- Gold prices reach a new record high of $2465/oz, driven by post-CPI and rate cut optimism.

- Despite a resurgent US Dollar, gold’s upward momentum remains strong, briefly dipping before rallying to new highs.

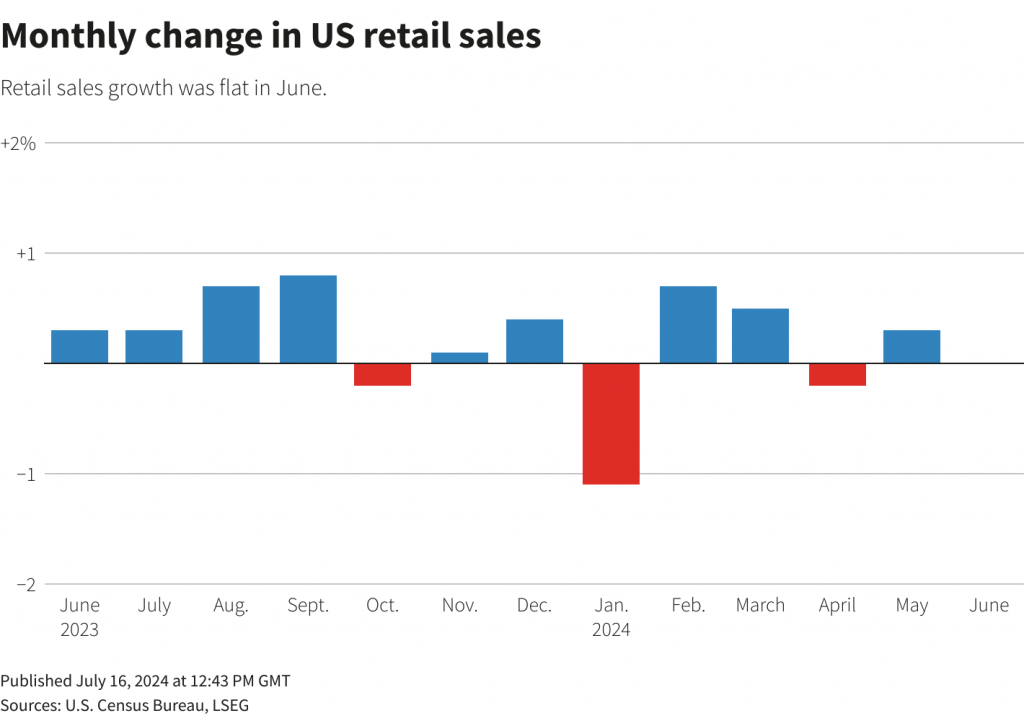

- June’s US retail sales figures and an upward revision of May’s data had minimal impact on gold’s rally and market expectations for Fed rate cuts.

Most Read: GBP/USD Faces Challenges in Breaking Through Key 1.3000 Level

Gold prices continue to ride the wave of post-CPI and rate cut optimism as the precious metal nears its previous all-time high around the $2450/oz mark.

This surge comes despite a resurgent US Dollar index, bolstered by recent events and positive US retail sales data. Initially, the strength in the US Dollar index seemed poised to cap gold prices, but this pressure failed to materialize. Gold briefly dipped to a low of $2429.45 before rallying to fresh daily highs at $2458.05.

June’s US retail sales numbers remained unchanged, but an upward revision of May’s figure to 0.3% temporarily paused gold’s rally. Nonetheless, the report did little to alter market expectations regarding Fed rate cuts, even as the US Dollar gained some strength.

Source: Refinitiv

The overall probability of a September rate cut has seen a slight increase, rising from 91.9% to 93.3%. Meanwhile, the DXY has rebounded from support at the 104.00 level but is currently facing resistance at the 200-day moving average, which stands at 104.42.

US Dollar Index Chart, July 16, 2024

Source: TradingView (click to enlarge)

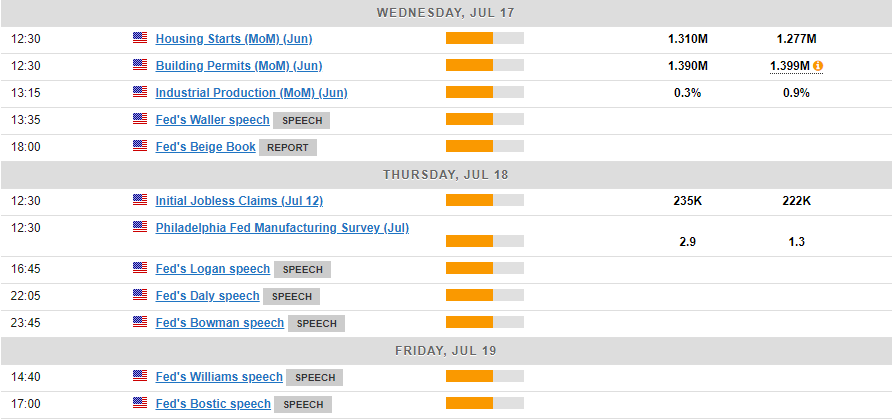

The Week Ahead: Fed Policymakers to Push Back on Rate Cut Bets?

The economic calendar for the upcoming week is light on high-impact US economic data. The main focus will be on Federal Reserve speakers, with several policymakers scheduled to address the public in the coming days.

For all market-moving economic releases and events (GMT-Time), see the MarketPulse Economic Calendar. (click to enlarge)

For the US Dollar to sustain its recovery following last week’s selloff, Fed policymakers will need to adopt a distinctly hawkish tone.

In contrast, gold appears to be on an unstoppable upward trajectory. With minimal price action to analyze, it is challenging to predict where this rally might encounter resistance.

Technical Analysis

From a technical standpoint, Gold is now in uncharted territory. The break above previous all-time highs at $2450/oz makes that a key level of support.

If the $2450/oz continues to hold then further gains are the most likely outcome. Psychological and round numbers are always key for Gold so keep a watch on $2475 and of course the psychological $2500/oz handles.

Alternatively, a break below $2450 brings $2432 support into focus before the psychological $2400 maybe revisited once more.

Support

- 2450

- 2432

- 2400

Resistance

- 2475

- 2500

XAU/USD Daily Chart, July 16, 2024

Source: TradingView.com (click to enlarge)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.