- Gold prices have dropped due to increased US Treasury yields, profit-taking, and the anticipation of a less dovish Fed outlook for 2025.

- The upcoming Fed meeting and its economic projections, especially regarding rate cuts, will significantly impact gold prices.

- India’s gold imports are expected to decline in December due to a lack of festivals and rising gold prices.

- Analysts are optimistic about gold’s prospects in 2025, with a target of $3000/oz, driven by potential Chinese stimulus and increased demand during the Lunar New Year.

Most Read: BoJ Rate Hike in Focus: USD/JPY, GBP/JPY Technical Analysis

Gold has struggled this week continuing its selloff from the back end of last week. An increase in US Treasury yields coupled with profit taking and the potential for a less dovish Fed outlook for 2025, have all played a role.

The selloff has brought the precious metal back to the range (2624-2650) it hovered in ahead of the rally which began on December 9. The Fed meeting tomorrow could be the deciding factor in what Gold prices do heading toward the end of the year.

Gold Traders Face Fed Conundrum

Market participants are heading into this week’s Fed meeting with mixed feelings. The decision at the meeting seems to be a foregone conclusion, why then are market participants adopting a cautious approach?

The decision at this week’s meeting may not hold much sway in the minds of market participants and rightly so in my opinion. I do think that a lot of this has already been priced into the Gold price leaving the updated economic projections and commentary from Fed Chair Powell. This is where I believe all eyes will be focused on in tomorrow’s meeting.

There has been growing consensus over the past month that 2025 may not bring as many rate cuts from the Fed as previously hoped. This stems from a variety of factors, the most pertinent being the return of US President Donald Trump.

The Fed have thus far said they will wait to see the impact of Trump policies on the economy but one cannot wonder whether this is already at play in the back of their minds. Will it influence discussions and the updated economic projections?

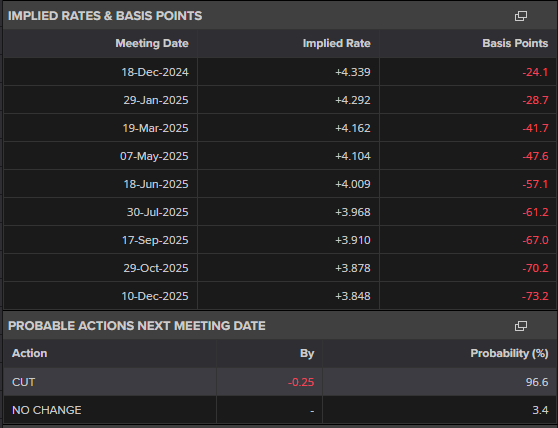

These are the more pressing questions that could drive the next move in Gold prices. As things stand markets are only pricing in around 73bps of rate cuts through December 2025. This means only around 50bps of cuts next year. Any changes to the probabilities here are likely to have a major impact on the US Dollar and Gold prices and could drive prices in the coming weeks.

Source: LSEG (click to enlarge)

India’s Gold Imports Plunge in December

India’s gold imports are expected to drop sharply in December after reaching record highs in November. This slowdown is due to a lack of big festivals and rising gold prices, which are making buyers delay their purchases, according to trade and government officials.

India remains the world’s second largest consumer of the precious metal and this could also be a contributing factor to the recent price decline. Gold imports more than doubled in November compared to the previous month, reaching a record $14.8 billion.

China Stimulus and Lunar New Year

Looking ahead, analysts seem upbeat about the prospects for Gold in 2025. Many have placed a target around the $3000/oz mark. Chinese authorities are looking at increasing stimulus as demand remains weak in the world’s second largest economy.

This week’s retail sales data proved as much, dropping down to 3% YoY from a previous print of 4.8%. Stimulus measures could help push demand in China and thus help gold prices move higher, especially with the Lunar New Year coming up.

During the Lunar New Year period, jewelry demand usually increases because of gift-giving traditions. The hope is that the next round of stimulus by Chinese authorities will finally lead to an improvement in demand as China prepares for an intriguing 2025.

Economic Calendar

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis – Gold (XAU/USD)

From a technical analysis standpoint, Gold is already in a bearish trend on the four-hour timeframe with lower highs and lower lows. The selloff has been quite abrupt with no significant pullback materializing. Instead we have had some shallow recoveries like yesterday which have failed to push beyond the 2660 handle.

As things stand a four-hour candle close above the 2660 handle is needed for a change in structure to take place which could embolden bulls. This could lead to a sustained recovery but given the recent selling pressure buyers may remain on edge and not ready to commit.

Market participants will likely derive confidence depending on the rhetoric from the Fed at tomorrows meeting. A dovish outlook for 2025 could lead to a renewed push to 2700 while a more hawkish take on the rate cut path could send Gold below the 2600 handle.

Immediate resistance at 2660 with a break above leading to resistance at the 2675 and 2685 handles.

Immediate support rests 2624 before the 2610 and 2600 handles become the areas of focus.

Gold (XAU/USD) Four-Hour (H4) Chart, December 17, 2024

Source: TradingView (click to enlarge)

Support

- 2624

- 2610

- 2600

Resistance

- 2660

- 2675

- 2685

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.