Gold remains heavily supported despite the extremely bearish close of last Friday, which was the lowest weekly close since July, breaking the 1,285 – 1,295 support zone that has been supporting prices since August. This support arose from the uncertainty surrounding the unresolved US Debt Ceiling which invited investors demand just in case US actually default. The validity of this assertion can be seen from price action which climbed on Monday following the failed Senate vote over the weekend. In similar fashion, prices started to decline when there are reports that a deal could ostensibly be brokered soon, only to see all hopes of a quick deal vanish when further reports came out on Tuesday – driving prices to test 1,285 once again.

However, despite all these increase demand for the ultimate safe asset (as opposed to Treasuries which are under fire due to the possibility of default), prices are undoubtedly lower compared to 2 months ago where the risks of default was actually lower. This actually underlines the weakness in Gold and one wonders how much lower we would be if US politicians did not create such a big mess.

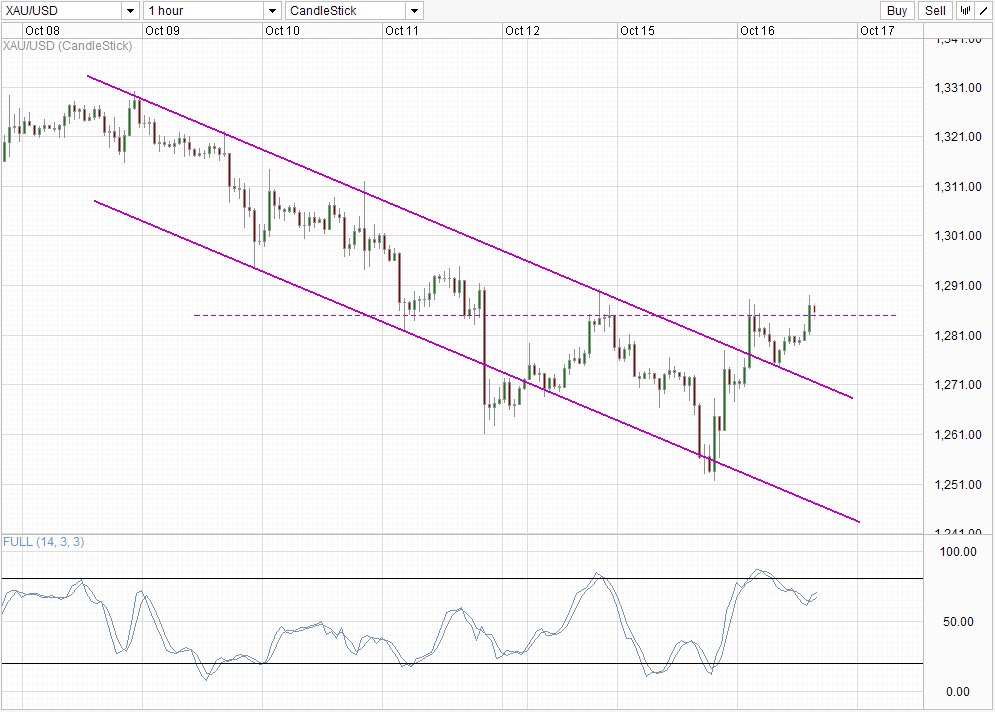

Hourly Chart

Not that short-term momentum is concerned though. Following the failed test of 1,285 during US session yesterday, prices pulled lower as expected but has found support along the Channel Top. The rebound during Asian hours led to a retest of 1,285 right now which appears to be more successful that previous attempts even though we are not fully clear of the resistance level. Nonetheless the signs are good – Stochastic curve is pointing higher after forming a trough despite forming a bearish cycle signal just prior. This suggest that a push towards 1,300 round figure may still be possible in the short-term, but it is unlikely that Gold will be able to continuously trade higher given that we are still close to being Overbought.

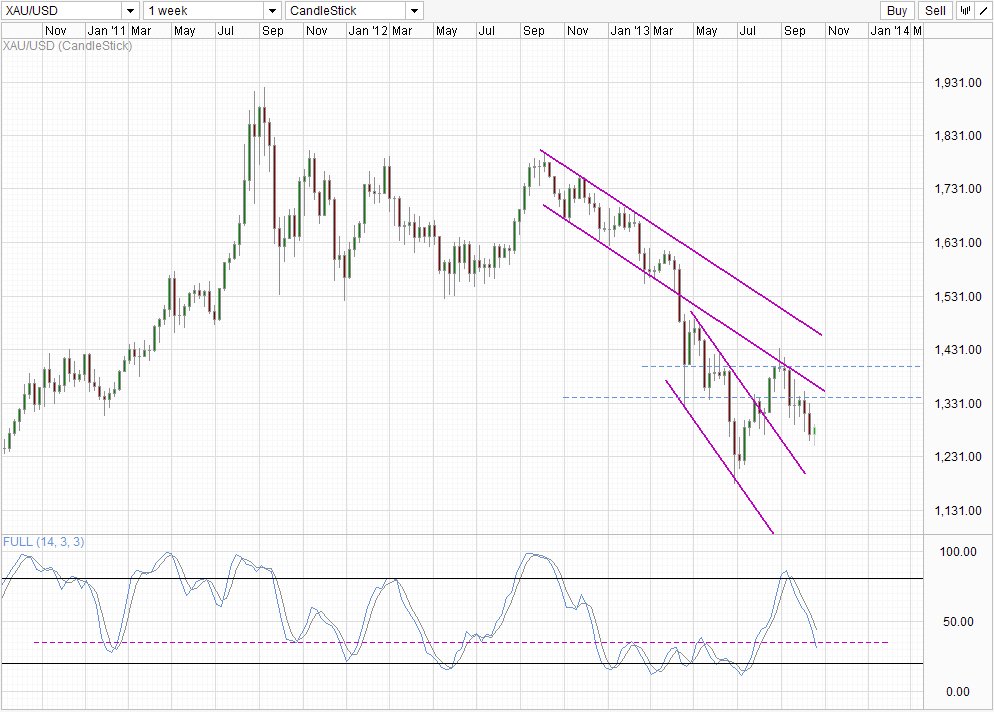

Weekly Chart

Weekly Chart remains bearish despite this week’s bullish recovery. Stochastic readings have pushed below yet another key “support” level of 35.0, which implies that bearish momentum will continue. This is in line with the observation made earlier; where gold prices are inherently bearish and we could potentially see even heavier selling action once the Debt Ceiling problem clears.

Bearish target for now would be the 1,200 – 1,225 support back in early July. From a price action perspective the ultimate bearish target will be the Channel Top below, but it is likely that Stochastic curve will hit Oversold levels before that happens, and hence we should reasonably expect some significant support around the aforementioned levels especially since that is the line in the sand for most Gold miners around the globe.

More Links:

USD/INR – Higher Despite USD Weakness

AUD/USD – Moves to Four Month High near 0.9550

EUR/USD – Relies Heavily on Support at 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.