The yellow metal took yet another significant step lower yesterday, pushing deeper below 1,300 fueled by positive risk trends which saw US stocks climbed higher. What is interesting is that Gold prices remained stable during early Asian hours even though Japanese Tankan Indexes came in mostly below expected except for the non-manufacturing indexes. Furthermore, prices actually took a dive at 8.00pm EST, the time of release for Chinese official Manufacturing PMI data which came in at 50.3 – matching expectations. This sharp decline suggest that market is being bearish and is basically finding excuses to sell Gold. This assertion can be affirmed by looking at the lack of bullish response with the weaker than expected HSBC Chinese Manufacturing PMI numbers were released 45 mins later.

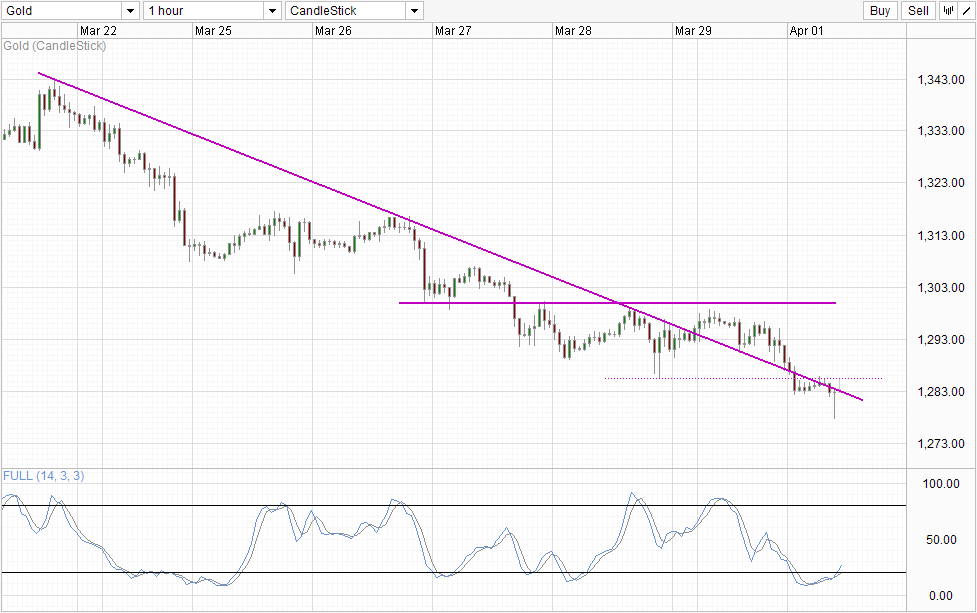

Hourly Chart

Certainly prices did retrace back the initial losses, but overall price is lower than the early Asian session. Also, we are now back below the descending trendline, and even though Stochastic readings favors a bullish recovery, it is still possible if not more likely that prices may continue lower straddling along the trendline.

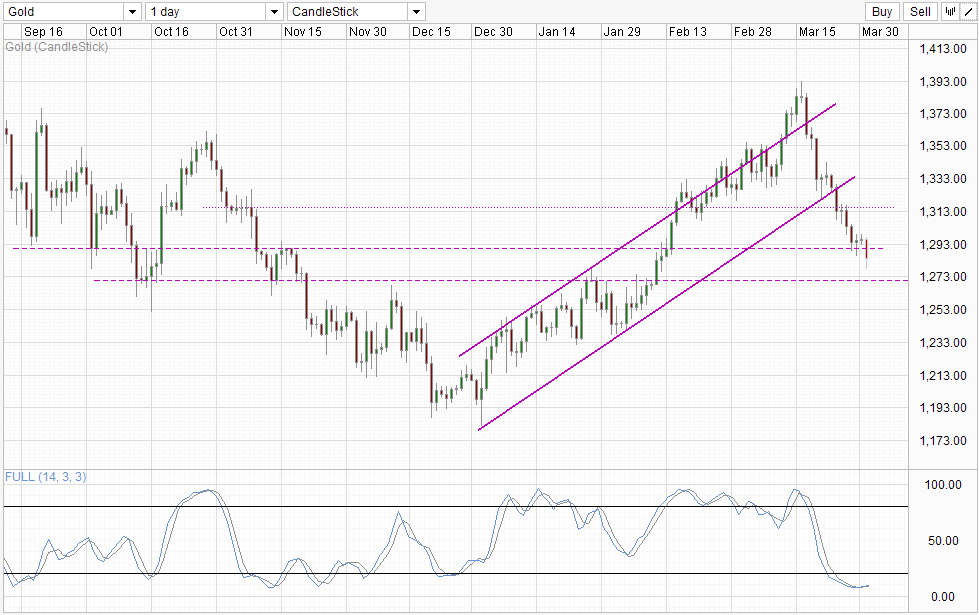

Daily Chart

Daily Chart is less bearish though, as we’ve not seen any significant pullback since the recent highs around 1,390+. Hence, the flattening of Daily Stochastic curve should not be ignored even though counter-trend signals tend to be unreliable during strong trends (and the reason why we did not put more weight for the bullish signal on Hourly Chart). This would imply that prices may find significant support around 1,270, potentially halting the bearish push by at least 1-2 days based on past trends. It is also possible that we could even see stronger bullish response to bring us to 1,290 once again or perhaps even a 1,300 retest on the daily chart (and not the retest on the hourly chart). Should that happen, the likelihood of further bearish extension increases if 1,300 resistance holds and we could see a full breakdown of the bullish momentum that has been in play since early Jan.

More Links:

GBP/USD – Pound Remains Firm After Dovish Yellen Comments

USD/CAD – Loonie Flies Higher As Canadian GDP Rebounds

USD/JPY – Dollar Breaks Above 103 As Japanese Manufacturing Numbers Slide

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.