- Gold prices retest $2500/oz ahead of Fed Chair Powell’s Jackson Hole speech.

- Gold’s rebound in the European session and technical analysis suggest bullish momentum.

- September rate cuts likely already priced in. What impact will Powell’s remarks have?

Most Read: Japanese Yen Price Action Ideas: USD/JPY, EUR/JPY

Gold prices are back at $2500/oz following a long awaited retracement which materialized during Thursdays US session. A combination of a stronger US Dollar, rising US Yields and potential profit taking ahead of Fed Chair Powell’s address at the Jackson Hole Symposium likely all playing a role.

Market participants appeared to be positioning themselves ahead of the highly anticipated speech by Fed Chair Jerome Powell. Many had hoped Powell would confirm September rate cuts, however following Wednesday’s downward revision to US jobs data market participants believe a rate cut in September is a foregone conclusion. This leaves the question then, what will the market’s response to Powell’s remarks be?

As things stand, the weakness in the US Dollar and the rise in Gold at the back end of last week hint that a lot of the expectations around a September rate cut may already be priced in. A bunch of Fed policymakers confirmed yesterday that they are supportive of rate cuts in September and despite this Gold struggled in the US session. A sign that a September rate cut may largely be priced in perhaps?

This is my thinking ahead of Powell’s remarks and hence my apprehension regarding the impact his speech will have.

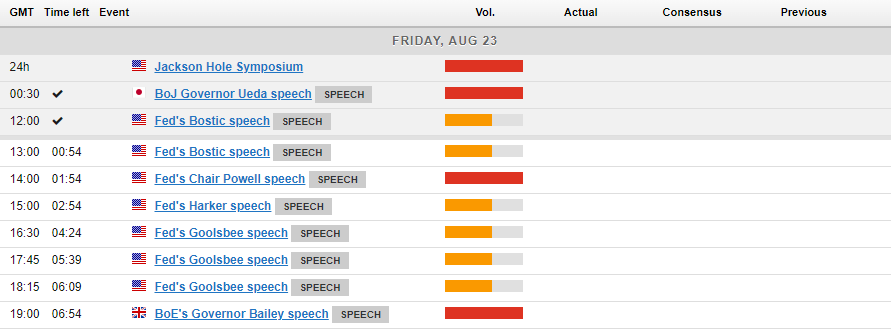

There are a host of other Federal Reserve policymakers on the docket as well today thus volatility may still be on the cards. However, in terms of direction I am not expecting anything significant out of Powell’s remarks. I will be paying attention to any mention around a potential 50 bps cut in September, something markets were pricing in favorably just 10 days ago. As things stand, futures are pricing in just shy of a 100 bps of cuts through to the end of 2024.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis Gold (XAU/USD)

From a technical standpoint, the rebound in Gold in the European session has been impressive as the precious metal peaks above the $2500/oz handle. Yesterday’s dip may have been a precursor that allowed bulls to reload while allowing others to get in at a better price.

This could explain the speed of the recovery this morning as Fed Chair Powell is set to take the stage.

Yesterday’s massive bearish engulfing candle found support at the key 2472 area before buyers returned to the fold. I had been anticipating such a pullback since Monday as gold held the high ground above the $2500/oz mark.

Given that Gold continues to print ATH, finding key levels of late has been a challenge. Immediate resistance in today’s US session may be present at 2514 and 2531.66, which is the weekly high thus far.

The downside is a bit easier with immediate support at 2484, before the 2472 area comes back into focus. A move lower opens up a retest of the 2450 key area of support.

GOLD (XAU/USD) Daily Chart, August 23, 2024

Source: TradingView (click to enlarge)

Support

- 2484

- 2472

- 2450

Resistance

- 2514

- 2531.66

- 2550

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.