody wants war, and hence the justification for safe haven assets such as Gold to climb higher is weak at least for now.

From a technical perspective, Stochastic indicator suggest that bullish momentum may be reversing as well with Stoch curve pointing lower after briefly tagging the Oversold level this morning. This opens up a move towards 1,375 support level as the short-term bearish target.

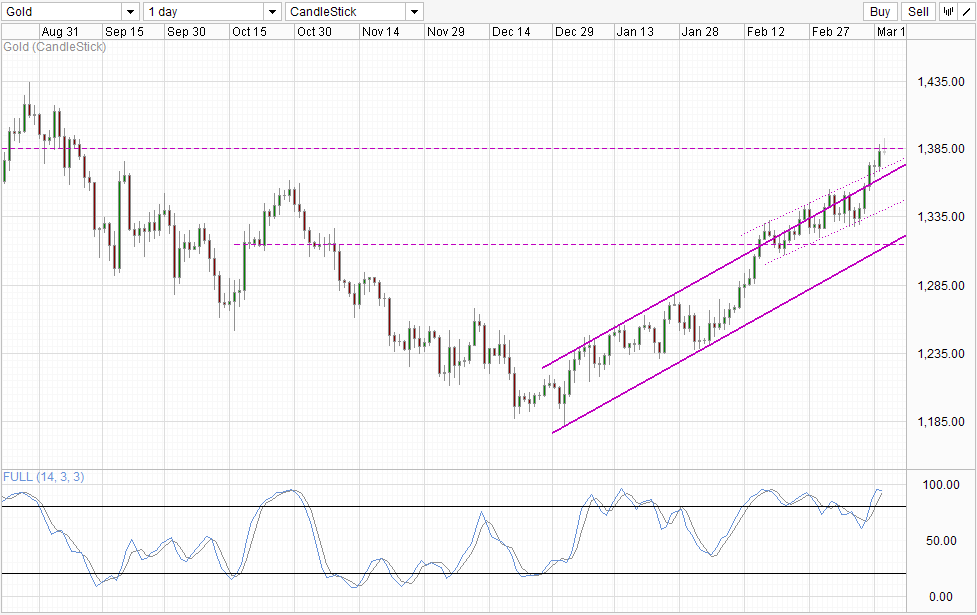

Daily Chart

Bullish momentum is still strong on the Daily Chart, but there is a chance of a top being formed with 1,385 resistance appearing to be holding right now. If we close today bearishly, an Evening Star pattern will be formed. If the bearish candle today breaches both the Channel Top lines, the likelihood of a strong bearish correction towards 1,300 becomes higher. Stochastic indicator agree with this outlook with Stoch curve already starting to reverse and may cross Signal Line soon.

Fundamentally, the case for Gold to climb higher without any war between Russia/Ukraine is weak as global inflation risk is low. Furthermore, risk appetite in stocks remains bullish for now and we will need to see stronger capitulation of risk sentiment globally before stronger gains in Gold can be seen. Also, current rally has been driven mostly by speculators with Commitment of Trader Reports showing speculative positions climbing to an 11 month high last week. Should prices start to reverse, expect speculators who tend to be much more flip floppy to start selling, lending strength to a quick push towards 1,300 round figure scenario.

More Links:

GBP/USD – Pound Shrugs Off Weak Trade Data

USD/JPY – Yen Rally Continues As Markets Fret Over Ukraine

EUR/USD – Euro Reverses Direction on Ukraine Fears, Draghi Comments

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.