Is there still great demand for safe havens and inflation hedges?

After a period of consolidation, gold prices have been rising again in recent days, hitting a 10-day high in the process.

This comes even as central banks signal an aggressive tightening cycle this year to combat soaring inflation and risk appetite remains healthy as Ukraine and Russia continue to engage in negotiations.

Clearly, there is still plenty of uncertainty and unease in the markets and while central banks are trying to get to grips with inflation, the worst is yet to come. And with commodity prices soaring, it could still get much worse.

So there’s still plenty of appetite for a safe haven and inflation hedge, as has become evident once more.

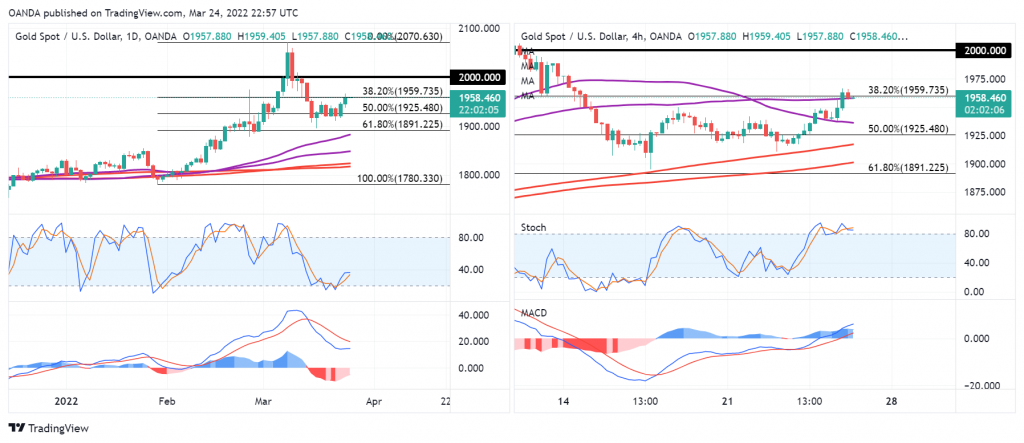

There was plenty of support around $1,900 around the 61.8 fib and 200/233-day SMA band on the 4-hour chart where the price initially rebounded off. But how much higher will it go? Can it reach record highs?

It saw some resistance around $1,960 and a move above here could see it test $2,000 once more. A move above here and talk of record highs could soon follow.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.