Price action of Gold has been mostly similar to the rest of the major currency pairs today – namely not a lot has happened. Nonetheless, it is clear that prices remain bearish. An unexplained decline was seen during early European hours, and that was driven by nothing other than pure sentiment. Weaker than expected German Retail Sales and Euro-Zone CPI failed to rejuvenate prices as well even though that should have triggered flight to safety.

To be fair, risk trends are actually bullish right now – DAX remains in the black (+0.03%) while FTSE 100 is much stronger at +0.63% despite the disappointing Euro-Zone economic number, even EUR/USD is strangely bullish and we’ve just hit a fresh daily high after the CPI numbers have been released.

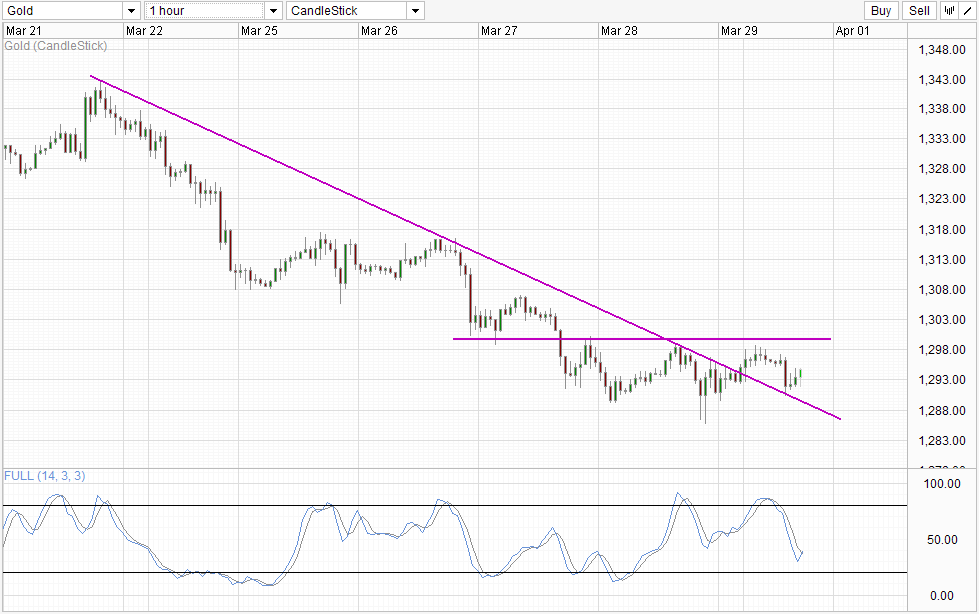

Hence, we shouldn’t be too harsh on the Gold bulls for not being able to push prices much higher given the circumstance. However, that doesn’t change the fact that overall direction for Gold remains bearish and a push towards descending trendline is possible. Stochastic indicator may suggest otherwise right now, but it is likely that current reversal in Stoch curve may be temporary as “resistance” can be found around the 50.0 level and it will not be too surprising to see Stoch curve – and price levels to head lower.

Short-term price target will be descending trendline and confluence with the recent swing low around 1,285 – 1,288. Beyond that may be difficult to forecast but it is certainly possible that prices may simply straddle the trendline lower in a measured decline. On the other hand, a slight rebound may also be possible given that Stochastic indicator will be Oversold when price hits around 1,285, but overall bearish bias will remain if prices stay under 1,300.

More Links:

EUR/USD Technicals – Short-Term Downtrend Threatened

USD/JPY Technicals – Testing 103.0 Resistance

AUD/USD Technicals – Bearish Response Seen Ahead Of 0.93 Break, RBA Rate Decision

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.