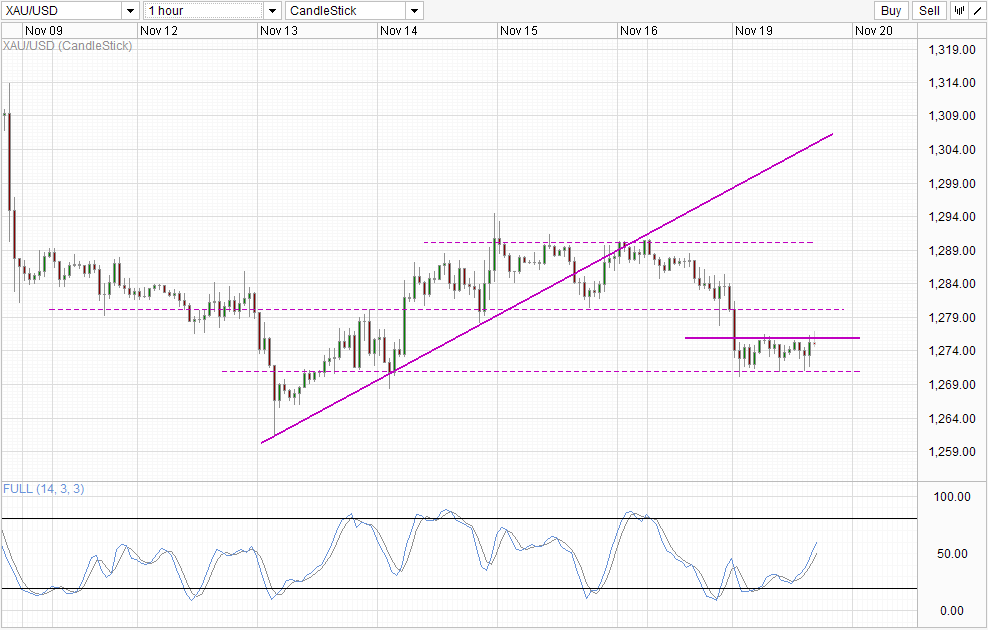

Hourly Chart

Gold prices accelerated lower during US session following the break of 1,280 during US trading session. Even though price was already bearish to begin with as bulls were unable to breach 1,290 resistance, but prices did test 1,280 earlier and failed, with a retest happening quickly after 2 hours – an incredible feat considering that the failure should have open up a move back towards 1,290 with Stochastic readings showing a fresh bullish cycle signal as well. Hence the decline at around 10am EST (11pm SGT) is strong, but this is not an inexplicable move.

The driver that broke 1,280 was the same that pushed EUR/USD from is peak yesterday. Latest Net Long-Term TIC Flows came in at $25.5B, much better than the expected $20.0B and a welcomed reversal from previous month’s -$9.8B. A net inflow of foreign investment funds into US is a vote of confidence that foreigners believe in the long-term growth prospect of US economy, and supports a Fed taper action. Furthermore, having a net influx of foreign funds will naturally strengthen USD, resulting in a lower Gold price even if we do not take into consideration the QE taper speculative play.

Since then, price as mostly stabilized, trading between 1,271 – 1,276. This is actually good news for bears though, as this rest allow further bearish momentum to emerge in the future. Stochastic curve has moved up significantly, and will likely be within Overbought region if price continue to stay at current levels (or trade slightly higher) for a little while more. Even if 1,276 is broken, 1,280 will provide additional resistance, opening a move back towards 1,270 – 1,271 in the short-term, and potentially lower if momentum allows.

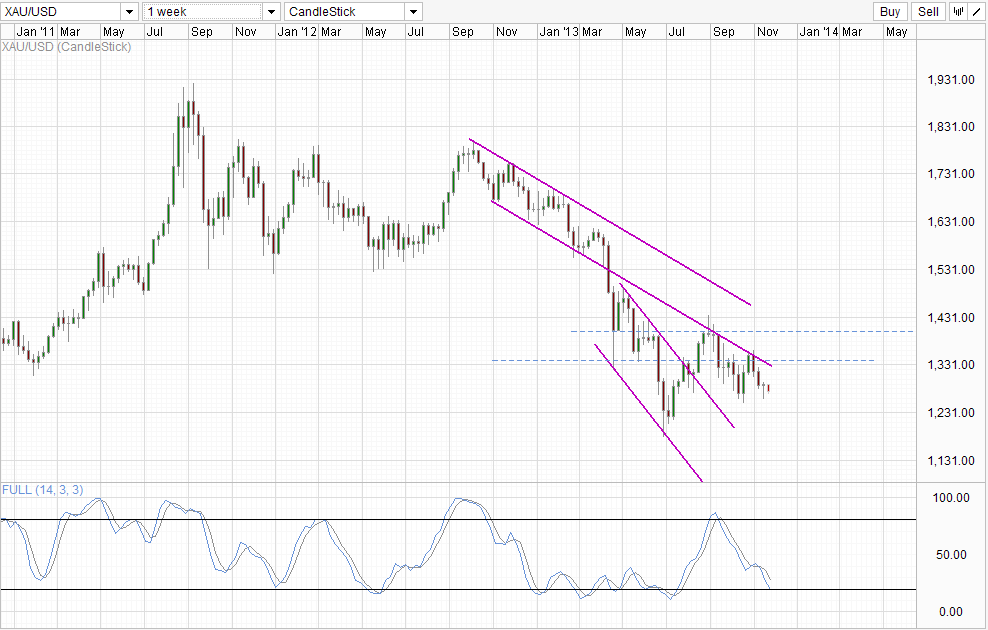

Weekly Chart

Long-term chart is heavily bearish now, but bearish objectives beyond 1,250 may be hard to reach as Stochastic tells us that bearish momentum may be overstretched soon. This doesn’t change the overall outlook, just that strong support can be expected and we may end up having a bullish pullback before further bearish movement can take place.

More Links:

EUR/USD Technicals – Bullish Above 1.35 With 1.354 In Sight

USD/CAD – Loonie Edges Higher As Foreign Securities Purchases Jumps

GBP/USD – Little Change As Pound Remains Above 1.61

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.