- Strong US Jobs Report Impacts Fed Expectations with some analysts now predicting no cuts at all.

- The S&P 500 experienced a sell-off, breaking below key support levels and raising concerns about further potential downside.

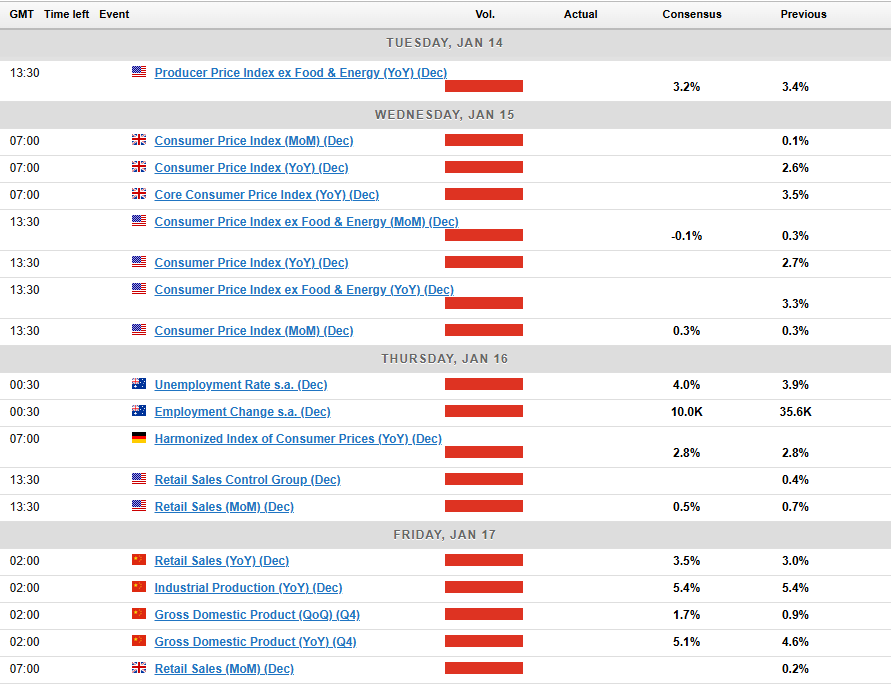

- US inflation and retail sales data will be crucial in shaping market expectations for future monetary policy.

- In addition to US data, the week ahead includes key economic releases from China, UK and Australia.

Read More: Global Market Outlook 2025: Trends, Risks, and Opportunities for Traders

Week in Review: US Jobs Growth Surge as Markets See Less Fed Rate Cuts

Another shortened trading week has come to an end as the US had a day of mourning on Thursday for former President Jimmy Carter.

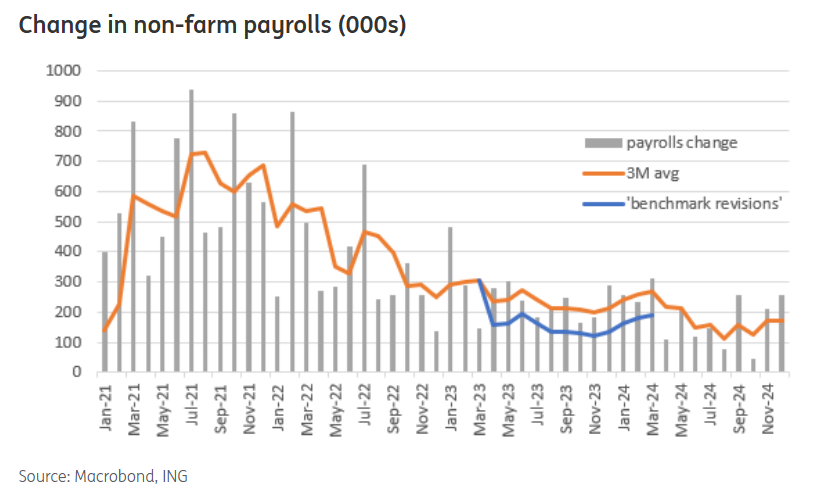

The week turned out to be an eventful one with the first NFP jobs report of the year stoking volatility and coming in much better than expected. The US jobs report shows that 256,000 jobs were added in December, much higher than the expected 165,000. Job numbers for the past two months were adjusted down by 8,000.

The unemployment rate dropped to 4.1% from 4.2%, even though it was expected to stay at 4.2% or possibly rise to 4.3%. Wages grew 0.3% from the previous month, while yearly wage growth slowed to 3.9% from 4%.

Source: ING, Macrobond (click to enlarge)

The impact resulted in a selloff in US equities with the S&P 500 hitting a one-week low after a strong jobs report raised new worries about inflation and made people think the Federal Reserve will be more careful about cutting interest rates this year.

Bank of America for its part has already said that they are now pricing in no rate cuts from the Federal Reserve in 2025.

The commodities picture is one of the few bright spots for market participants. Gold and Oil both enjoyed stellar weeks with gains of 1.92% and 2.48% respectively. Oil was up around 5% at a stage in the US session but failed to hold onto gains.

On the FX front, the US Dollar continues to rule the roost. Friday’s data only served to cement that with losses for a host of US dollar denominated fx pairs. GBP/USD tapped its 2024 low before bouncing higher to trade at 1.2250.

Following this week’s Jobs data, The Fed is now certain to keep rates unchanged in January, with the market barely expecting any chance of a rate cut. There’s also a growing chance of a longer pause, as the market doesn’t fully expect a rate cut to happen before September.

All of this is likely to keep the US Dollar on the front foot moving forward.

The Week Ahead: US, UK Inflation and China in the Spotlight

Asia Pacific Markets

The week ahead in the Asia Pacific region still remains light on the data front.

The highlights all come from China as markets hope the stimulus announced at the back end of 2024 may begin to transmit to the data.

All data releases will be on Friday and include retail sales, industrial production and GDP data. Retail sales and industrial production will be watched closely for signs of a demand recovery which may have a knock on effect on sentiment as well as commodity linked currencies like the Australian Dollar and the South African Rand.

Australia will also be in the limelight this coming week with a double header of high impact releases. Both of the releases relate to the Australian labor market which may provide more insights into the health of the Australian economy.

Europe + UK + US

In developed markets, the US ended last week with blockbuster jobs data which saw markets now price in just one rate cut in 2025. Obviously this will change as more and more data is released and President Trump assumes office.

The Federal Reserve will likely be focused on inflation moving forward as evidenced by the minutes released this past week. The week ahead brings exactly that, US inflation and retail sales data will be released.

Inflation has been rising too quickly in recent months, but experts expect it to slow slightly with a 0.2% increase in December, which might calm worries about high inflation sticking around. Retail sales could get a boost from strong car sales, but other areas might show weakness, especially with recent signs that people are borrowing less.

In Europe, it is a quiet week on the data front but the UK will release inflation and retail sales numbers as well. Following a topsy-turvy week for the UK with losses for the GBP and a significant drop in yields, markets will no doubt be paying close attention.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Chart of the Week

This week’s focus is on the S&P 500 again following the selloff on Friday.

The S&P 500 has printed a fresh low following Friday’s selloff which could leave the index ripe for an early week recovery.

However, the bigger question will be whether any recovery is sustainable or is it a retracement before the next leg to the downside.

The Daily candle close on Friday will be key as price is currently flirting with the 100-day MA. A break and close below this could add bearish pressure on the index.

A retracement from current price may find resistance at 5910, 6000 and of course the swing high at 6025.

A break of the 100-day MA could bring support at 5757,5669 and 5635 all into focus.

S&P 500 Daily Chart – January 10, 2025

Source: TradingView.Com (click to enlarge)

Key Levels to Consider:

Support

- 5757

- 5669

- 5635

Resistance

- 5910

- 6000

- 6025

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.