The Canadian dollar fell to an 18-month low against the greenback as OPEC delays a key decision on production cuts until tomorrow and Bank of Canada Governor Stephen Poloz stated the economy was weaker than forecast and predicted low oil prices would cut growth.

Final oil production cut details to come tomorrow at OPEC and allies meeting

Oil prices tumbled after OPEC was unable to finalize a decision on production cuts. The group did agree on production curbs, but talks at the OPEC and allies meeting tomorrow will be needed in order to agree upon a total amount. The key remains Russia and how much they will be able to commit.

Russia has said they could contribute a maximum of 150,000 barrels per day (bpd) cut, but Middle East-dominated OPEC insists Russia cut by 250,000-300,000 bpd. Expectations before the meeting were for OPEC and allies to cut production between 1.0-1.4 million barrels per day. Expectations on Wall Street are that if we see a cut below 1.2 million barrels, that could be bearish for oil prices. Oil is Canada’s largest export and softer oil prices can weigh on the Canadian currency.

Poloz Year-End Economic Progress Report

The decade of exceptionally low interest rates has led to a buildup of household debt, consisting mostly of mortgages. And we are all aware of large increases in house prices in recent years, particularly in some of our largest cities. These financial vulnerabilities have made monetary policy more complicated. It is fair to say that the data released since our October MPR have been on the disappointing side.

Global oil prices are well below our forecast assumptions made in our October MPR, primarily due to supply forces. There is also an important overlay of worry about moderating global economic growth, given heightened trade tensions, with implications for future oil demand.

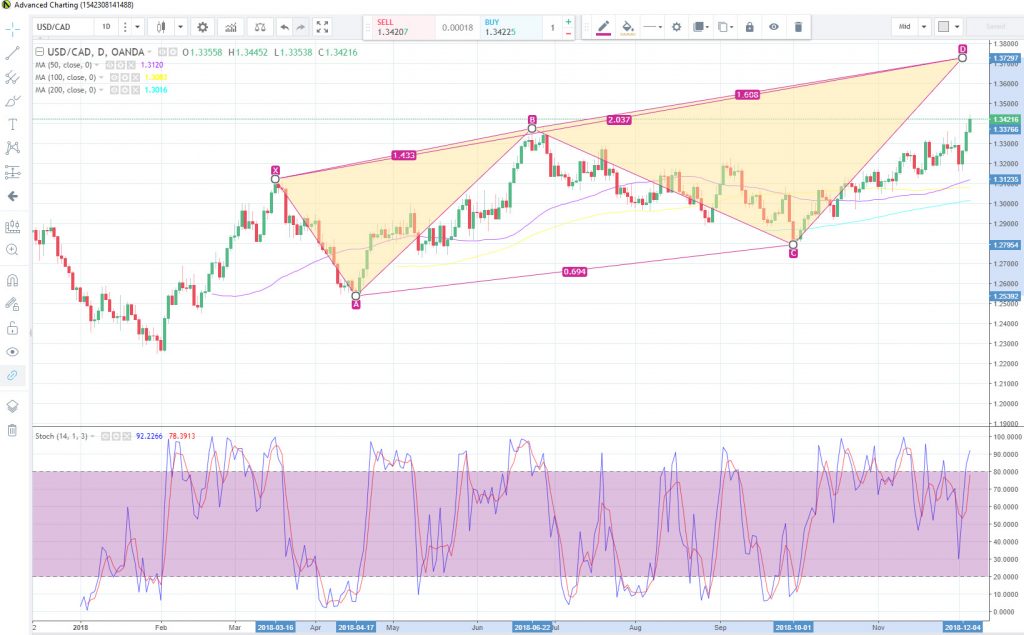

USD/CAD Daily Chart

Price action on the USD/CAD daily chart shows that price is accelerating above the bullish channel. If upside breaks out above the 1.35 handle, momentum could target the 1.3750-1.3800 area. It is around that area that price could form a bearish butterfly pattern. If the bullish move stalls, price may approach the lower boundary of the bullish channel.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.