Gold prices traded lower today on positive risk appetite as the demand for safe havens such as Gold decreases when stocks are performing so well. Nikkei 225 is trading 1.45% higher, ASX by 0.52% and Hang Seng by 0.57%. However, the reason for the increase in risk appetite is interesting considering that there’s nothing between yesterday and today that could have triggered a reverse in risk appetite. Economic data docket was light during Eurozone, while US market was closed. Chinese GDP figures were released during early Asian session yesterday, but the reaction during Asian hours were rather muted, hence it will be tenuous to suggest that today’s cheery risk appetite is a delayed response from yesterday.

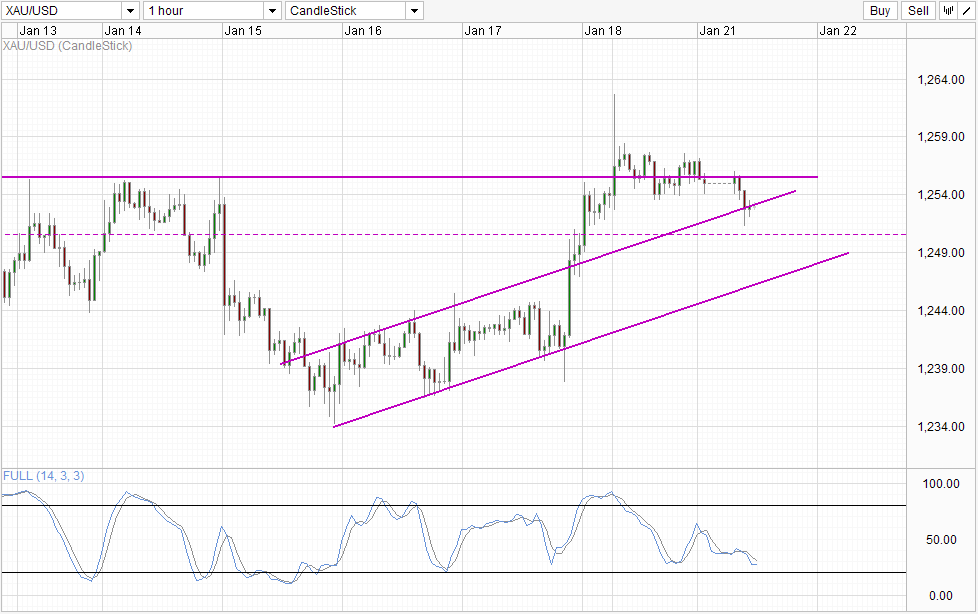

Hourly Chart

What does this mean for Gold prices? Given that the reason for positive risk appetite is shaky, there is a high likelihood that risk appetite may make a U-Turn soon, and the chances of rising Channel Top holding becomes higher. Even if price manage to break into the Channel, it is likely that 1,250 will provide ample support, failing which Channel Bottom will be able to come to the rescue. Stochastic readings agree as Stoch curve is close to the Oversold region, and will likely be within Oversold when prices hit 1,250 – increasing the possibility of prices pushing towards 1,255 in the short-term.

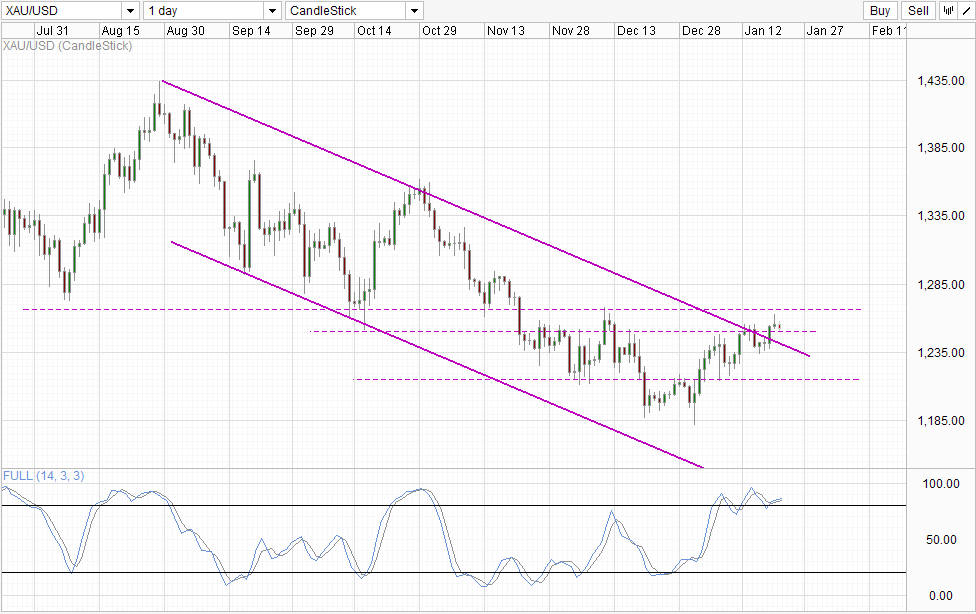

Daily Chart

Daily Chart is a mixed bag though. Prices have successfully pushed beyond the descending Channel, but overall bearishness remained. This cannot be regarded as unexpected as overwhelming bearish pressure in the long-run will always remain given the bearish fundamentals surrounding Gold (QE taper, decline physical demands by India and China, Global recovery narrative). However, it is nonetheless interesting to see that Stochastic readings remain pointing higher despite an Evening Star pattern about to form. Given current levels, it is possible that Stoch readings may still remain above 80.0 level or at least above 70.0 (where previous peak and trough was seen) even if 1,250 is broken. This increases the likelihood of price rebounding off Channel Top, and we may not be able to see strong bearish acceleration in the short/mid term (in this perspective amounts to 1-2 weeks).

Therefore, traders who wish to play the long-term downtrend may need to wait longer for confirmation that the bearish momentum is back in force, and not risk getting caught by volatility as price may be able to move between 1,235 – 1,270 without any sign of directional clarity.

More Links:

GBP/USD – Resistance at 1.6450 Stands Tall

AUD/USD – Trying to Hold Above 0.88

EUR/USD – Settles Around 1.3550

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.