Prices behaved as expected yesterday, with yesterday’s decline highlighting the strong bearish momentum that remains in play. The slight decline in US stocks helped to support prices against further losses, but with Asian markets seemingly bullish once again we’re seeing Gold prices trending lower again.

It bears mentioning as well that yesterday’s decline implies that Gold bears are rather aggressive as they are committing to short-positions even though we have a major news event risk in the form of US NFP today. The decline has also pared gains from profit taking activities on Wednesday, suggesting that the next wave of bearish sell-off is here. Given these, it is possible that a significant bearish move may occur in the next few hours before NFP is released.

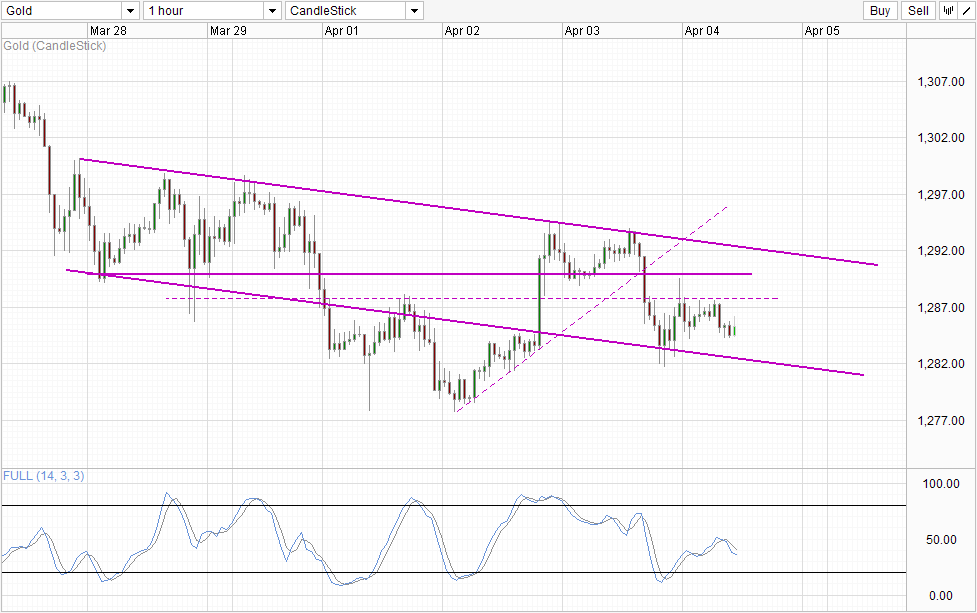

Hourly Chart

Descending Channel Bottom is the obvious bearish target for now. In the event that NFP print is worst than expected and Gold prices rally, it is possible that Gold prices may pushed higher but as long as soft resistance 1,288 remains intact it will not be surprising to see S/T bearish momentum moving lower for the rest of the US session. If Channel Bottom is broken before NFP announcement, a retest of Channel Bottom is possible and should price fail to move up above Channel Bottom we could also see further bearish movement towards this week’s swing low.

On the other hand, if NFP numbers are favorable to bears, it will not be surprising to see prices extending this week’s loss and we can expect bearish momentum to continue next week as well as there will be fundamental justification for Gold to collapse further when previously prices have simply been moving on pure sentiment alone.

Daily Chart

Daily Chart agrees, suggesting that a move towards 1,270 is possible. However, strong bullish response should be expected around the 1,270 level as the bull trend seen in 2014 would be invalidated if 1,270 is broken. Furthermore, we have not seen any significant bullish pullback since the decline in mid March and a pullback scenario is favored. Stochastic indicator agrees with Stoch curve deeply within the Oversold region and likely to reverse higher – suggesting a short-term pullback (if not a bullish reversal) is possible.

More Links:

GBP/USD – Pound Slides As Services PMI Falters

USD/CAD – Loonie Steady As Canadian Trade Balance Improves

AUD/USD – Slightly Lower After Sluggish Australian Retail Sales

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.