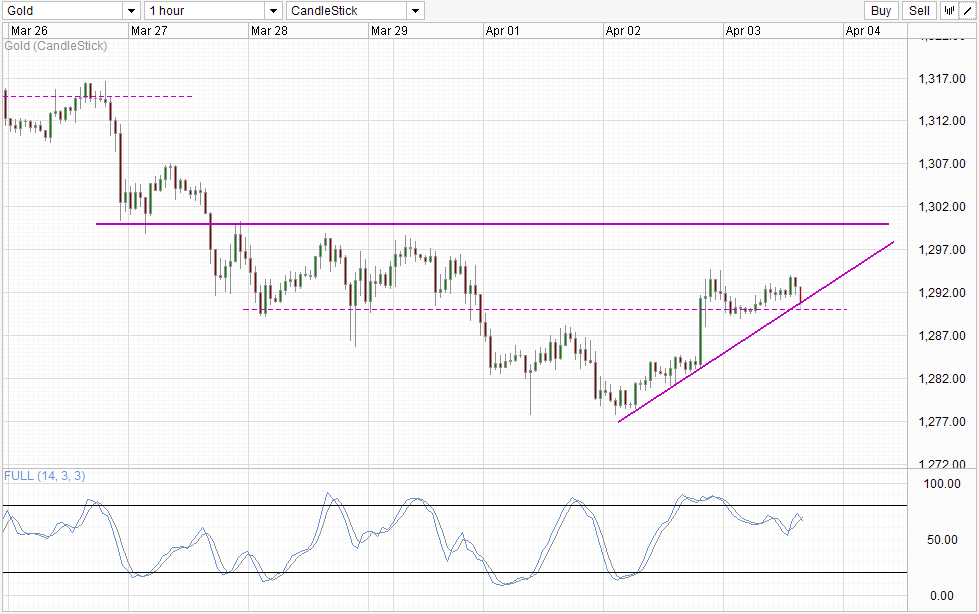

Gold prices rallied surprisingly yesterday, breaking the 1,290 resistance level to hit a high of 1,294.6 during early US session. This is the strongest bullish response that we have seen in 2 weeks, but that wasn’t enough to bring prices back to black on a Weekly basis. Furthermore, market watchers attributed this climb to short-covering activities before this Friday’s Non-Farm Payroll data, which is very different from genuine outright bullish demand for Gold. As such, overall bearish momentum remains intact and we should not expect prices to climb up significantly higher in the near term.

Does that mean that prices will move lower in the immediate future?

Stochastic readings suggest that a bearish cycle is still in play which favors further bearish push from here out. From a technical perspective, if prices does break the rising trendline and the 1,290 round figure we could see quick acceleration towards recent swing low. From a sentiment point of view, any significant bearish movement from here would imply that bears are highly aggressive as they will be disregarding the major event risk on Friday, and we could see more aggressive selling on in the next 24 hours before NFP data is released. In the most bearish scenario it is even possible that traders may throw caution to the wind as simply hold their short positions into the news event.

It’s not all doom and gloom for Gold though, there is some possibility that US stocks may start to reverse soon if S&P 500 is unable to clear the 1,890 resistance. In such a case it is possible that Gold prices may stay supported due to safe haven flows. However, considering that Gold has been moving lower consistently in the past 2 weeks on pure bearish sentiment alone, it is possible that bears will simply shrug off any bullish pressure and continue straight lower.

More Links:

AUD/USD Technicals – Slight Bullish Rebound Possible In S/T But Outlook Bearish

WTI Crude – Bulls Seen Around 99.5 Keeping Price Afloat

S&P 500 – Early Signs Of Break But 1,890 Still Holding For Now

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.