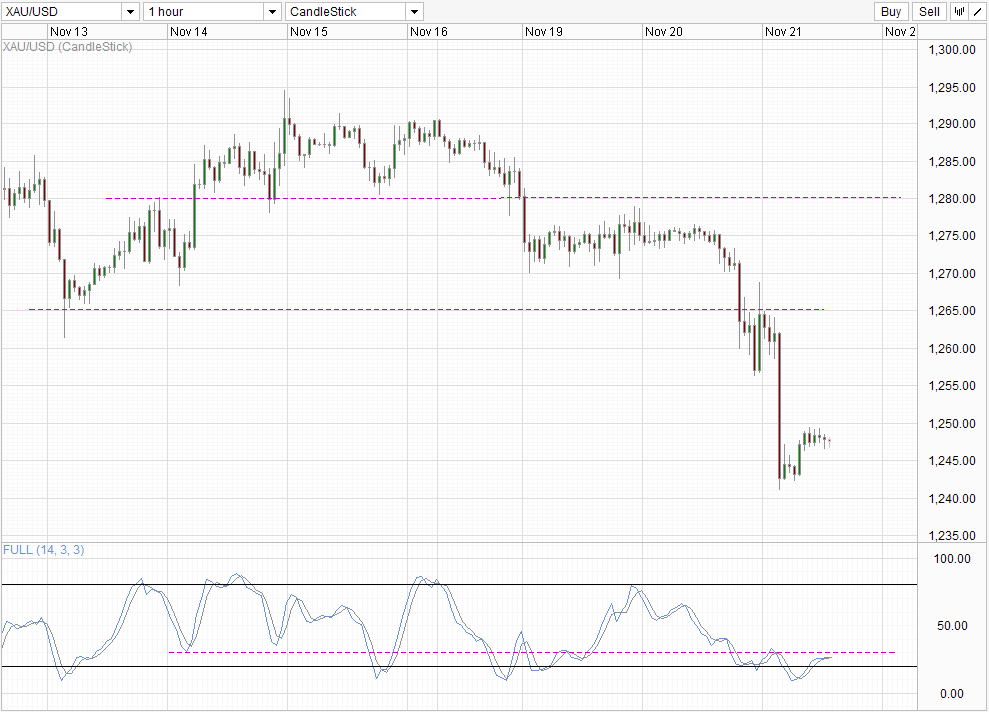

Hourly Chart

Price of Gold fell, similar to Stock and Bond Prices due to latest revelation from FOMC Minutes which reflected that Fed members deem it appropriate for a tapering action to take place in the next few months, most likely during early 2014. Gold was hit hardest (from a % loss perspective) compared to major stock indices and Treasuries as it has been the most inherently bearish in the past year. Price has since stabilized and recovered, but we’re still trading below the 1,250 round figure, a key support level that was previously thought would be unbreakable given the previous pace of bearish momentum.

Now that we’re trading below the level, the inability of price to even test the round figure suggest that overall sentiment is bearish, and favors a move back towards earlier swing low once again. Stochastic agrees, with the fresh bullish cycle signal not able to take off, and looks likely to head lower soon. However, ability to push beyond 1,240 is highly suspect given that bearish momentum will be oversold should price hit there once again, suggesting that we may need additional bearish driver (another hawkish Fed member shooting his mouth off or a stronger than expected US economic news) before further bearish objectives can be contemplated.

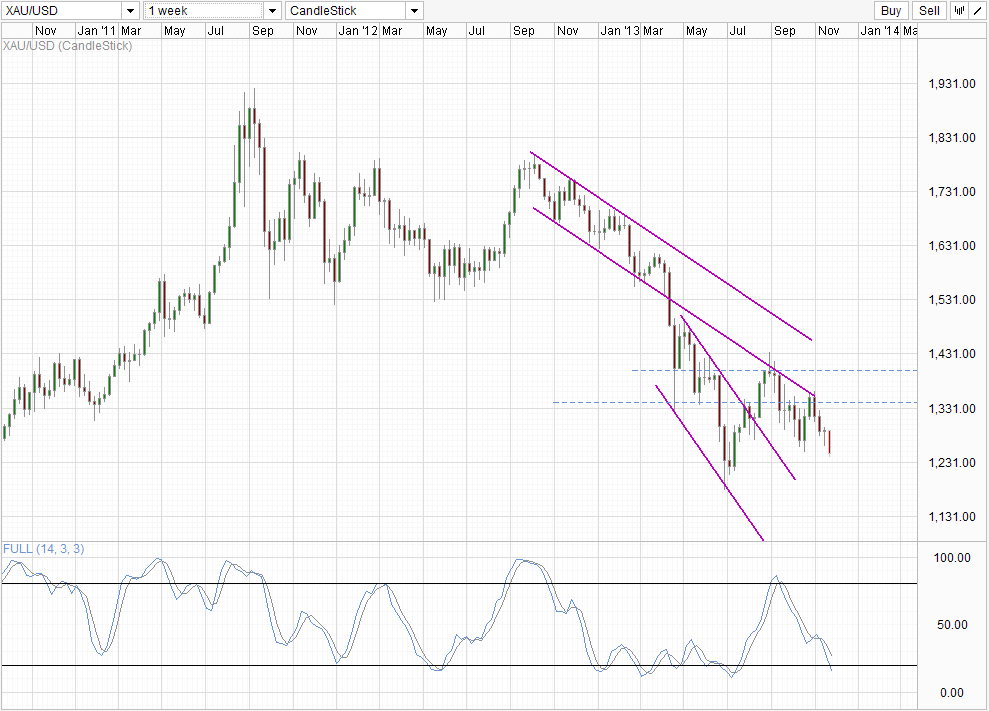

Weekly Chart

This applies to Weekly Chart as well, where bearish momentum is strong but Stochastic curve has indicated that we are already within the Oversold region. Hence, we should not be surprise if prices are unable to break the previous swing low of around 1,200, especially given that December FOMC meeting has a high likelihood of Fed choosing not to taper – a move that may result in temporary bullishness which will prevent a break of 1,200. However, overall bearish bias will continue to remain in play, and hence traders should not assume that any rebound from here will have long lasting trend emerging as long as trade below 1,400.

More Links:

US10Y – Staying above 126.5 for now post FOMC Mintues

US S&P 500 – Stocks Feeling Taper Heat But L/T Bullish Momentum Intact

GBP/USD – Continues to Struggle at Resistance at 1.6150

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.